Dec 11, 2023 | Albuquerque Real Estate News, For Buyers, For Sellers, Housing Market Updates, Pricing, Real Estate Market Reoprt

A Comprehensive Guide to the Albuquerque MSA Housing Market Tracker

We recently launched the Albuquerque Real Estate Market Tracker, your indispensable tool for navigating the dynamic real estate landscape of the Albuquerque Metropolitan Statistical Area (MSA), which includes Bernalillo, Sandoval, Valencia, and Torrance counties. This guide offers weekly insights into the market, focusing on single-family detached homes and providing an in-depth analysis of the latest trends, inventory changes, and price movements. Whether you’re a buyer, seller, or a real estate professional, our tracker is designed to give you a competitive edge in the vibrant Albuquerque housing market.

Coverage and Scope: What to Expect

The Albuquerque Real Estate Market Tracker offers a comprehensive housing market overview, covering key metrics such as the Market Action Index (MAI), inventory levels, new listings, and more. This seven-day snapshot is your gateway to understanding the nuances of the local real estate market.

The Importance of Real-Time Market Insights

In today’s fast-paced real estate environment, staying informed with the most current data is crucial. Our tracker provides up-to-date information, enabling you to make timely and informed decisions.

Key Metrics of the Albuquerque Market Tracker

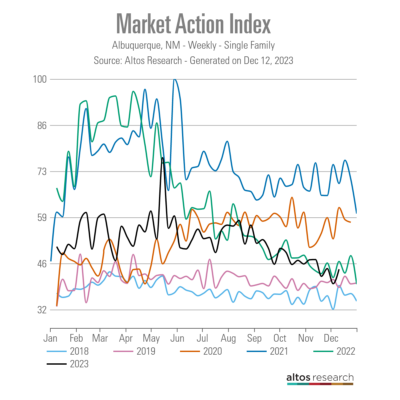

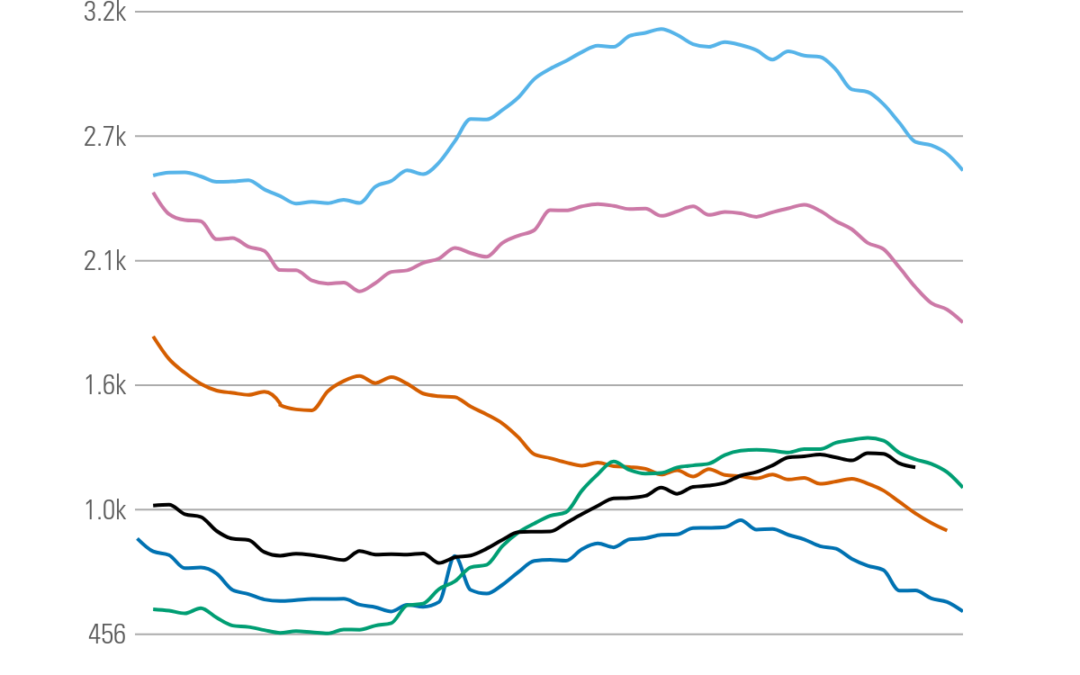

Market Action Index (MAI): Understanding Market Favorability

The MAI is vital in determining whether the market favors buyers or sellers. It analyzes the current rate of property sales against existing inventory, offering a clear picture of market conditions.

