Dec 26, 2023 | Albuquerque Home Values, Albuquerque Real Estate News, Albuquerque Real Estate Talk, For Buyers, For Sellers, Housing Market Updates, Real Estate Market Reoprt

Casitas and AUD’s Accessory Dwelling Units in Albuquerque

The City of Albuquerque has made some significant movements in allowing Casitas (AUDs) on residential properties zoned R-1, and they are offering free casita construction plans on its website. The plans are so detailed and complete that they help streamline and make the cost of building Accessory Dwelling Units on one’s property very affordable, with significant savings in contractor fees.

There are many different reasons why people want to have a casita. Some people use them to produce rental income. They can also be used for home offices, home theaters, a painting space, or a hobby room. People should also have some extra living space for family members to stay in when they visit.

To be allowed to start construction, it is crucial to get a site plan, speak to a planning and zoning department, and make sure the construction plan is within regulation.

The increase in value that casitas allow is challenging to determine. The answer to this question will vary depending on construction costs and level of finish, to name a few.

What Home Buyers Searched for in 2023

The amenities inside the house you buy is significant and Zillow tells us what the top amenities people want are. Zillow, the number one Home Shopping website, looked at over 250 billion user searches in 2023.

The top 10 searches were primarily practical needs that an average family would ask for in a new home, such as a two-car garage and a backyard. However, some personalities were shown, with searchers seeking a house with a fireplace and a walk-in closet.

How vital these items are is crucial for people selling their home and for real estate professionals since it is essential to understand what is important to different home buyers.

From practical (the ever-wanted garage) to picturesque (a backyard retreat anyone?), these are the amenities that round out both the modern and traditional. Backyard: For most Americans, part of the “dream” is an eco-friendly, grass-filled backyard. Fireplace: An architectural luxury, the fireplace creates your dream home scenario on a cold, particularly fabulous winter’s day. Walk-in closet: The practical yet vain response to the master bedroom’s walk-in closet is always positive. Patio: There’s nothing better than extending your living room outside, friends. Open floor plan: A modus operandi of the millennial, the open floor plan is the dreamiest combination of kitchen, dining, and family rooms. Forever together. Pool: The ability to have your very own swimming pool in a warm area is a picturesque scenario. Family room: Who doesn’t love extra space for that big family? Basement: Just more space for any occasion — workout room, media room, etc. Granite counters: This durable feature signifies a high-end kitchen or bathroom.

Mortgage Rates and Buy vs Rent

Low interest rates, especially sub-seven percentages, factor heavily in the buying consideration, and we caution renters, in particular, to do the math regarding the cost of owning.

Air Ducts in Your Home

One of the topics we covered in our last episode was the importance of performing regular cleanings and inspections of heating ducts in residential properties. This is especially necessary in some older homes, which often have in-floor heating and cooling ducts. When purchasing, we cannot overstate how critical it is to perform a complete inspection of these ducts with a camera-scoping procedure to detect potential problems such as collapses or corrosion.

Our comprehensive coverage of the Albuquerque real estate market is designed to empower individuals with the knowledge they need to navigate this crucial aspect of their lives confidently. From housing trends to financing options, market dynamics, and buyer/seller tips, we strive to provide our listeners and readers with valuable insights to help them make informed decisions and achieve their real estate goals.

Dec 11, 2023 | Albuquerque Real Estate News, For Buyers, For Sellers, Housing Market Updates, Pricing, Real Estate Market Reoprt

A Comprehensive Guide to the Albuquerque MSA Housing Market Tracker

We recently launched the Albuquerque Real Estate Market Tracker, your indispensable tool for navigating the dynamic real estate landscape of the Albuquerque Metropolitan Statistical Area (MSA), which includes Bernalillo, Sandoval, Valencia, and Torrance counties. This guide offers weekly insights into the market, focusing on single-family detached homes and providing an in-depth analysis of the latest trends, inventory changes, and price movements. Whether you’re a buyer, seller, or a real estate professional, our tracker is designed to give you a competitive edge in the vibrant Albuquerque housing market.

Coverage and Scope: What to Expect

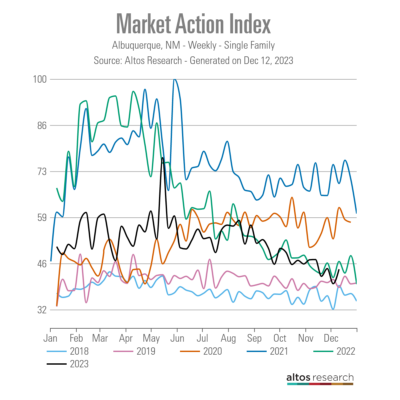

The Albuquerque Real Estate Market Tracker offers a comprehensive housing market overview, covering key metrics such as the Market Action Index (MAI), inventory levels, new listings, and more. This seven-day snapshot is your gateway to understanding the nuances of the local real estate market.

