What to Expect From Your Albuquerque Real Estate Broker in 2026

What to Expect from Your Albuquerque Real Estate Broker in 2026

By Venturi Realty Group

Albuquerque Real Estate Talk, Episode 568 – Tego and Tracy Venturi break down what buyers and sellers should expect from their real estate brokers in 2026, from pricing and concessions to negotiation, transparency, and down payments.

After more than 568 consecutive episodes of Albuquerque Real Estate Talk, Tego and Tracy Venturi have a clear view of how the 2026 market is different – and what that means for the job of your real estate broker. As Tego puts it, “we’ve been here talking about real estate in Albuquerque every week for 568 episodes now,” and each show is about helping buyers, sellers, and even other agents understand what it really takes to succeed in this market.

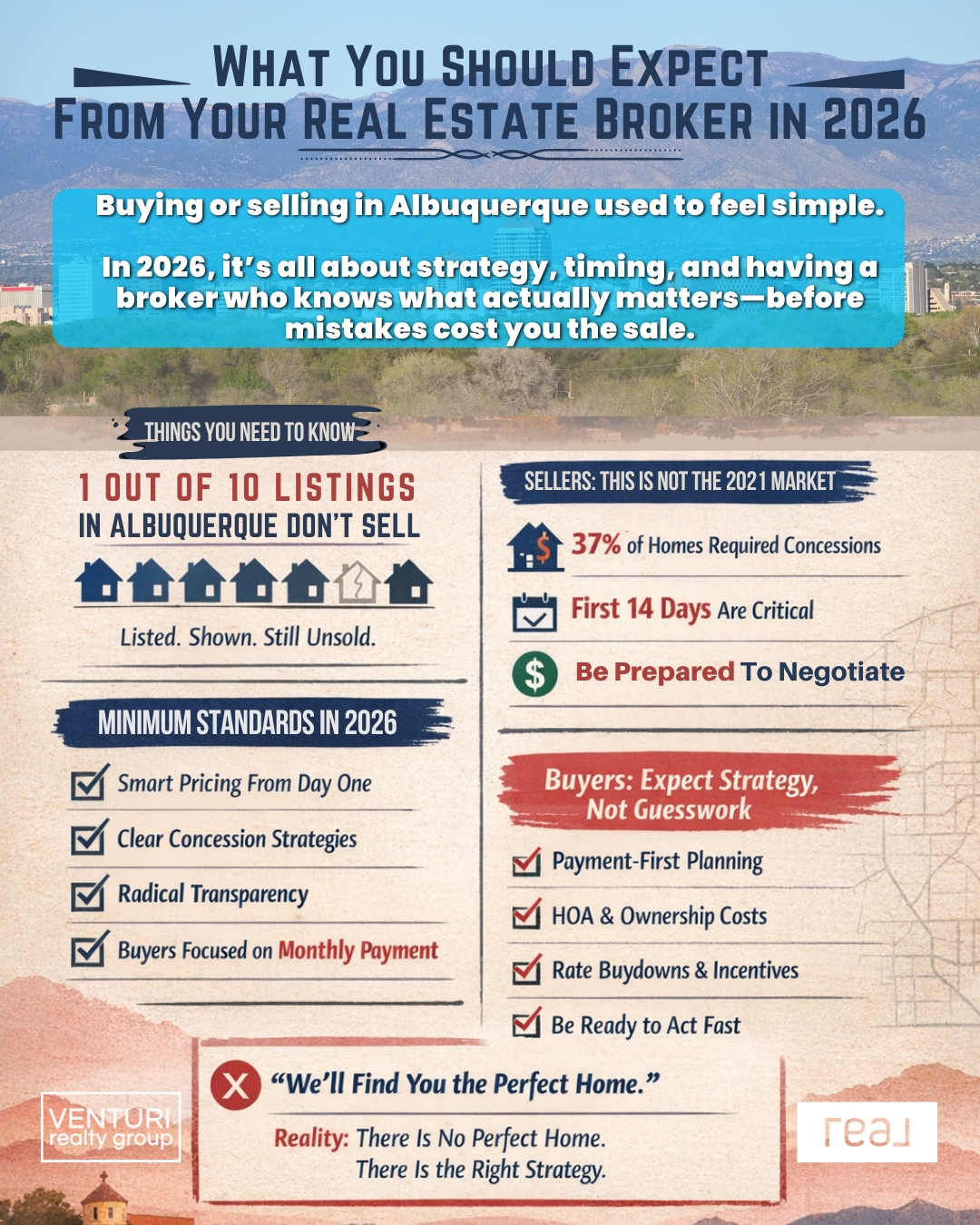

In this episode, they start with a sobering statistic: about one out of every ten homes listed in the Albuquerque area comes off the market without ever selling. At the same time, 37% of recent sales involved seller concessions, with builders and resale sellers alike using credits and incentives to help buyers manage higher payments. That combination – a meaningful share of listings never selling while many successful ones use smart finance strategies – is exactly why expectations of your broker are changing.

“Home sellers are giving concessions at a higher level than really we’ve ever seen.”

From there, the conversation moves through what to expect from a listing broker, what buyers should demand from their broker in a “monthly payment driven” market, a question-of-the-week on how much cash is really needed for a down payment in 2026, and a “bad real estate advice” segment on the myth of the perfect home. The result is a practical checklist for Albuquerque consumers who want an agent that offers more than just a sign in the yard or a key to open doors.

The 2026 Standard for Listing Brokers in Albuquerque