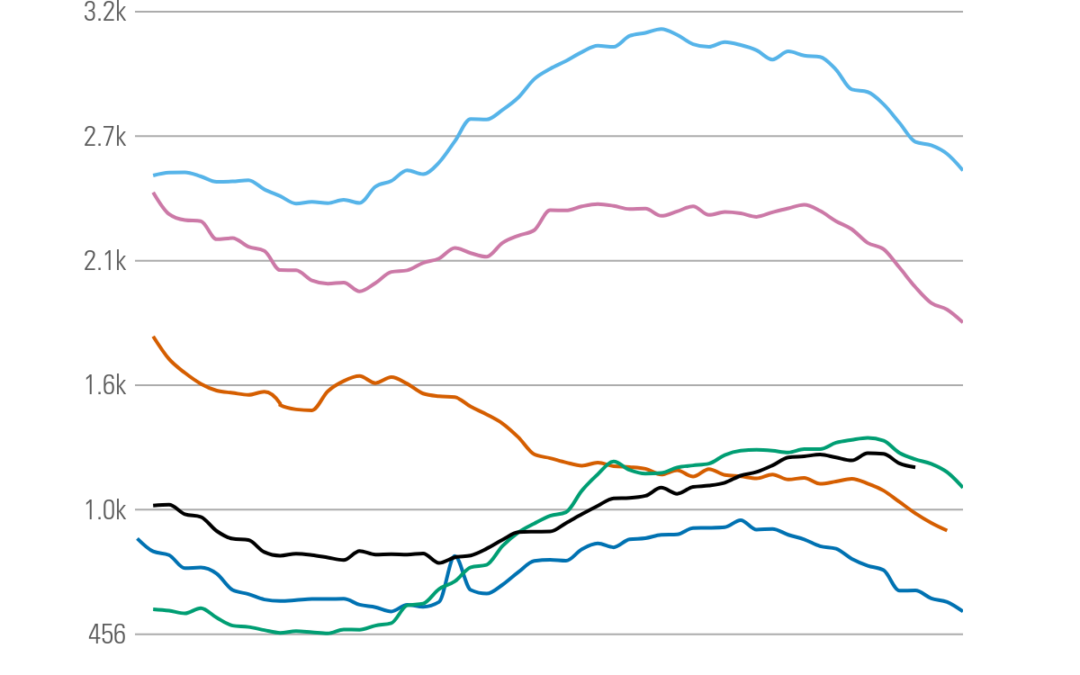

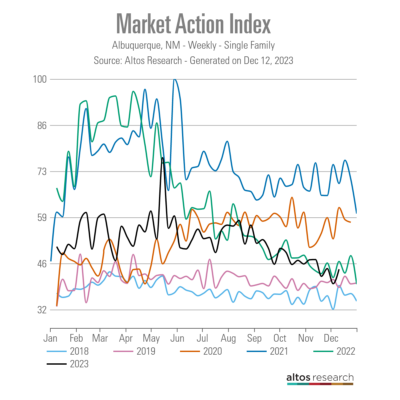

Inventory Analysis: The Pulse of Market Supply and Demand

Monitoring inventory levels is critical to understanding market trends. It provides insights into whether we’re in a buyer’s or seller’s market and helps predict future market dynamics.

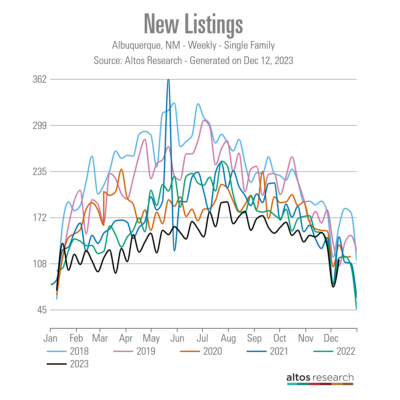

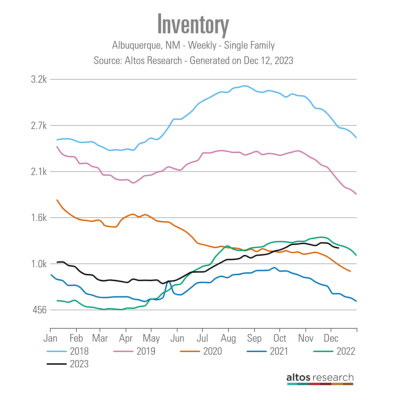

New Listings Insights: Tracking Market Entries

The number of new listings offers a window into seller behavior and market shifts. This data is crucial for anticipating changes in the market landscape.

Listings Absorbed: A Measure of Market Activity

This metric (listings absorbed) reveals how quickly properties are being purchased, indicating the current demand and the market’s overall health.

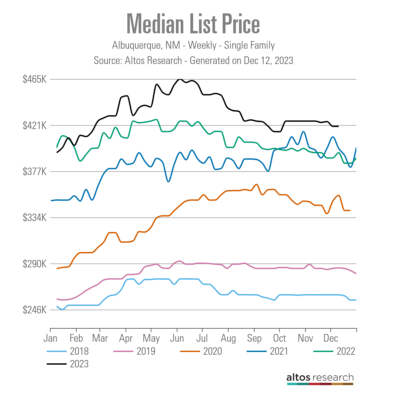

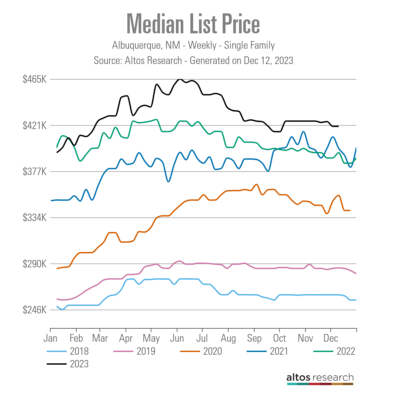

Median List Price: Decoding Market Value

The median list price is an essential indicator of seller confidence and buyer interest. It helps predict future price trends and provides insights into the market’s current state.

List Price per Square Foot: A Detailed Market Comparison Tool

By comparing the median asking price per square foot, we gain a more nuanced understanding of the market, factoring in variations in home sizes for a more accurate analysis.

This metric sheds light on the pricing strategies of new market entrants and is a crucial indicator of emerging market trends.