The Importance of Real-Time Market Insights

In today’s fast-paced real estate environment, staying informed with the most current data is crucial. Our tracker provides up-to-date information, enabling you to make timely and informed decisions.

Key Metrics of the Albuquerque Market Tracker

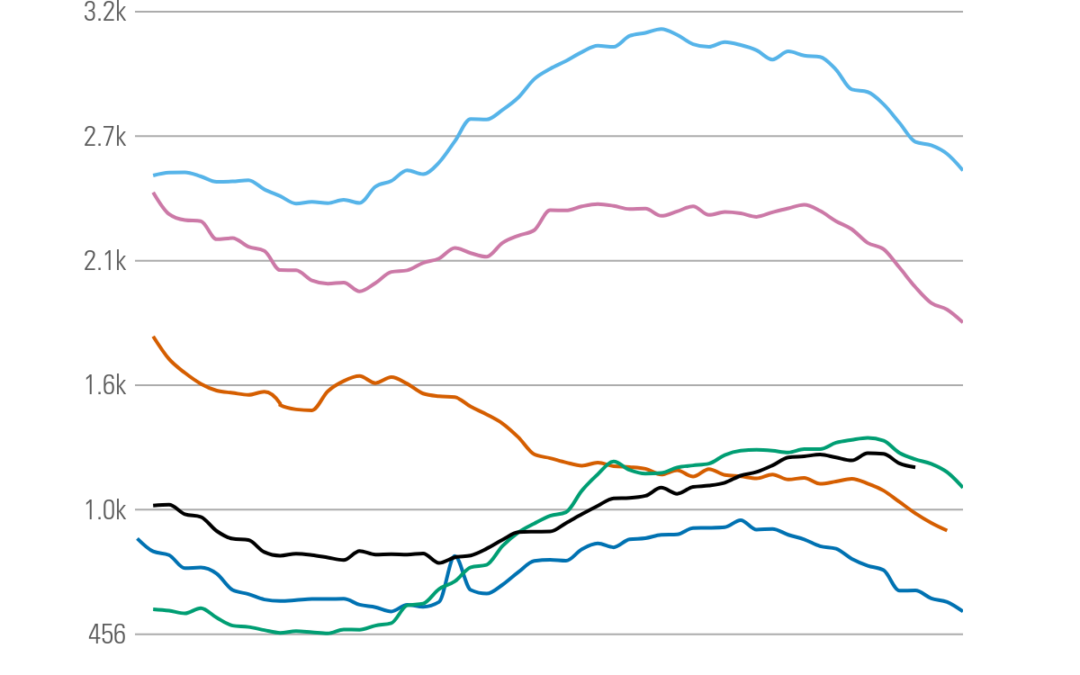

Market Action Index (MAI): Understanding Market Favorability

The MAI is vital in determining whether the market favors buyers or sellers. It analyzes the current rate of property sales against existing inventory, offering a clear picture of market conditions.

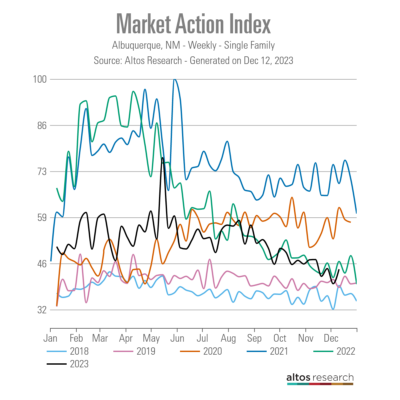

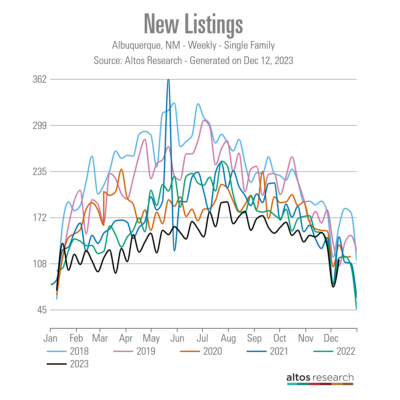

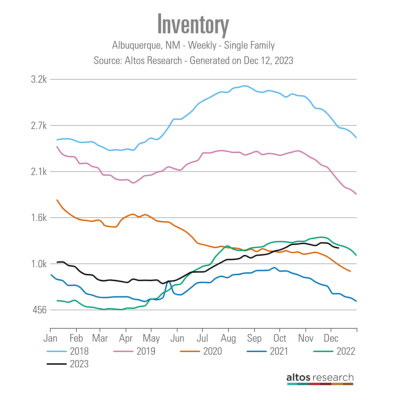

Inventory Analysis: The Pulse of Market Supply and Demand

Monitoring inventory levels is critical to understanding market trends. It provides insights into whether we’re in a buyer’s or seller’s market and helps predict future market dynamics.

