Albuquerque Real Estate Trends: November 2025 Market Update (Slow but Steady)

Albuquerque Real Estate Trends: November 2025 Market Update (Slow but Steady)

November 2025 was one of the slowest months we’ve seen in a while for Albuquerque home sales. Closings dropped, prices stayed basically flat, and inventory inched up but remains below pre-2020 levels. Here’s what the data really says and what it means if you’re thinking about buying or selling in 2026.

- Closed sales in November fell to 638, down about 12% from November 2024 and almost 200 fewer than in October.

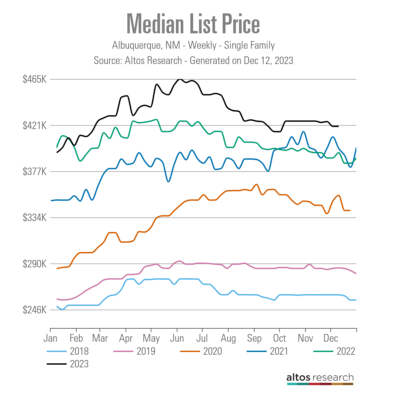

- Prices are flat to slightly up for 2025 overall: median at $355,000 across all home sales in November, 1.4% lower than November 2024.

- We expect annual appreciation to be ~2–3% higher year-over-year for the full year.

- Inventory sits around 2,086 homes, up ~5% from last year but still slightly below 2019 levels at this time of year.

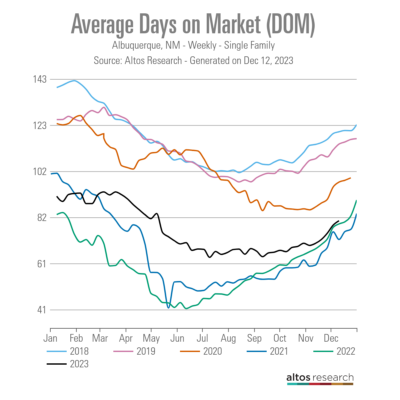

- Days on Market has drifted back toward a “normal” pace at about 49 days, similar to 2018–2019.

- National forecasts call for a ~14% jump in home sales next year, which could mean roughly 1,400 more closings in the Albuquerque area if that plays out locally. :

Market Snapshot – November 2025

November was sluggish. Only 638 single-family homes (attached and detached) closed in the Albuquerque area, about 190 fewer than in October and roughly 12% below November 2024’s 728 closings. Year-to-date, though, total 2025 sales are still slightly ahead of 2024, so November looks more like a soft patch than a collapse.

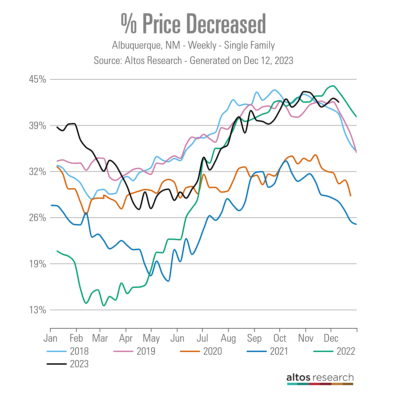

On the pricing side, the median sales price came in at $355,000 in November, down 1.4% compared to November a year ago and off from October’s $362,750. But when you zoom out beyond a single month, 2025 still looks like a modestly positive year for prices, with overall appreciation tracking in the 2–3% range and price-per-square-foot for November running exactly flat versus last year.

Why it matters

- Buyers: You’re not fighting runaway price gains. A flat-to-modestly-up market gives you more room to negotiate and more time to think.

- Sellers: You can still sell at or near the peak values achieved over the last couple of years, but you can’t count on multiple offers day one. Strategy and pricing matter again.

- Investors: A boring market is usually a healthy market. Small, steady gains are more sustainable than boom-and-bust cycles.