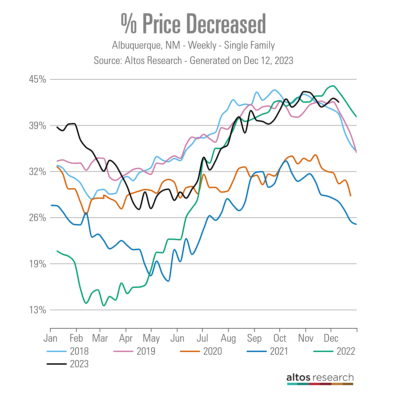

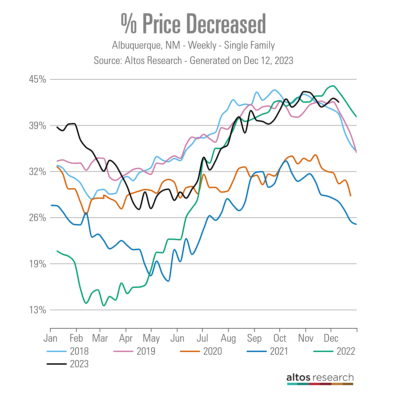

Percent of Price Decreases: Indicators of Market Health

Understanding the proportion of homes with reduced prices helps gauge market demand and potential shifts in pricing trends.

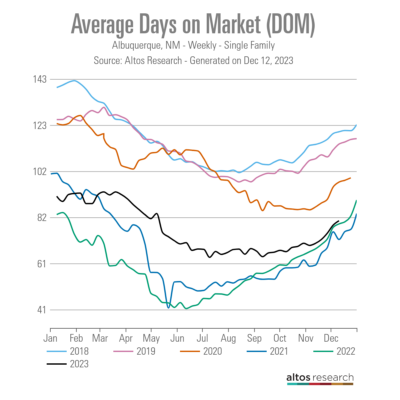

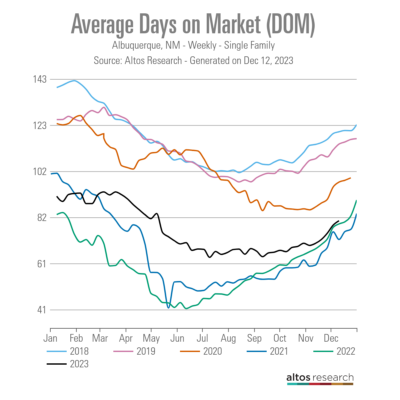

Average Days on Market: Timing the Market’s Pulse

Tracking the average time homes spend on the market provides insights into how fast properties sell, indicating the market’s pace and activity level.

Percent Relisted: Understanding Market Resets

This figure highlights the proportion of homes returning to the market, offering a perspective on the stability and fluidity of the market.

Why the Albuquerque MSA Housing Market Tracker is Essential

For Buyers: Making Informed Decisions

The tracker offers valuable insights into market trends for those looking to purchase a home, helping you make well-informed decisions.

For Sellers: Maximizing Market Advantage

Sellers can use the tracker to understand current market conditions and strategically price their homes to maximize their advantage.

For Real Estate Professionals: A Tool for Strategic Planning

Real estate agents and professionals can leverage the tracker for strategic planning, staying ahead of market trends, and advising clients effectively.

Conclusion: Navigating the Albuquerque Housing Market with Confidence

Summing Up: The Value of Real-Time Insights

The Albuquerque MSA Housing Market Tracker is an indispensable tool for anyone involved in the Albuquerque real estate market. Its comprehensive and timely data empowers users to make informed decisions, stay ahead of market trends, and confidently navigate the market.

FAQs: Your Questions Answered

Q1: How often is the Albuquerque Market Tracker updated?

A1: The tracker is updated weekly on Sunday, providing the most current insights into the Albuquerque housing market.

Q2: Can the tracker help predict future market trends?

A2: Yes, by analyzing current data and trends, the tracker can offer valuable predictions about future market directions.

Q3: Is the tracker useful for first-time home buyers?

A3: Absolutely, it’s a valuable resource for anyone entering the market, especially first-time buyers seeking to understand market dynamics.

Q4: Does the tracker cover rental properties?

A4: The focus of our tracker is on single-family detached homes, offering specific insights into this segment of the market.

Q5: How can sellers use the tracker to their advantage?

A5: Sellers can use the tracker to gauge market conditions, price their homes competitively, and understand buyer trends.

Jul 20, 2022 | Buying Myths, For Buyers, Pricing

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still going up. You no doubt are feeling the pinch on your wallet at the gas pump or the grocery store, but that news may also leave you wondering: should I still buy a home right now?

Greg McBride, Chief Financial Analyst at Bankrate, explains how inflation is affecting the housing market:

“Inflation will have a strong influence on where mortgage rates go in the months ahead. . . . Whenever inflation finally starts to ease, so will mortgage rates — but even then, home prices are still subject to demand and very tight supply.”

No one knows how long it’ll take to bring down inflation, and that means the future trajectory of mortgage rates is also unclear. While that uncertainty isn’t comfortable, here’s why both inflation and mortgage rates are important for you and your homeownership plans.

When you buy a home, the mortgage rate and the price of the home matter. Higher mortgage rates impact how much you’ll pay for your monthly mortgage payment – and that directly affects how much you can comfortably afford. And while there’s no denying it’s more expensive to buy and finance a home this year than it was last year, it doesn’t mean you should pause your search. Here’s why.