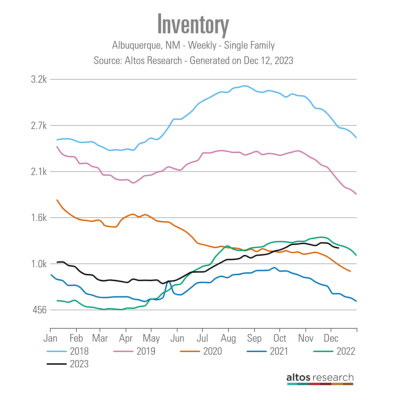

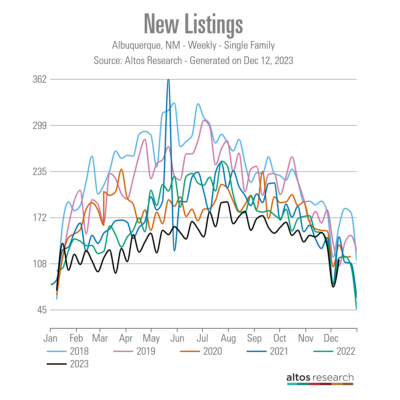

New Listings Insights: Tracking Market Entries

The number of new listings offers a window into seller behavior and market shifts. This data is crucial for anticipating changes in the market landscape.

Listings Absorbed: A Measure of Market Activity

This metric (listings absorbed) reveals how quickly properties are being purchased, indicating the current demand and the market’s overall health.

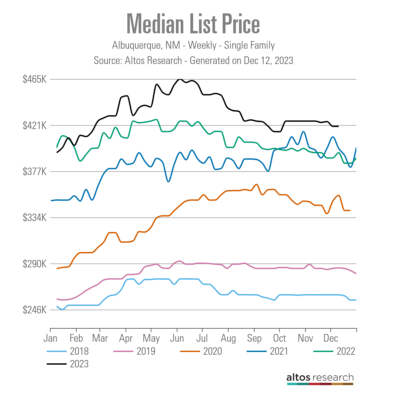

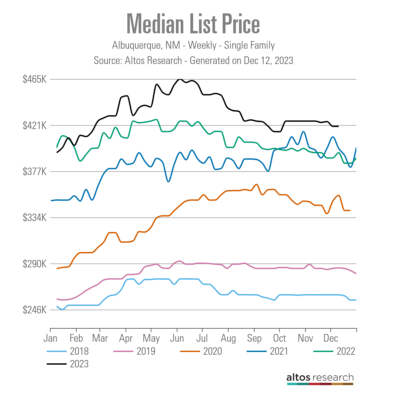

Median List Price: Decoding Market Value

The median list price is an essential indicator of seller confidence and buyer interest. It helps predict future price trends and provides insights into the market’s current state.

List Price per Square Foot: A Detailed Market Comparison Tool

By comparing the median asking price per square foot, we gain a more nuanced understanding of the market, factoring in variations in home sizes for a more accurate analysis.

This metric sheds light on the pricing strategies of new market entrants and is a crucial indicator of emerging market trends.

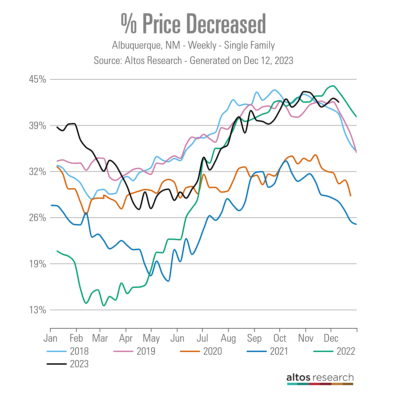

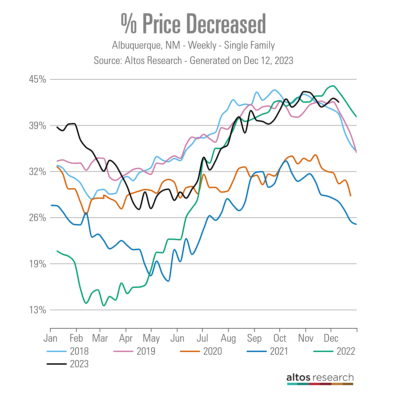

Percent of Price Decreases: Indicators of Market Health

Understanding the proportion of homes with reduced prices helps gauge market demand and potential shifts in pricing trends.