Foot Traffic & Buyer Demand: Holiday Dip, Normal Pattern

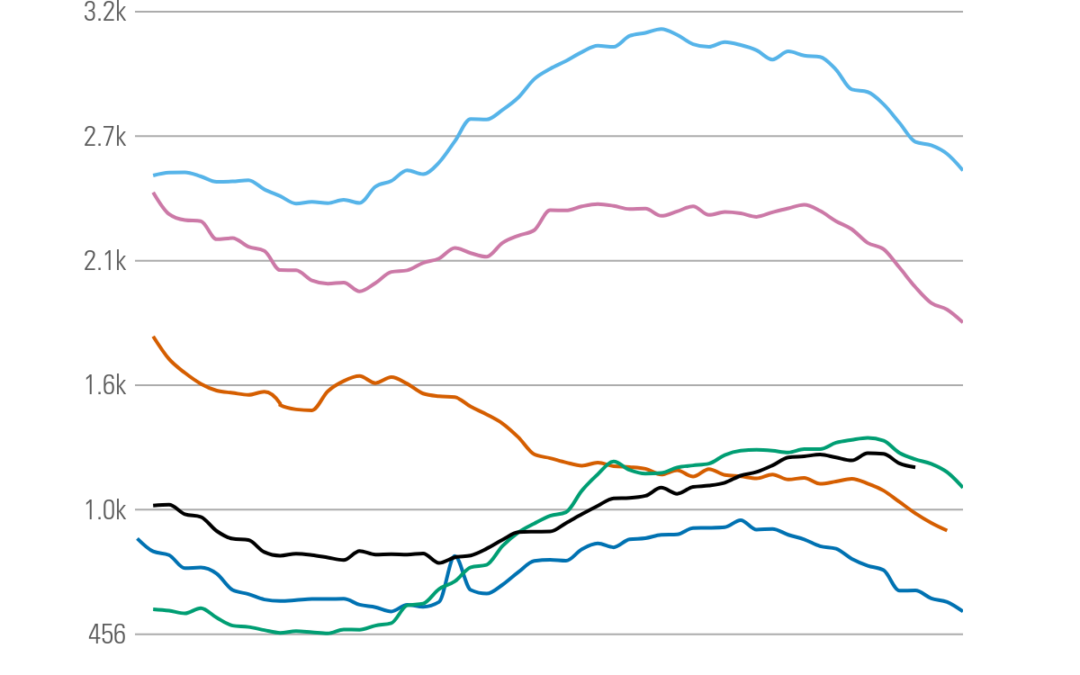

One of the best forward-looking indicators we watch is showing activity—how many buyers are actually out touring homes each week. In 2025, showings slid sharply at the end of November, right on cue with the Thanksgiving holiday. That same late-November drop shows up in every recent year on the chart. After the holiday, activity starts to recover into December, then takes another pause around Christmas.

Overall, 2025 has fewer buyers out shopping than some of the boom years, but the showing trend looks very similar to 2024. Fewer house hunters, yes. But not a ghost town.

Why it matters

- If you’re selling: Expect fewer showings over the holidays. That doesn’t mean your home is “broken” – it’s just the calendar.

- If you’re buying: This is a sneaky window of opportunity. With fewer competing buyers in November and December, you may have more negotiating room.

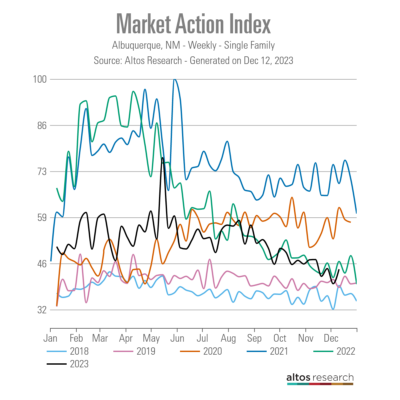

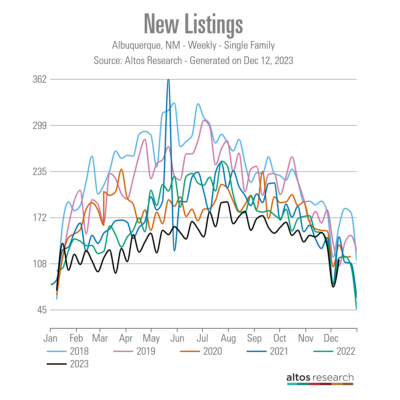

Inventory: Up From Last Year, Still Below 2019

Active listings for November clocked in at about 2,086 homes on the market. That’s roughly 4.9% more inventory than one year ago and about 300 fewer homes than we saw in October as sellers started to pull back heading into the holidays.

When we look at a longer weekly view back to 2019, Albuquerque has more homes on the market than in the tight-supply years from 2020 through 2024, but still fewer than in 2019, when there were about 2,150 active listings at the same time of year. Many large markets nationally have already moved above their 2019 inventory levels, but Albuquerque remains a bit undersupplied by that benchmark.

Why it matters

- Still a supply shortage: We have more homes to choose from than during the extreme pandemic squeeze, but not a glut.

- Pricing support: Slightly tight inventory helps keep prices from falling even when demand is soft.

- Strategy for sellers: With fewer new listings hitting the market through January and early February, a well-prepared listing can stand out.

Days on Market: Back to a “Normal” Pace

Average Days on Market (DOM) for homes that actually sold in November landed at 49 days. That’s strikingly similar to February 2020, right before the pandemic, which sat at about 45 days. It also feels a lot like the 2018–2019 market—slower than the frenzy years, but still healthy.

Remember, DOM measures how long a property sits from Active status until it goes under contract (Pending). It doesn’t include the homes that never sell, only the ones that find a buyer.

Why it matters

- Buyers: You have time to think, inspect, and negotiate. Homes aren’t vanishing in 24 hours anymore.