When Tracy asks, “What to expect from your listing broker in 2026?”, Tego immediately reframes the conversation around outcomes. Roughly 10% of the homes that get listed for sale in the Albuquerque area are withdrawn without selling – even after photos, showings, and weeks or months on the market. That reality means sellers should expect a broker who understands not just how to list a home, but how to keep it out of that unsold 10%.

A big part of that is what Tego calls the “finance first strategy.” Rather than thinking only in terms of list price and price reductions, your listing broker should be fluent in concessions and rate buydowns. They explain how “37% of the homes here in the fourth quarter of 2025 had some sort of concession,” and that when it’s done properly, a seller credit can lower the buyer’s monthly payment while allowing the seller to net more than they would with a straight price cut.

Tracy walks through the practical side of this: in a world where new home builders are offering incentives like appliances, credits, and rate buydowns, resale sellers are often competing with those packages whether they realize it or not. A good listing broker should talk with you up front about if and how to offer concessions, and when it might make more sense to structure a credit than to reduce the asking price.

Pricing strategy itself is another non-negotiable. Tego stresses that, unlike in 2020–2022, you can’t “just throw any number out there” and count on buyers to show up. Today, you need to nail that first 14-day listing period with a data-driven price based on relevant sales and active competition. As he puts it, “you don’t wanna be one of the 110 day homes,” because the average days on market for sold homes is around the mid-40s, while unsold active listings average about 110 days.

“The bare minimum these days is professional photography and really good photography, really good media when you present your home to the market.”