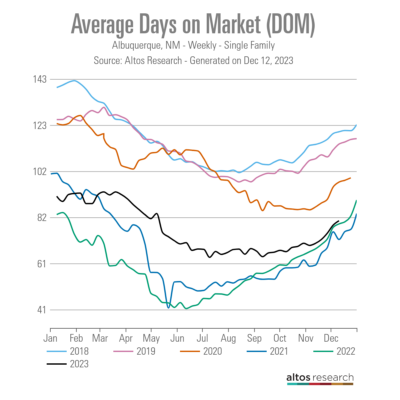

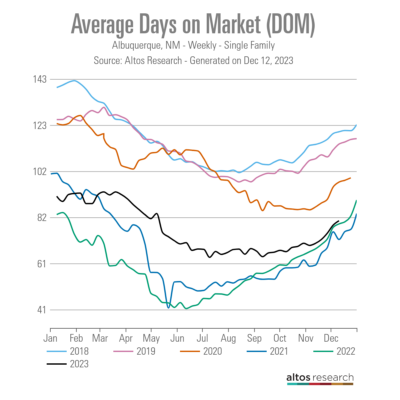

Average Days on Market: Timing the Market’s Pulse

Tracking the average time homes spend on the market provides insights into how fast properties sell, indicating the market’s pace and activity level.

Percent Relisted: Understanding Market Resets

This figure highlights the proportion of homes returning to the market, offering a perspective on the stability and fluidity of the market.

Why the Albuquerque MSA Housing Market Tracker is Essential

For Buyers: Making Informed Decisions

The tracker offers valuable insights into market trends for those looking to purchase a home, helping you make well-informed decisions.

For Sellers: Maximizing Market Advantage

Sellers can use the tracker to understand current market conditions and strategically price their homes to maximize their advantage.

For Real Estate Professionals: A Tool for Strategic Planning

Real estate agents and professionals can leverage the tracker for strategic planning, staying ahead of market trends, and advising clients effectively.

Conclusion: Navigating the Albuquerque Housing Market with Confidence

Summing Up: The Value of Real-Time Insights

The Albuquerque MSA Housing Market Tracker is an indispensable tool for anyone involved in the Albuquerque real estate market. Its comprehensive and timely data empowers users to make informed decisions, stay ahead of market trends, and confidently navigate the market.

FAQs: Your Questions Answered

Q1: How often is the Albuquerque Market Tracker updated?

A1: The tracker is updated weekly on Sunday, providing the most current insights into the Albuquerque housing market.

Q2: Can the tracker help predict future market trends?

A2: Yes, by analyzing current data and trends, the tracker can offer valuable predictions about future market directions.

Q3: Is the tracker useful for first-time home buyers?

A3: Absolutely, it’s a valuable resource for anyone entering the market, especially first-time buyers seeking to understand market dynamics.

Q4: Does the tracker cover rental properties?

A4: The focus of our tracker is on single-family detached homes, offering specific insights into this segment of the market.

Q5: How can sellers use the tracker to their advantage?

A5: Sellers can use the tracker to gauge market conditions, price their homes competitively, and understand buyer trends.

Dec 2, 2022 | Albuquerque Real Estate News, For Sellers

Should I Sell My Albuquerque House or Keep It As A Rental?

Tego

Tracy, we’ve been getting a lot of people asking this question, and so we want to answer it and put a video out on it. And that is I’ve got a home I’m thinking of selling, but I’m also thinking maybe I should just rent it. And so let’s go through some of the pros and cons of that and what people should be thinking about.

Tracy

Sure. So some of the pros right. We’ve seen houses appreciate greatly over the last few years, and maybe you want to hold on to that house and have it keep appreciating and have somebody else pay you while it’s appreciating.

Tego

Right.

Tracy

And if you have an underlying mortgage, they might be paying it off for you while you’re doing something else for your living.

Tego

Yes. There’s a lot of good financial reasons to do that, not for everybody. So you need somebody to help you evaluate that. That’s something we can do. If you’re interested, we’re the Venturi Group with Keller Williams here in Albuquerque. So just reach out to us. Tracy, if you are going to be renting your home, one of the things you need to consider is, is it allowed? For a couple of different ways. One is, does your mortgage allowed? If you have a mortgage, you need to check on that. Also, are there neighborhood regulations, CC&Rs or HOA rules that might disallow it? You nit iseed to check that as well.

Tracy

And the CC&Rs and the HOA rules Tego could vary between short term rental and long term rentals. So there’s a lot of people who want to do short term rental these days, and that might be a little bit harder to find neighborhoods where that’s allowed. So long term is usually pretty okay, but obviously check with the rules.

Tego

So, Tracy, what are some of the other reasons?

Tracy

Well, you know, if you’re moving and you think there’s a chance you might need to move back again, you might want to hold on to that house and rent it out. We’ve seen that a lot. Job change, life changes, people move somewhere else, and then they want to go back and they want to be where they were. So that might be another reason to rent out your house.