Homeownership Is Historically a Great Hedge Against Inflation

In an inflationary economy, prices rise across the board. Historically, homeownership is a great hedge against those rising costs because you can lock in what’s likely your largest monthly payment (your mortgage) for the duration of your loan. That helps stabilize some of your monthly expenses. Not to mention, as home prices continue to appreciate, your home’s value will too. That’s why Mark Cussen, Financial Writer at Investopedia, says:

“Real estate is one of the time-honored inflation hedges. It’s a tangible asset, and those tend to hold their value when inflation reigns, unlike paper assets. More specifically, as prices rise, so do property values.”

Also, no one is calling for homes to lose value. As Selma Hepp, Deputy Chief Economist at CoreLogic, says:

“The current home price growth rate is unsustainable, and higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.”

In a nutshell, your home search doesn’t have to go on hold because of rising inflation or higher mortgage rates. There’s more to consider when it comes to why you want to buy a home. In addition to shielding yourself from the impact of inflation and growing your wealth through ongoing price appreciation, there are other reasons to buy a home right now like addressing your changing needs and so much more.

Bottom Line

Homeownership is one of the best decisions you can make in an inflationary economy. You get the benefit of the added security of owning your home in a time when experts are forecasting prices to continue to rise.

Jul 13, 2022 | First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers, Pricing

If you’ve been thinking about buying a home, you likely have one question on the top of your mind: should I buy right now, or should I wait? While no one can answer that question for you, here’s some information that could help you make your decision.