- Sellers: A realistic expectation is key. If your home takes 30–60 days to go under contract, that’s not failure – it’s the market.

- Pricing check: If you’re well beyond the average DOM for your price bracket, it’s a signal to revisit price, condition, or marketing.

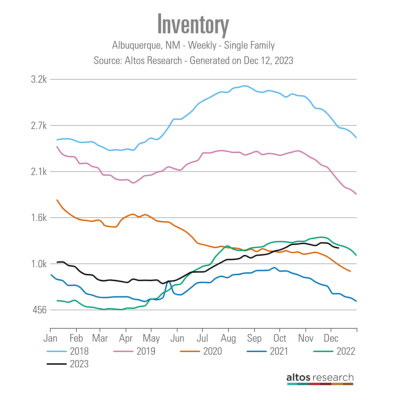

Pending Sales & New Listings: Quiet but Steady

Looking at “homes in pending” each week, we finished November with 969 pending sales, and the 90-day moving average sat around 1,021—just a hair above the same point in 2024 (about 1,002). That tells us there is steady contract activity happening behind the scenes, even if the closed sale count looked weak in November.

New listings are following their usual seasonal pattern. They dropped off sharply through late November and will likely keep easing down into January before picking up again in February and March. For several years in a row, that pattern has repeated almost like clockwork.

Why it matters

- Buyers: You’ll see fewer fresh options over the holidays, but you can still find opportunities among existing inventory and homes returning to the market.

- Sellers: Less competition from new listings can help your home stand out if you’re willing to list in December or January.

How Albuquerque Compares & What’s Next for 2026

Compared to some big markets—parts of Texas, Denver, and Phoenix—Albuquerque has held up better on prices, with far less downward pressure. Our median of $355,000 and average price around $410,000 still sit below many regional peers, even as we wrestle with our own affordability challenges.

Nationally, the National Association of REALTORS® is projecting about a 14% increase in home sales for next year. If that plays out here, it would mean roughly 1,400 more closed sales on top of the ~10,000 transactions expected in our market for 2025. We’ll see how that forecast lines up with reality once we get into the spring selling season.

Why it matters

- More move-up and move-down buyers: As rates and affordability stabilize, some of the “locked-in” owners may finally make their move.

- Pricing stability: A moderate increase in sales without a major inventory surge usually supports flat-to-modest price gains.

- Planning window: If you’re targeting a move in 2026, now is a good time to tighten up your finances and get a strategy in place.

Buyer & Seller Q&A – November 2025 Edition

Q: Are Albuquerque home prices going up or down right now?

A: For November 2025, the median price was $355,000, down about 1.4% from last November. But looking at the full year, prices are roughly 2–3% higher than 2024, and price-per-square-foot for November is flat year-over-year. In plain English: prices are basically holding steady, not surging or crashing.

Q: Why were November 2025 home sales in Albuquerque so slow?

A: We only saw 638 closings in November, which is low for our market and notably weaker than both October and last November. The holiday calendar, fewer active buyers, and a slower national economy all play a role. The good news is pending sales and showings suggest it’s a soft patch, not a full stop.

Q: How many homes are for sale in Albuquerque right now?

A: The November reading showed about 2,086 active listings. That number moves daily, but it’s a good snapshot: slightly more homes available than last year at this time, but still a bit below 2019 levels, so we’re not in a high-inventory buyer’s market yet.

Q: Why are homes staying longer on the market?

A: Average Days on Market is now around 49 days—up from the frenzy years but similar to 2018–2019 and to pre-pandemic 2020. DOM measures how long it takes a home to go from Active to Pending. With more balanced supply and demand, it’s normal for homes to take 30–60 days to find the right buyer.

Q: Is 2025 a good time to buy a house in Albuquerque?

A: For many buyers, yes. Prices are stable, inventory is modestly higher, and you’re not fighting bidding wars on every well-priced home. Whether it’s “good” for you depends on your budget, job stability, and time horizon. If you plan to own for 5–10 years, a flat or slow-growth market like this can be a solid entry point.

Q: Is now a good time to sell my home in Albuquerque?

A: If you have a compelling reason to move, you can still sell successfully. Prices are near their highs, and inventory is not excessive, which helps well-priced, well-prepared homes stand out – especially during the winter when new listing counts are lower. If you’re flexible on timing, we’ll help you decide whether an early-spring or late-winter launch makes more sense for your specific neighborhood and price point.

About Venturi Realty Group — Data-driven Albuquerque real estate pros with 4,000+ closed transactions and active involvement in GAAR and SWMLS. We host the Albuquerque Real Estate Talk podcast and provide weekly market updates to help you make informed decisions. Call 505-448-8888 or visit WelcomeHomeABQ.com.

Albuquerque Market Updates | Search Homes | Contact Venturi Realty Group