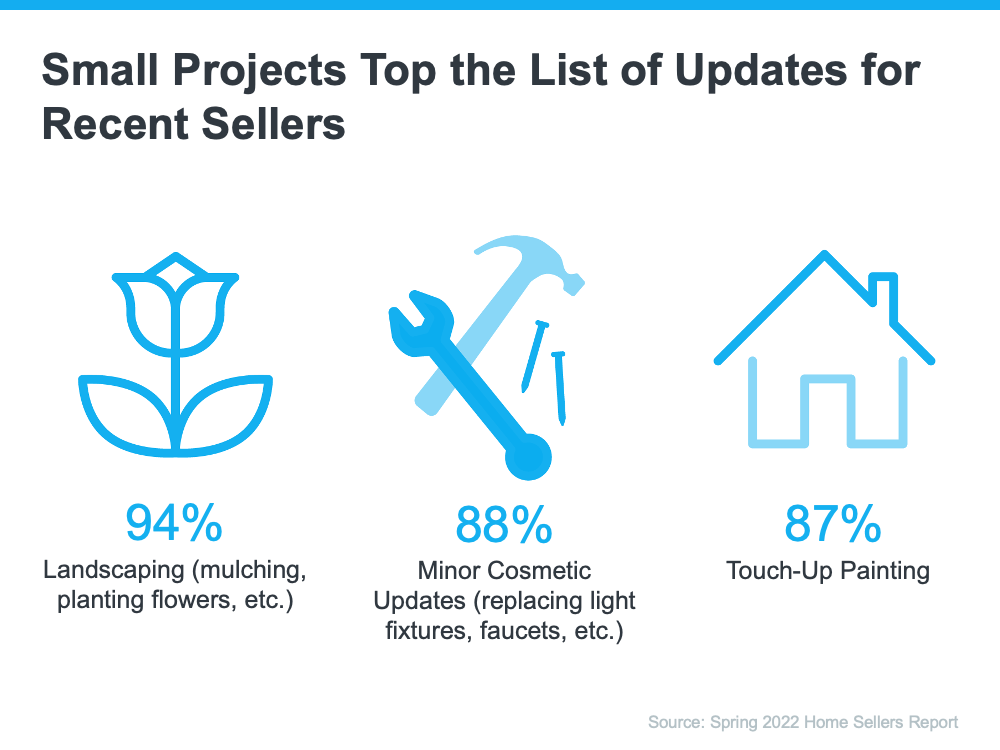

Condition and presentation matter just as much. Tracy talks about the “move in ready” standard and the need for honest conversations about odors, clutter, and deferred maintenance. Sometimes that means decluttering half of what you own, sometimes repainting, and sometimes simply deep-cleaning carpets and baseboards. Their advice is to talk with a broker early so you don’t overspend on projects that won’t move the needle, and so you can get as close as possible to that model-home feel buyers respond to.

From there, the expectations go deeper into radical transparency. Tego says you don’t need a “yes man” – you need someone who will be frank about pricing and condition, even when it’s uncomfortable. That can include discussing whether a pre-listing home inspection makes sense for your property, how to handle repairs, and how to position the home so buyers can “make your offer knowing the condition” instead of being surprised later.

Marketing in 2026 is more than just placing a listing in the MLS. Tego describes looking at listings still using dark, vertical cell-phone photos and contrasts that with what should now be the minimum standard: professional photography, strong visuals, and a “digital twin” of the home via a 3D walkthrough and floor plan. With help from their media producer, they also push short-form video and reels across platforms to get listings in front of as many qualified buyers as possible.

Finally, sellers should expect serious lead management and data. Tracy explains the importance of having someone answer sign calls live whenever possible, responding quickly to email inquiries, and following up with other agents so interested buyers don’t move on. On the analytics side, Tego wants sellers to understand absorption rate and months of supply: how many homes like theirs are for sale, how quickly they’re selling, and what that means for realistic timelines in neighborhoods like Ventana Ranch. Together, these elements define what a truly professional listing broker looks like in 2026.

Seller Checklist: What to Expect from Your Listing Broker in 2026

- Finance-first pricing and concessions strategy Your broker should understand seller credits, rate buydowns, and how a $10,000 concession can sometimes lower a buyer’s payment while netting you more than a simple price reduction.

- Data-driven pricing and the crucial first 14 days Expect a clear pricing plan based on relevant local sales and competition, with a strategy for that first two-week launch window so you avoid becoming one of the 110-day unsold listings.

- Move-in-ready standard and honest feedback Your broker should walk the property with you, talk candidly about odors, clutter, repairs, and staging, and help you get as close as possible to that clean “model home” presentation buyers expect.

- Professional media and a true digital twin High-quality photography, strong online visuals, and a 3D walkthrough or floor plan should be treated as the bare minimum when bringing your home to the market.