The Future of Home Price Appreciation

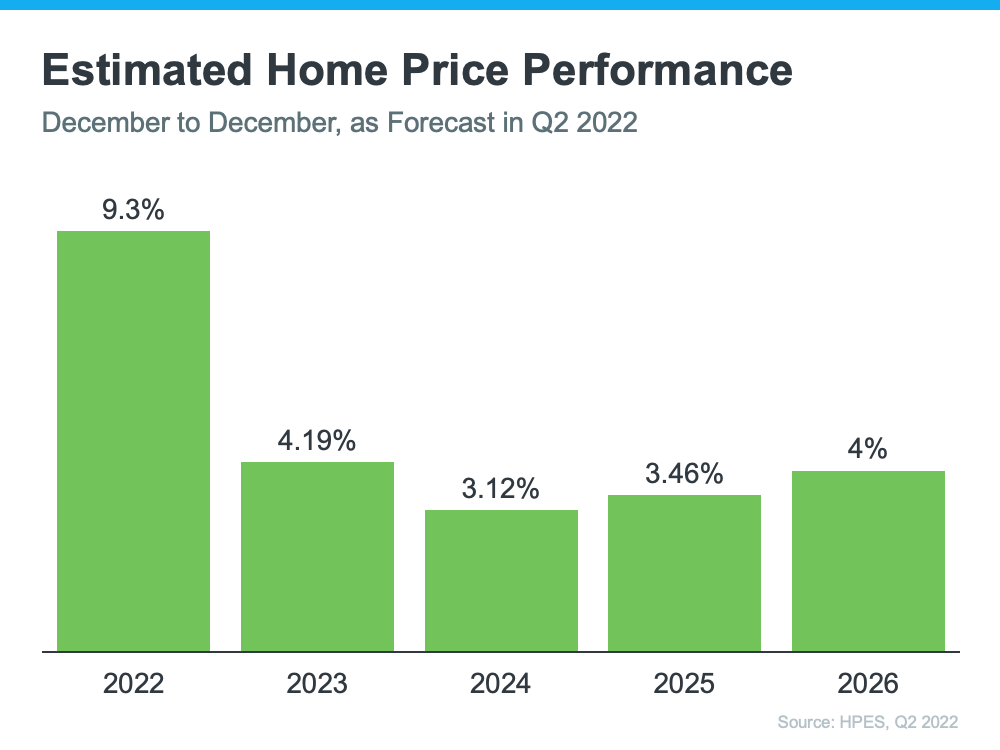

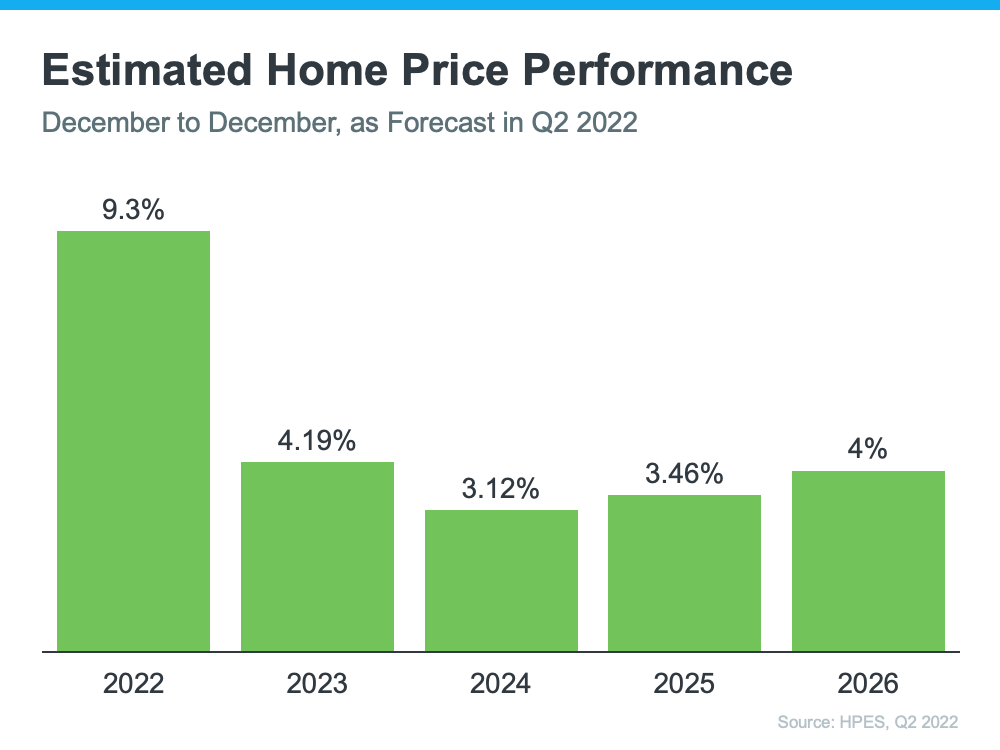

Each quarter, Pulsenomics surveys a national panel of over 100 economists, real estate experts, and investment and market strategists to compile projections for the future of home price appreciation. The output is the Home Price Expectation Survey. In the latest release, it forecasts home prices will continue appreciating over the next five years (see graph below):

As the graph shows, the rate of appreciation will moderate over the next few years as the market shifts away from the unsustainable pace it saw during the pandemic. After this year, experts project home price appreciation will continue, but at levels that are more typical for the market. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“People should not anticipate another double-digit price appreciation. Those days are over. . . . We may return to more normal price appreciation of 4%, 5% a year.”

For you, that ongoing appreciation should give you peace of mind your investment in homeownership is worthwhile because you’re buying an asset that’s projected to grow in value in the years ahead.

What Does That Mean for You?

To give you an idea of how this could impact your net worth, here’s how a typical home could grow in value over the next few years using the expert price appreciation projections from the Pulsenomics survey mentioned above (see graph below):

As the graph conveys, even at a more typical pace of appreciation, you still stand to make significant equity gains as your home grows in value. That’s what’s at stake if you delay your plans.

Bottom Line

If you’re ready to become a homeowner, know that buying today can set you up for long-term success as your asset’s value (and your own net worth) is projected to grow with the ongoing home price appreciation. Let’s connect to begin your homebuying process today.

Jul 12, 2022 | For Buyers, For Sellers, Housing Market Updates, Interest Rates, Pricing

The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help answer those questions, let’s turn to the experts for projections on what the second half of the year holds for residential real estate.

Where Mortgage Rates Will Go Depends on Inflation

While one of the big questions on all buyers’ minds is where will mortgage rates go in the months ahead, no one has a crystal ball to know exactly what’ll happen in the future. What housing market experts know for sure is that the record-low mortgage rates during the pandemic were an outlier, not the norm.

This year, rates have climbed over 2% due to the Federal Reserve’s response to rising inflation. If inflation continues to rise, it’s likely that mortgage rates will respond. Greg McBride, Chief Financial Analyst at Bankrate, explains it well:

“Until inflation peaks, mortgage rates won’t either. Without improvement on the inflation front, we don’t know where the interest rate ceiling will be.”

Whether you’re buying your first home or selling your current house to make a move, today’s mortgage rate is an important factor to consider. When rates rise, they impact affordability and your purchasing power. That’s why it’s crucial to work with a team of professionals, so you have expert advice to help you make an informed decision about your best move.

The Supply of Homes for Sale Projected To Continue Increasing

This year, particularly this spring, the number of homes for sale has grown. That’s partly due to more homeowners listing their houses, but also because higher mortgage rates have helped ease the intensity of buyer demand. Moderating buyer demand slows down the pace of home sales, which in turn helps inventory rise.

