Dec 26, 2023 | Albuquerque Home Values, Albuquerque Real Estate News, Albuquerque Real Estate Talk, For Buyers, For Sellers, Housing Market Updates, Real Estate Market Reoprt

Casitas and AUD’s Accessory Dwelling Units in Albuquerque The City of Albuquerque has made some significant movements in allowing Casitas (AUDs) on residential properties zoned R-1, and they are offering free casita construction plans on its website. The plans...

Dec 11, 2023 | Albuquerque Real Estate News, For Buyers, For Sellers, Housing Market Updates, Pricing, Real Estate Market Reoprt

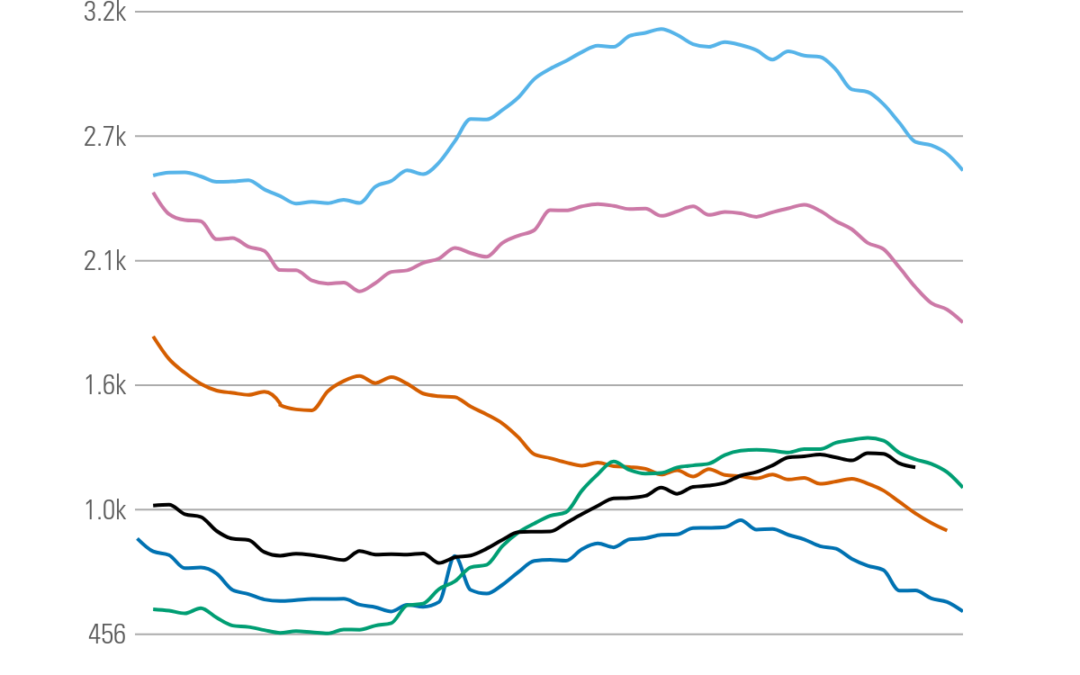

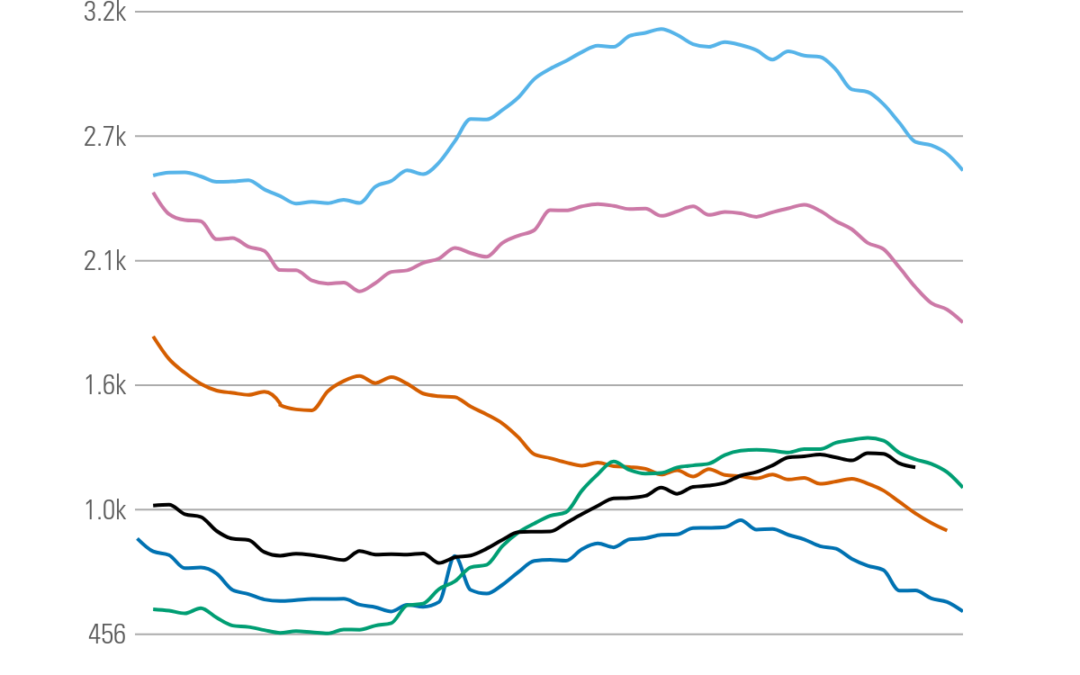

A Comprehensive Guide to the Albuquerque MSA Housing Market Tracker Introduction to the Albuquerque Housing Market Tracker We recently launched the Albuquerque Real Estate Market Tracker, your indispensable tool for navigating the dynamic real estate landscape of the...

![Great News About Housing Inventory [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/07/21111823/20220722-MEM.jpg)

Jul 22, 2022 | First Time Home Buyers, For Buyers, Housing Market Updates, Infographics, Move-Up Buyers

Some Highlights Experts say the number of homes for sale is growing this year, and that can have a big impact on your move. If you’re planning to buy, additional options in today’s market may be just what you’ve been waiting for. More inventory means added...

Jul 20, 2022 | Buying Myths, For Buyers, Pricing

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still going up. You no doubt are feeling the pinch on your wallet at the gas pump or the grocery store, but that news may also leave you wondering: should I...

Jul 19, 2022 | First Time Home Buyers, For Buyers, Move-Up Buyers

If you’re planning to buy a home this year, you might have heard that pre-approval is a necessary step to take before starting out on your journey. But why is that? And is it still important in today’s shifting market? The truth is, getting a pre-approval letter from...

![Should I Rent or Should I Buy? [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/07/14123557/20220715-KCM-Share-549x300.png)

Jul 15, 2022 | First Time Home Buyers, For Buyers, Infographics, Rent vs. Buy

Some Highlights It’s worth considering the many benefits of homeownership before you make the decision to rent or buy a home. When you buy, you can stabilize your housing costs, own a tangible asset, and grow your net worth as you gain equity. When you rent, you face...

![Great News About Housing Inventory [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/07/21111823/20220722-MEM.jpg)

![Should I Rent or Should I Buy? [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/07/14123557/20220715-KCM-Share-549x300.png)