- Lead capture and fast response systems Your listing team should have processes so sign calls, emails, and inquiries from other agents are answered quickly while potential buyers are still engaged and standing in front of your home.

- Clear explanation of absorption rate and competition You should walk away understanding how many homes like yours are for sale, how fast they’re selling, and what that means for your pricing, timeline, and negotiation expectations.

What Buyers Should Expect from Their Broker in the 2026 “Monthly Payment” Market

On the buy side, Tracy starts with a simple but powerful lens: think about your monthly payment. For most financed buyers, that payment is made up of principal, interest, taxes, insurance, and often extras like homeowners association dues. They describe how a buyer might fixate on a $200,000 condo only to discover a $400-per-month HOA fee that dramatically changes their real buying power. In Tego’s words, the 2026 housing market “is a monthly payment market for the bulk of people,” driven in part by higher interest rates.

That’s why conversations about rate buydowns and seller credits are just as important for buyers as they are for sellers. Tego and Tracy explain how a rate buydown can allow a buyer whose budget feels like $380,000 to comfortably afford a $400,000 home when a seller contributes to the buydown, keeping the payment similar. Your buyer’s broker and lender should be talking proactively about using concessions this way, rather than treating price as the only lever in a negotiation.

Preparation is another recurring theme. Tracy talks about the “prepared buyer” and the trifecta that comes into play when a lender is involved. After showing clients ten or more homes, it’s common for a clear “gem” to appear – the one that really fits. But as she notes, someone else is often out seeing those same homes too. A good buyer’s broker will have coached you early on about getting pre-approved, understanding your payment comfort zone, and being ready to write a clean, timely offer when that special home hits the market.

Negotiation extends well beyond price. The team emphasizes strategies for both the initial offer and the inspection and repair phase, noting that 25–30% of homes that go under contract end up coming back on the market, often during inspections. Your broker should be skilled at keeping the deal together through appraisal questions, survey issues, and repair requests, focusing on win–win outcomes rather than win–lose standoffs that derail transactions.

“You also need a realtor that’s kind of there for you when you need just a shoulder to cry on.”

There’s also an expectation of radical transparency and emotional support. Buying a home isn’t just about searching online and touring properties; it’s loan applications, inspections, packing, moving, and juggling everything else in life at the same time. Tracy talks about the importance of a realtor who always tells you what to expect next and serves as a calm, reasonable voice when the process feels overwhelming.

Your broker should also help you think beyond the mortgage payment to total monthly costs and maintenance. Tracy points out that older homes can carry higher utility bills than newer, energy-efficient homes, and that buyer’s brokers should be talking with clients about utilities, HOA dues, and ongoing upkeep as part of the decision-making process.

In their “Bad Real Estate Advice” segment, Tego and Tracy tackle the myth of the perfect home. Tego frames it this way: “our bad real estate advice of the week is, ‘We’re gonna find you the perfect home.’” Tracy even notes that the custom home they built for themselves decades ago still isn’t truly perfect – there are things they would change. The takeaway for buyers is that every home involves tradeoffs in budget, location, and features, and a good broker will help you balance those tradeoffs realistically instead of promising perfection.

The question of the week brings the discussion down to dollars: “How much cash do I actually need for a down payment in 2026?” Tego and Tracy acknowledge that the honest answer is, “it depends,” but they explain the range of options available. Conventional loans can start around 3% down, FHA loans commonly use 3.5% down, and qualified buyers can use VA or USDA loans with zero down. In New Mexico, certain programs provide down payment and closing cost assistance for households in specific income brackets, and closing costs themselves can sometimes be negotiated for the seller to help pay via concessions.

They also clarify that while a traditional 20% down payment on a conventional loan can help avoid mortgage insurance, many successful buyers in Albuquerque purchase with far less cash upfront. The key is working with a broker and lender who understand the dozens – even hundreds – of loan programs in the market and can match your situation with the right option.