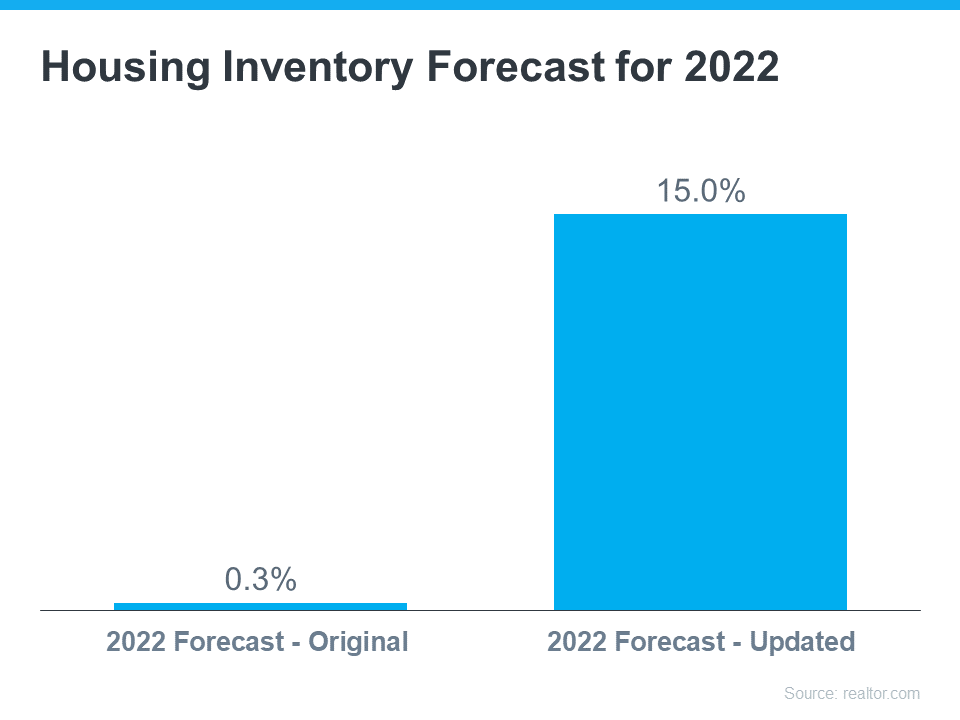

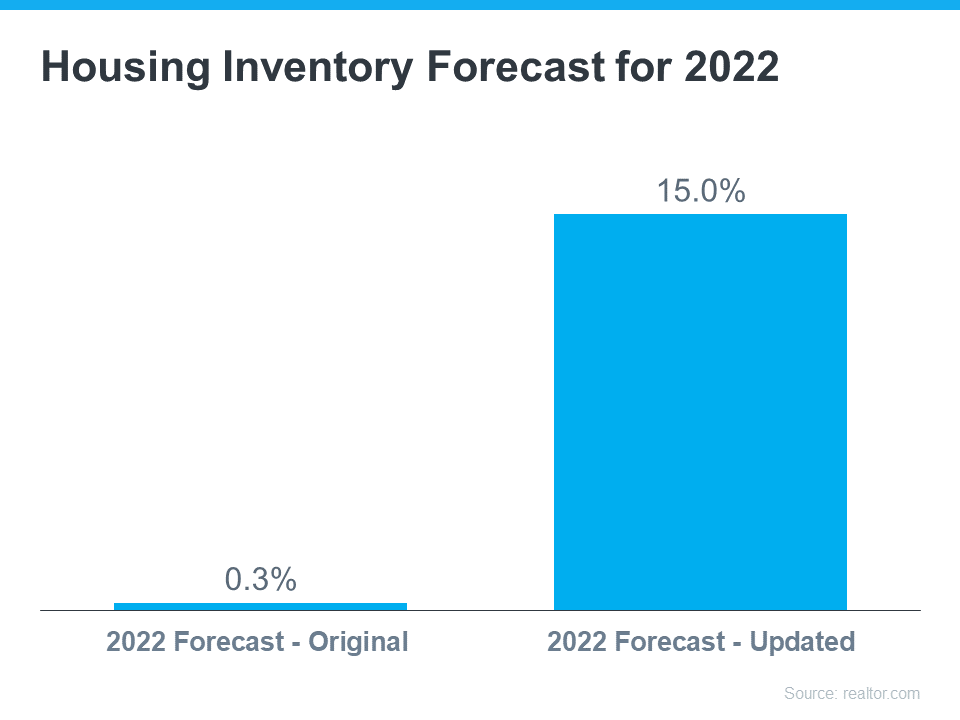

Experts say that growth will continue. Recently, realtor.com updated their 2022 inventory forecast. In the latest release, they increased their projections for inventory gains dramatically, going from a 0.3% increase at the beginning of the year to a 15.0% jump by the end of 2022 (see graph below):

More homes to choose from is great news if you’re craving more options for your home search – just know that there isn’t a sudden surplus of inventory on the horizon. Housing supply is still low, so you’ll need to partner with an agent to stay on top of what’s available in your market and move fast when you find the one. It’s not going to be easy to find a home, but it certainly won’t be as difficult as it has been over the past two years.

Home Price Forecasts Call for Ongoing Appreciation

Due to the imbalance between the number of homes for sale and the number of buyers looking to make a purchase, the pandemic led to record-breaking increases in home prices. According to CoreLogic, homes appreciated by 15% in 2021, and they’ve continued to rise this year.