Tego

Some financial reasons, that’s my deal, is obviously the income from cash flow, right. The rental income, money coming in. There’s also tax advantages to having a rental property. You can depreciate the asset. There’s also you’re building equity over time, and somebody else is helping you pay down that mortgage that you have on the property. All of those things you need to, especially the tax and some of the implications there. You do need to talk to your accountant and your CPA about that’s our disclaimer there.

Tracy

Right. So not everybody is meant to be a landlord Tego right.

Tego

Yeah.

Tracy

So you might want to hire a property manager, which might cost a little bit of money. Right. They usually take 10% to 15% of the rent to manage the property for you, but then it’s managed for you. There are other possible downsides to renting out your house. You could have it vacant for a while, while you’re waiting for a new tenant. There could be damage to the house. You have to still keep up the equipment and make sure it’s working properly. But overall, there’s lots of pros and cons.

Tego

Yeah, absolutely. And really what it comes down to, whether it makes sense for you or not to convert your home into a rental property, it just has to be right for you. And so if you want any help picking some of these questions, just reach out to us again with the Venturi Group, Keller Williams Realty. You can reach us at 505-448-8888 here in beautiful Albuquerque, New Mexico. Thanks for watching. Take care.

Jul 18, 2022 | For Sellers, Housing Market Updates, Move-Up Buyers, New Construction

If you put a pause on your home search because you weren’t sure where you’d go once you sold your house, it might be a good time to get back into the market. That’s because today’s market is undergoing a shift, and the supply of homes for sale is increasing as a result. That means you may have a better chance of finding a home that will meet your current needs. Here are some options to consider.

Buying an Existing Home Can Give You That Lived-in Charm

According to the National Association of Realtors (NAR), the supply of existing homes (a home that’s been previously owned) has steadily increased since the beginning of the year. The graph below indicates inventory levels are rising, and that’s largely due to more homes coming onto the market and the pace of sales slowing:

As the graph shows, if you’re looking for a home with lived-in charm, supply is rising, and that’s great news for you.

Danielle Hale, Chief Economist for realtor.com, gives insight into why more homeowners are listing their homes and adding to the growing supply of existing homes today:

“Home sellers in many markets across the country continue to benefit from rising home prices and fast-selling homes. That’s prompted a growing number of homeowners to sell homes this year compared to last, giving home shoppers much needed options. We’ve seen more homes come up for sale this year compared to last year . . .”

There are several benefits to buying an existing home. Many buyers want to purchase a home with history, and the character of older houses is hard to reproduce. Existing homes can often be part of an established neighborhood featuring mature landscaping that can give you additional privacy and boost your curb appeal.

Plus, timing can be a consideration as well. With an existing home, you can move in based on the timeline you agree to with the sellers, rather than building a new home and waiting for construction to finish. This is something to keep in mind, especially if you need to move sooner rather than later.

Just remember, while more sellers are listing their homes, supply is still low overall. That means you’ll have more options to choose from as you search for your next home, but you’ll still need to be prepared for a fast-moving market.

Purchasing a Newly Built or Under Construction Home Means Brand New Everything

Census data shows there’s an increasing number of new homes available for sale. It includes homes that are under construction, soon to be completed, and fully built. As the graph below highlights, the supply of new homes for sale has also grown this year:

When building a new home, you can create your perfect living space and customize it to your lifestyle. That could mean everything from requesting energy efficient options to specific design features. Plus, you’ll have the benefit of all new appliances, windows, roofing, and more. These can all help lower your energy costs, which can add up to significant savings over time.

When building a new home, you can create your perfect living space and customize it to your lifestyle. That could mean everything from requesting energy efficient options to specific design features. Plus, you’ll have the benefit of all new appliances, windows, roofing, and more. These can all help lower your energy costs, which can add up to significant savings over time.

The lower maintenance that comes with a newer home is another great advantage. When you have a new home, you likely won’t have as many little repairs to tackle, like leaky faucets, shutters to paint, and other odd jobs around the house. And with new construction, you’ll also have warranty options that may cover portions of your investment for the first few years.

Keep in mind, purchasing a new home could mean waiting a considerable amount of time before you can move. Robert Dietz, Chief Economist and Senior Vice President for Economics and Housing Policy at the National Association of Home Builders (NAHB), explains:

“New single-family home inventory remained elevated at a 7.7 months’ supply. . . . However, only 8.3% of new home inventory is completed and ready to occupy. The remaining have not started construction (25.9%) or are currently under construction.”

That’s an important factor when making your decision and one you should discuss with a trusted real estate advisor. They’ll help you think through all the pros and cons of both new and existing homes to help you arrive at your best decision.