Finally, they remind buyers not to overlook new construction. There are many new neighborhoods and incentives in the pipeline, from rate buydowns to included features, even though new builds may not always be in the exact location you first imagined. A 2026-ready buyer’s broker will help you consider both resale and new construction options, weigh the incentives, and see how each choice fits your lifestyle and monthly payment comfort zone.

Frequently Asked Questions

What should I expect from my listing broker in Albuquerque in 2026?

You should expect much more than a sign in the yard and an MLS entry. In this episode, Tego and Tracy describe a 2026-ready listing broker as someone who understands concessions and rate buydowns, builds a “finance first” pricing strategy, helps you nail the first 14 days on the market with accurate pricing, sets a clear move-in-ready standard for condition, invests in professional media and a digital twin, runs a true lead response system for inquiries, and explains market data like absorption rate and months of supply in your specific neighborhood.

How are concessions and a “finance first” strategy used to sell my home?

Concessions are seller-paid credits that can be applied to a buyer’s closing costs or rate buydown instead of simply lowering the price. Tego notes that about 37% of homes in the fourth quarter of 2025 had some form of concession, and that when structured properly, a concession can lower the buyer’s monthly payment while allowing the seller to net more than they would by cutting the price by the same amount. In 2026, your listing broker should be able to show you side-by-side examples of how a concession versus a price reduction would affect both your net proceeds and your buyer’s payment.

What should a buyer expect from their broker in the 2026 “monthly payment” market?

According to Tego and Tracy, buyers in 2026 should expect their broker to focus on monthly payment rather than just price, including HOA dues and utility considerations. Your broker should coordinate with your lender about rate buydowns and concessions, help you become a “prepared buyer” with pre-approval and a clear plan so you can move quickly on a gem when it hits the market, and bring strong negotiation skills to both offer writing and inspection repairs. Just as importantly, they should provide radical transparency and emotional support, guiding you through each step of an often stressful process.

How much cash do I actually need for a down payment in 2026?

The honest answer, as Tego and Tracy emphasize, is “it depends.” They explain that conventional loans can start around 3% down, FHA loans typically use 3.5% down, and qualified veterans and certain rural buyers can use VA or USDA loans with zero down. New Mexico offers programs that provide down payment and closing cost assistance for eligible buyers, and in some cases, sellers can contribute to closing costs through concessions. While 20% down on a conventional loan can help avoid mortgage insurance, many successful Albuquerque buyers in 2026 purchase with significantly less cash upfront by choosing the right loan program and structure.

Is there really such a thing as a “perfect home”?

In their “Bad Real Estate Advice” segment, Tego and Tracy say no. They highlight the phrase, “We’re gonna find you the perfect home,” as unrealistic advice, noting that even their own custom-built home isn’t truly perfect decades later. In practice, every buyer faces tradeoffs among price, location, features, and timing. A good broker in 2026 won’t promise perfection; instead, they’ll help you prioritize what matters most, understand where compromise is necessary, and ultimately find a home that works very well for your lifestyle and budget, even if it isn’t perfect in every way.

Have questions about Albuquerque real estate?

If you are thinking about buying or selling, or just want to understand how the current market affects your plans, our team is here to be a resource.

Call or text: (505) 448-8888

Email: info@welcomehomeabq.com

Website: WelcomeHomeABQ.com

Venturi Realty Group of Real Broker, LLC

![Why an Agent Is Essential When Pricing Your House [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/06/23153132/20220624-KCM-Share-549x300.png)

![Why an Agent Is Essential When Pricing Your House [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/06/23153135/20220624-MEM.png)

![Should You Update Your House Before Selling? Ask a Real Estate Professional. [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/05/11144319/20220513-KCM-Share-549x300.png)

![Should You Update Your House Before Selling? Ask a Real Estate Professional. [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/05/11144315/20220513-MEM.png)

![Give Your Curb Appeal a Boost Before You Sell [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/04/26113112/20220429-KCM-Share-549x300.png)

![Give Your Curb Appeal a Boost Before You Sell [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/04/26113033/20220429-MEM.png)