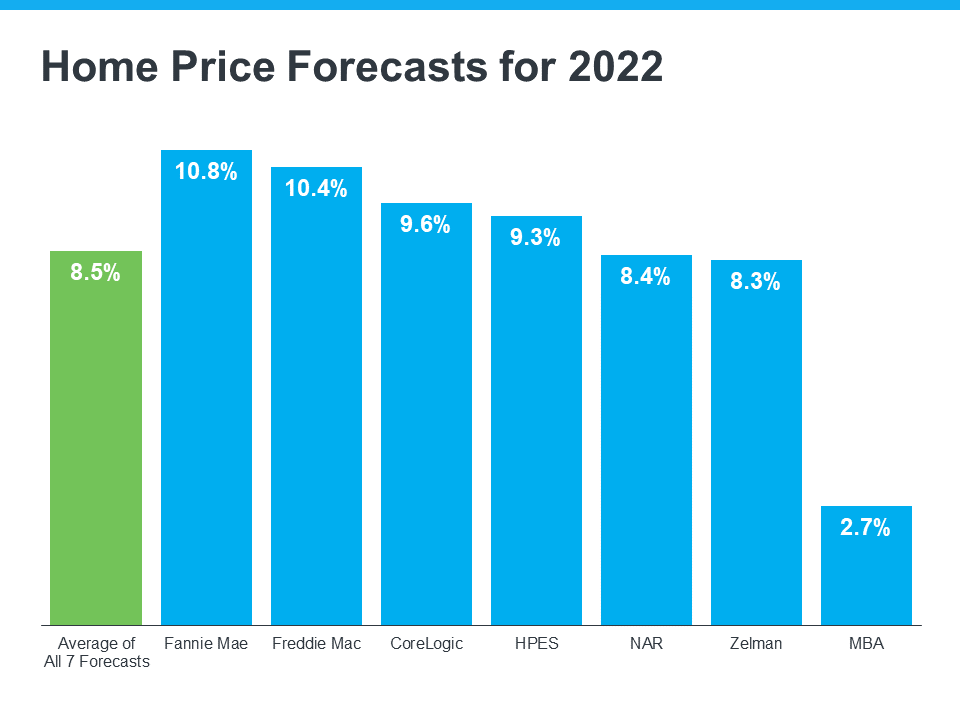

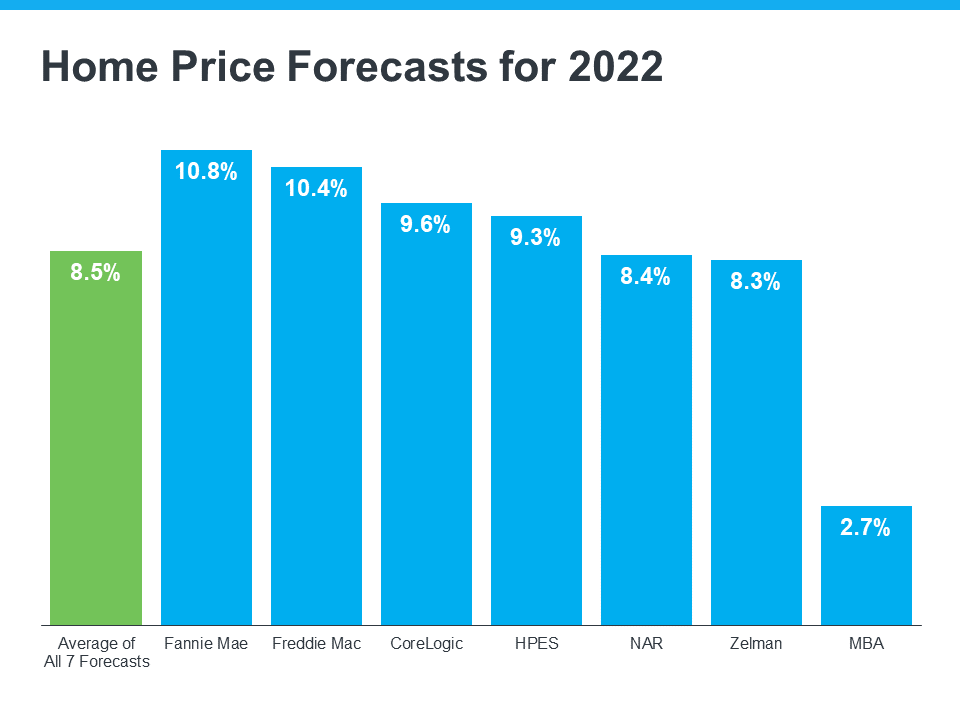

Even though housing supply is increasing today, there are still more buyers than there are homes for sale, and that’s maintaining the upward pressure on home prices. That’s why experts are not calling for prices to decline, rather they’re forecasting they’ll continue to climb, just at a more moderate pace this year. On average, homes are projected to appreciate by about 8.5% in 2022 (see graph below):

Selma Hepp, Deputy Chief Economist at CoreLogic, explains why the housing market will see deceleration, but not depreciation, in prices:

“The current home price growth rate is unsustainable, and higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.”

For current homeowners looking to sell, know your home’s value isn’t projected to fall, but waiting to make your purchase does mean your next home could cost more as home prices continue to appreciate. That’s why, if you’re thinking about buying your first home or you’re ready to make a move, it may make sense to do so now before prices climb higher. But rest assured, once you buy a home, that price appreciation will help grow the value of your investment.

Bottom Line

Whether you’re a homebuyer or seller, you need to know what’s happening in the housing market, so you can make the most informed decision possible. Let’s connect to discuss your goals and what lies ahead, so you can determine the best plan for your move.

Jul 6, 2022 | For Sellers, Move-Up Buyers, Pricing

It’s true that record levels of home price appreciation have spurred significant equity gains for homeowners over the past few years. As Diana Olick, Real Estate Correspondent at CNBC, says:

“The stunning jump in home values over the course of the Covid-19 pandemic has given U.S. homeowners record amounts of housing wealth.”

That’s great for your home’s value over the last couple of years, but what if you’ve lived in your home for longer than that? You may be wondering how much equity you truly have.

The National Association of Realtors (NAR) has done a study to calculate the typical equity gains over longer spans of time. The data they compiled could be enough to motivate you to move. Just remember, to find out how much equity you have in your specific home, you’ll want to get a professional equity assessment from a trusted real estate advisor.

How Your Equity Grows

Let’s start by establishing how you build equity in your home. While price appreciation is clearly a factor that can help boost your equity, you also build equity over time as you pay down your home loan. NAR explains:

“Home equity gains are built up through price appreciation and by paying off the mortgage through principal payments.”