Bottom Line

With the supply of homes for sale rising, you have options for your next home no matter what your preferences are. If you have questions or want help deciding what’s best for you, let’s connect and start the conversation today.

Jul 14, 2022 | For Buyers, For Sellers, Housing Market Updates

With so much talk about an economic slowdown, some people are asking if the housing market is heading for a crash like the one in 2008. To really understand what’s happening with real estate today, it’s important to lean on the experts for reliable information.

Here’s why economists and industry experts say the housing market is not a bubble ready to pop.

Today Is Nothing Like 2008

The 2008 housing crash is still fresh in the minds of many homebuyers and sellers. But today’s market is different. Odeta Kushi, Deputy Chief Economist at First American, says:

“This is not the same market of 2008. . . . It’s no secret the housing market played a central role in the Great Recession, but this market is just fundamentally different in so many ways.”

Natalie Campisi, Advisor Staff for Forbes, explains how today’s lending standards are different than those during the lead-up to the housing market crash:

“Among the differences between today’s housing market and that of the 2008 housing crash is that lending standards are tighter due to lessons learned and new regulations enacted after the last crisis. Essentially, that means those approved for a mortgage nowadays are less likely to default than those who were approved in the pre-crisis lending period.”

Another reason today’s housing market is nothing like 2008 is that the number of people looking to buy a home still outweighs the supply of homes for sale. As realtor.com notes:

“. . . experts don’t believe the market is in a bubble or a crash is in the cards, like during the Great Recession. The nation is still suffering from a housing shortage that has reached crisis proportions at a time when many millennials are reaching the age when they start to consider homeownership. That’s likely to keep prices high.”

Bottom Line

Experts say the housing market isn’t a bubble, and we’re not heading for a crash. Let’s connect so you can have a full picture of today’s housing market in our local area.

Jul 12, 2022 | For Buyers, For Sellers, Housing Market Updates, Interest Rates, Pricing

The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help answer those questions, let’s turn to the experts for projections on what the second half of the year holds for residential real estate.

Where Mortgage Rates Will Go Depends on Inflation

While one of the big questions on all buyers’ minds is where will mortgage rates go in the months ahead, no one has a crystal ball to know exactly what’ll happen in the future. What housing market experts know for sure is that the record-low mortgage rates during the pandemic were an outlier, not the norm.

This year, rates have climbed over 2% due to the Federal Reserve’s response to rising inflation. If inflation continues to rise, it’s likely that mortgage rates will respond. Greg McBride, Chief Financial Analyst at Bankrate, explains it well:

“Until inflation peaks, mortgage rates won’t either. Without improvement on the inflation front, we don’t know where the interest rate ceiling will be.”

Whether you’re buying your first home or selling your current house to make a move, today’s mortgage rate is an important factor to consider. When rates rise, they impact affordability and your purchasing power. That’s why it’s crucial to work with a team of professionals, so you have expert advice to help you make an informed decision about your best move.

The Supply of Homes for Sale Projected To Continue Increasing

This year, particularly this spring, the number of homes for sale has grown. That’s partly due to more homeowners listing their houses, but also because higher mortgage rates have helped ease the intensity of buyer demand. Moderating buyer demand slows down the pace of home sales, which in turn helps inventory rise.

