Apr 6, 2024 | Albuquerque Real Estate News

SAVE ON YOUR PROPERTY TAX BILL – Albuquerque Real Estate Talk Spring Surge in the Market Springtime traditionally brings a surge in new listings in the Albuquerque real estate market, and 2024 is no exception. Tego and Tracy discuss the noticeable uptick in...

Apr 2, 2024 | Albuquerque Real Estate News

Albuquerque Real Estate Talk 483 Match 23, 2024 Tego: [00:00:00] Welcome to Albuquerque real estate talk episode 483 end of March 2024 almost the end of March Lobo, basketball weekend pretty excited about that And this week. Well, wow, we got a lot to cover....

Apr 2, 2024 | Albuquerque Real Estate News, Albuquerque Real Estate Talk, Housing Market Updates, Real Estate Market Reoprt

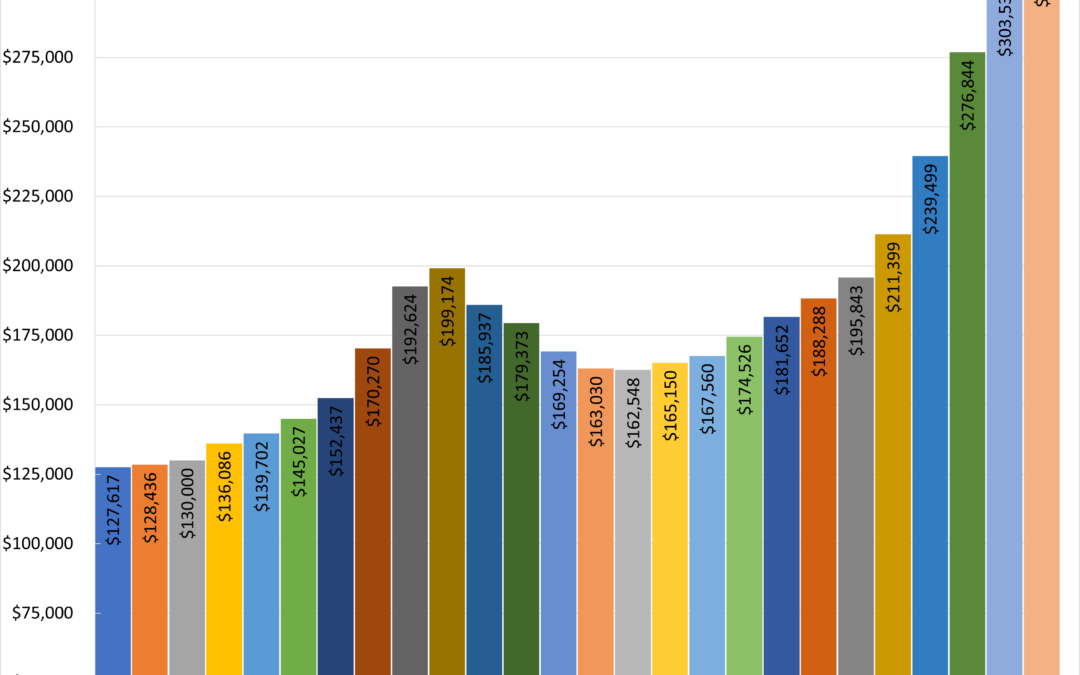

Albuquerque Housing Market 2024: Where Are Prices Now? Hello, everyone! I’m Tego Venturi from Albuquerque Real Estate Talk, and in today’s piece, we’re diving deep into the fabric of our city’s housing market. Albuquerque has been...

Feb 23, 2024 | Albuquerque Home Values, Albuquerque Real Estate News

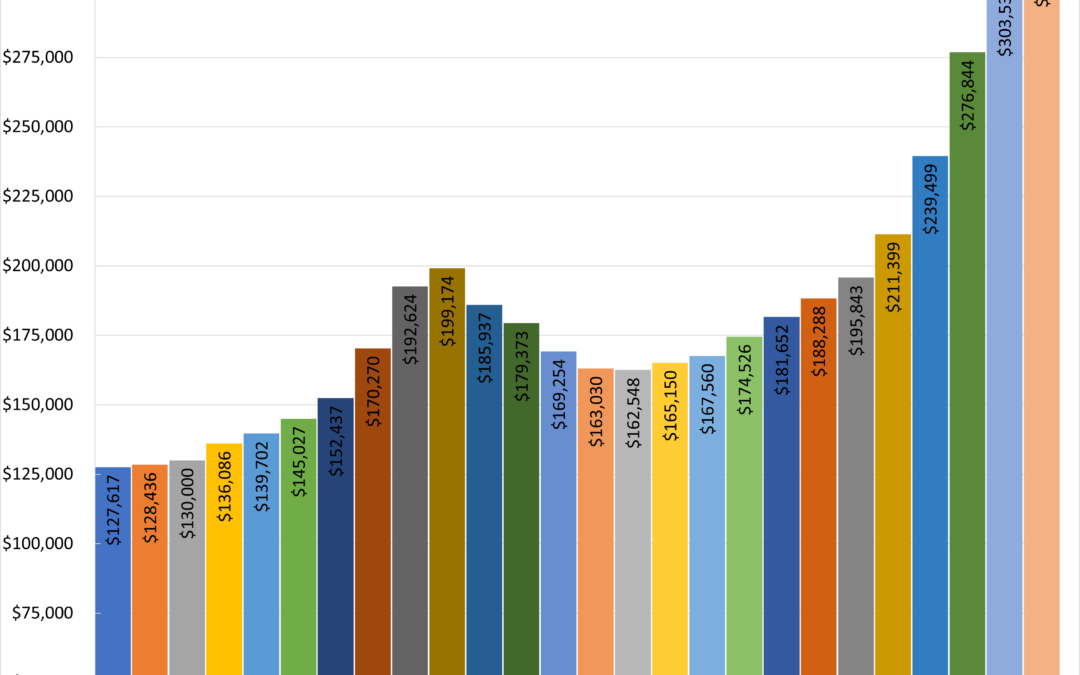

Albuquerque Home Values – The 25 Year Journey The Albuquerque housing market has undergone some ups and downs over the past 25 years, yet despite these changes, the long-term trend has consistently shown stable upward growth in values. We dug into the annual...

Feb 17, 2024 | Albuquerque Home Values, Albuquerque Real Estate News, Albuquerque Real Estate Talk, Housing Market Updates

Albuquerque Home Value Trajectory Over 25 Years | ABQ Real Estate Talk Navigating Albuquerque’s Evolving Real Estate Landscape: Insights and Opportunities Albuquerque’s population is teetering on the brink of a significant milestone. As we discussed...

Feb 10, 2024 | Albuquerque Home Values, Albuquerque Real Estate News, Albuquerque Real Estate Talk, First Time Home Buyers, Housing Market Updates, New Construction

Unpacking Albuquerque’s Housing Affordability Issues: ABQ Real Estate Talk February 10, 2024 Albuquerque Real Estate Talk 479 – February 10, 2024 As experienced Albuquerque Realtors, we aim to simplify the complex dynamics of the Albuquerque real estate...