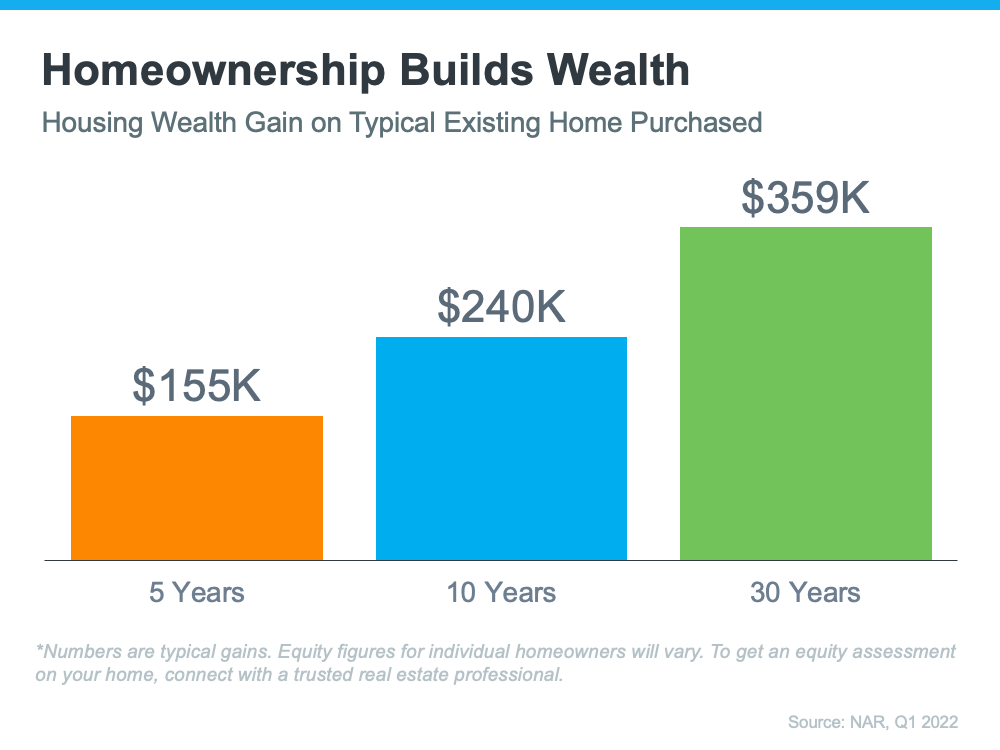

Average Equity Growth over Time

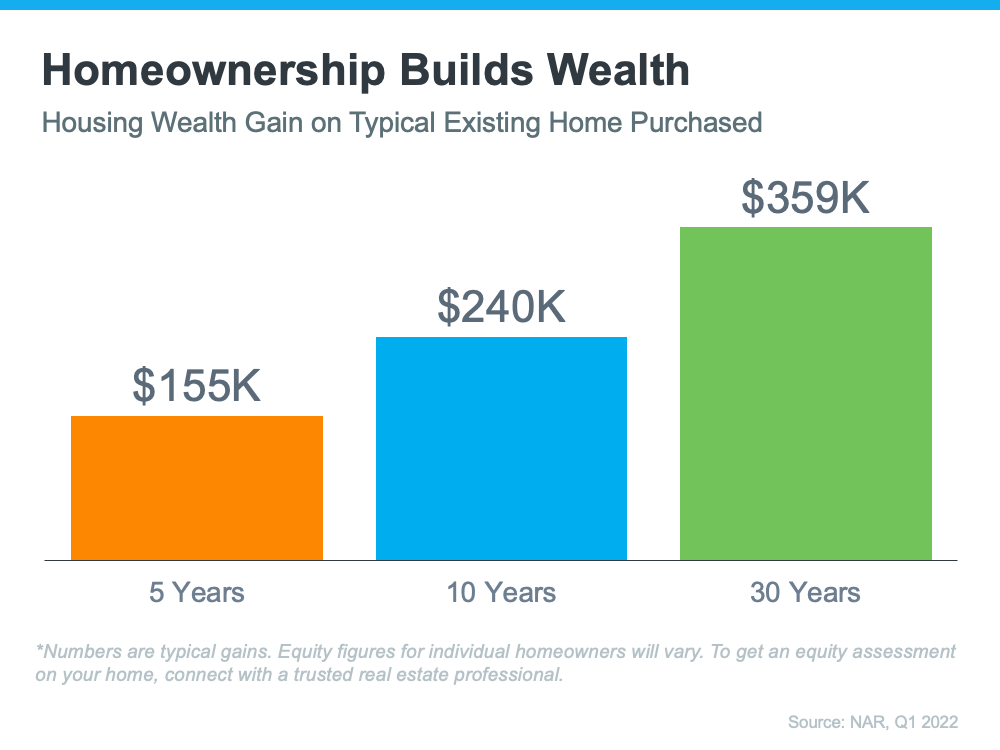

The study from NAR breaks down the typical equity gain over time (see graph below). It calculates the equity a homeowner potentially gained if they purchased the median-priced home 5, 10, or 30 years ago and still own it today.

These six-figure numbers are impressive and certainly enough to help you fuel a move into your next home, but they’re not a promised amount. Remember, your own equity gain will be different. It depends on how long you’ve been in the house, your home’s condition, any upgrades you’ve made, your area, and much more.

If you want to find out how much equity you have, partner with a trusted real estate professional for an equity assessment on your home. They can provide an expert opinion on what your house is worth today and how the equity you’ve gained over time can help you when you purchase your next home. It may be some (if not all) of what you need for your next down payment.

Bottom Line

If you’re thinking about selling your house and making a move, home equity can be a real game-changer, especially if you’ve been in your current home for a while. If you’re ready to find out how much equity you have, let’s connect.

![Why Growing Home Equity Is Great News if You Plan To Move [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/07/07152601/20220708-KCM-Share-549x300.png)

![Why Growing Home Equity Is Great News if You Plan To Move [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/07/07152602/20220708-MEM.png)