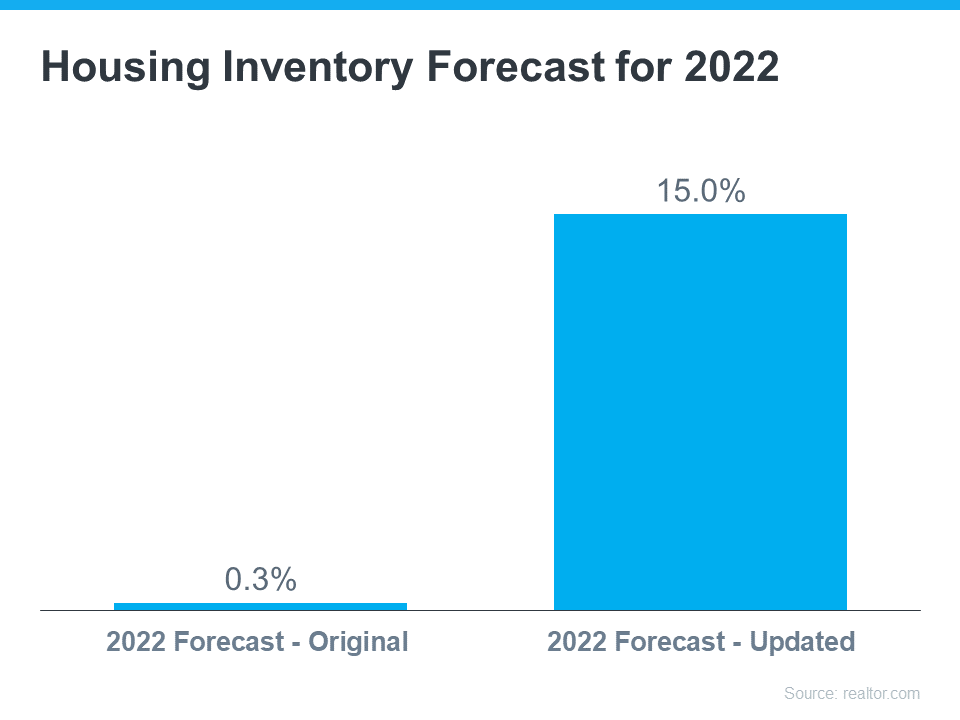

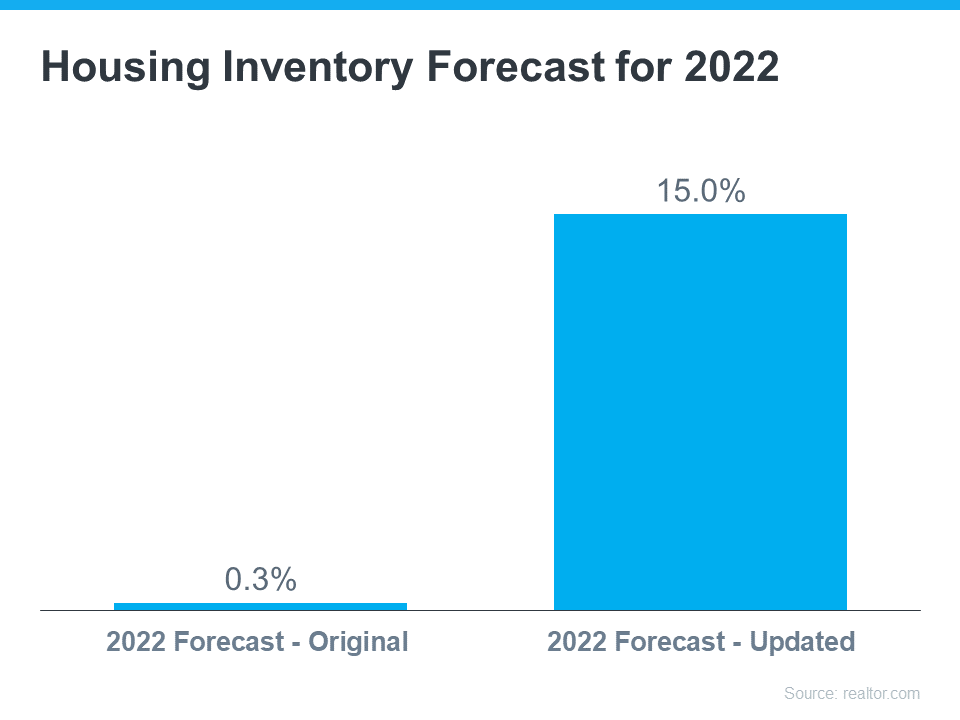

Experts say that growth will continue. Recently, realtor.com updated their 2022 inventory forecast. In the latest release, they increased their projections for inventory gains dramatically, going from a 0.3% increase at the beginning of the year to a 15.0% jump by the end of 2022 (see graph below):

More homes to choose from is great news if you’re craving more options for your home search – just know that there isn’t a sudden surplus of inventory on the horizon. Housing supply is still low, so you’ll need to partner with an agent to stay on top of what’s available in your market and move fast when you find the one. It’s not going to be easy to find a home, but it certainly won’t be as difficult as it has been over the past two years.

Home Price Forecasts Call for Ongoing Appreciation

Due to the imbalance between the number of homes for sale and the number of buyers looking to make a purchase, the pandemic led to record-breaking increases in home prices. According to CoreLogic, homes appreciated by 15% in 2021, and they’ve continued to rise this year.

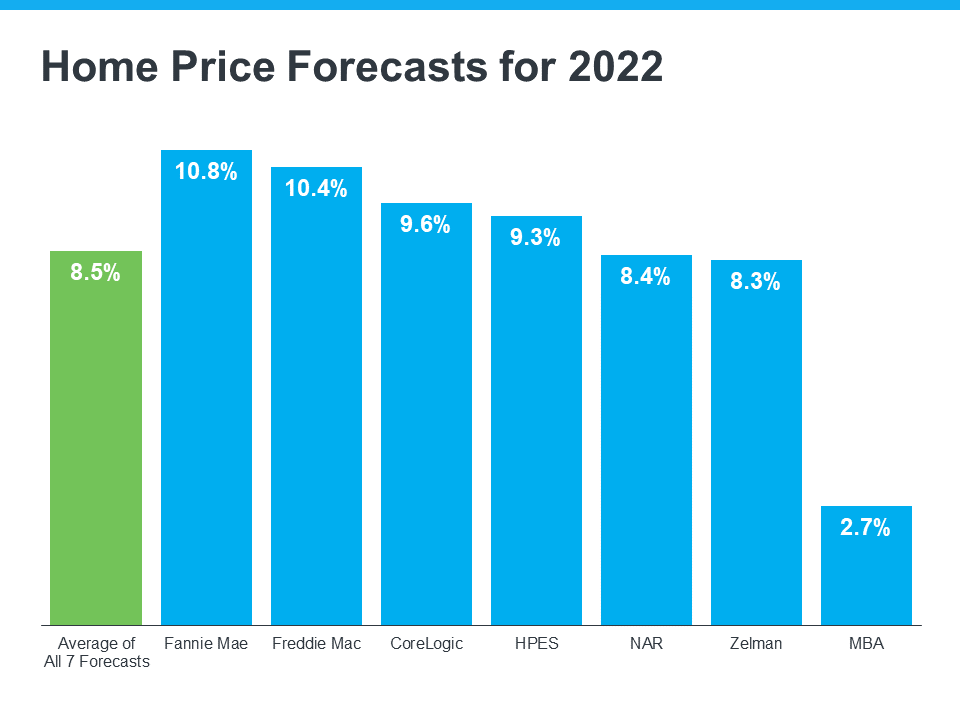

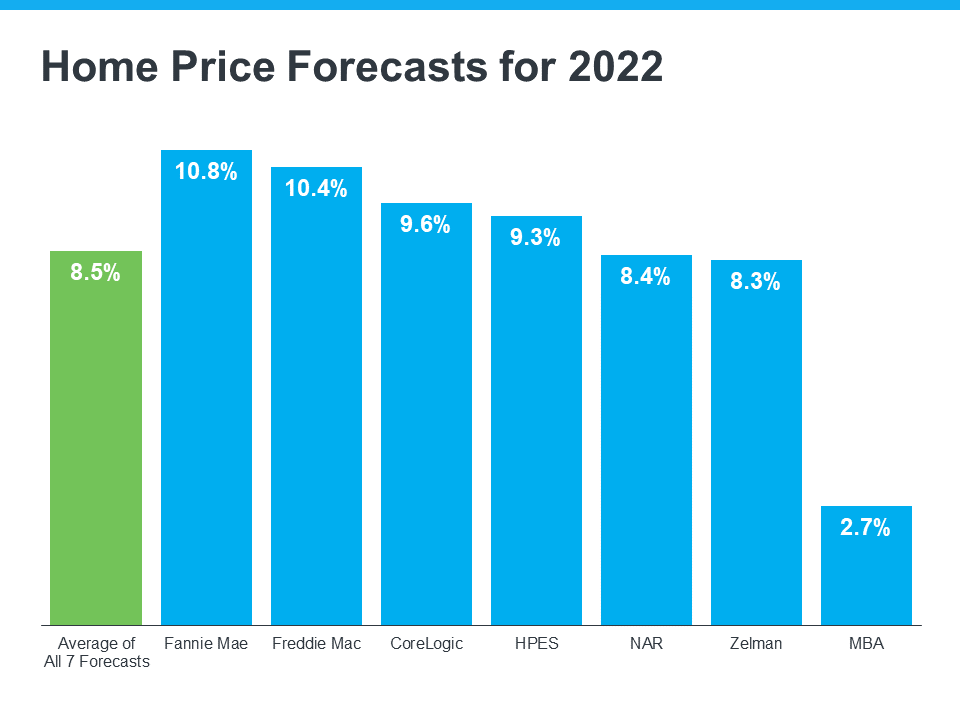

Even though housing supply is increasing today, there are still more buyers than there are homes for sale, and that’s maintaining the upward pressure on home prices. That’s why experts are not calling for prices to decline, rather they’re forecasting they’ll continue to climb, just at a more moderate pace this year. On average, homes are projected to appreciate by about 8.5% in 2022 (see graph below):

Selma Hepp, Deputy Chief Economist at CoreLogic, explains why the housing market will see deceleration, but not depreciation, in prices:

“The current home price growth rate is unsustainable, and higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.”

For current homeowners looking to sell, know your home’s value isn’t projected to fall, but waiting to make your purchase does mean your next home could cost more as home prices continue to appreciate. That’s why, if you’re thinking about buying your first home or you’re ready to make a move, it may make sense to do so now before prices climb higher. But rest assured, once you buy a home, that price appreciation will help grow the value of your investment.

Bottom Line

Whether you’re a homebuyer or seller, you need to know what’s happening in the housing market, so you can make the most informed decision possible. Let’s connect to discuss your goals and what lies ahead, so you can determine the best plan for your move.