Valentine’s in ABQ: Things To Do + What The Housing Market Means for You

Valentine’s Day in Albuquerque: Local Events, Single Women Buyers & 2026 Market Insights

By Venturi Realty Group

Albuquerque Real Estate Talk – Episode 569: Valentine’s Special & Market Insights (recorded the first week of February 2026)

In this Valentine’s edition of Albuquerque Real Estate Talk, Tego and Tracy Venturi lean all the way into the theme of love—love for New Mexico, for the Albuquerque community, for local businesses, and, of course, for homes. From creative date ideas around town to big-picture insights on who is buying homes and where the market may be heading, this episode blends lifestyle and data in classic Venturi fashion.

As Tracy puts it, “think about all the things we love about New Mexico, our community, the people, local businesses, things and, and homes and how much we love homes and how much people love their home.” That simple idea becomes the backbone of the conversation: how to enjoy where you live right now and how to plan for the home that fits your life in the years ahead.

“Think about all the things we love about New Mexico, our community, the people, local businesses, and homes.”

Along the way, the episode hits several of the show’s regular segments. There’s a Valentine’s events rundown put together by producer Samuel, a “question of the week” about whether a 30-year mortgage really locks you in for 30 years, and a “bad real estate advice” segment tackling the myth that a price reduction means something is wrong with a home. The show closes with takeaways from a coffee conversation with National Association of Realtors Deputy Chief Economist Jessica Lutz, including what to expect from mortgage rates and why baby boomers may not sell all at once in a so-called “silver tsunami.”

Valentine’s in Albuquerque: Unique Dates, Local Spots & Gallentine’s Ideas

When Tracy first pitched a Valentine’s episode, Tego hesitated—until they realized how naturally the theme fits Albuquerque real estate. The episode quickly turns into a tour of creative ways to celebrate love around the city, whether that’s romantic, spooky, or strictly Gallentine’s-style with friends.

Early in February, the Made with Love Market takes over the motel courtyard on Central near the ABQ BioPark and aquarium, with local makers, handmade jewelry, great food, and a fun “New Mexico true” atmosphere. It’s the kind of place, Tracy says, where you can wander, snack, and find “a special, unique New Mexico kind of Valentine’s gift” in one stop.

For couples who like their romance with a little edge, Samuel flagged an event at the historic Lobo Theater called “Love and Hangovers,” featuring the 1992 Bram Stoker’s Dracula on the big screen. It’s not Romeo and Juliet—more gothic than Shakespeare—but it still counts as a love story in its own dramatic way. As Tracy jokes, it’s perfect “for romantic with a side of spooky.”

“It’s perfect for romantic with a side of spooky.”

Leaning even further into the spooky side of Valentine’s, the Painted Lady Bed and Brew is hosting its “Dead Bath and Beyond” spooky goods market on Friday the 13th, the day before Valentine’s Day. If your Valentine is more Wednesday Addams than Cupid, this might be your scene. For those who prefer to move instead of nibble, there’s also the Cupid’s Chase 5K in the valley and a two-day Valentine’s market at the Rail Yards on February 14th and 15th, featuring local vendors in a setting that feels a lot like an off-season farmer’s market.

Foodies are not left out. Tully’s Italian Deli on San Mateo is offering a Valentine’s fixed-price dinner, complete with candlelit tables, classic Italian cuisine, and a live serenade of music. It’s an intimate, old-school setting where reservations are essential. Later in the month, Tully’s is also hosting a “Seven Husbands of Evelyn Hugo” book-themed tea party on February 22nd—ideal for a friend date or Gallentine’s outing.

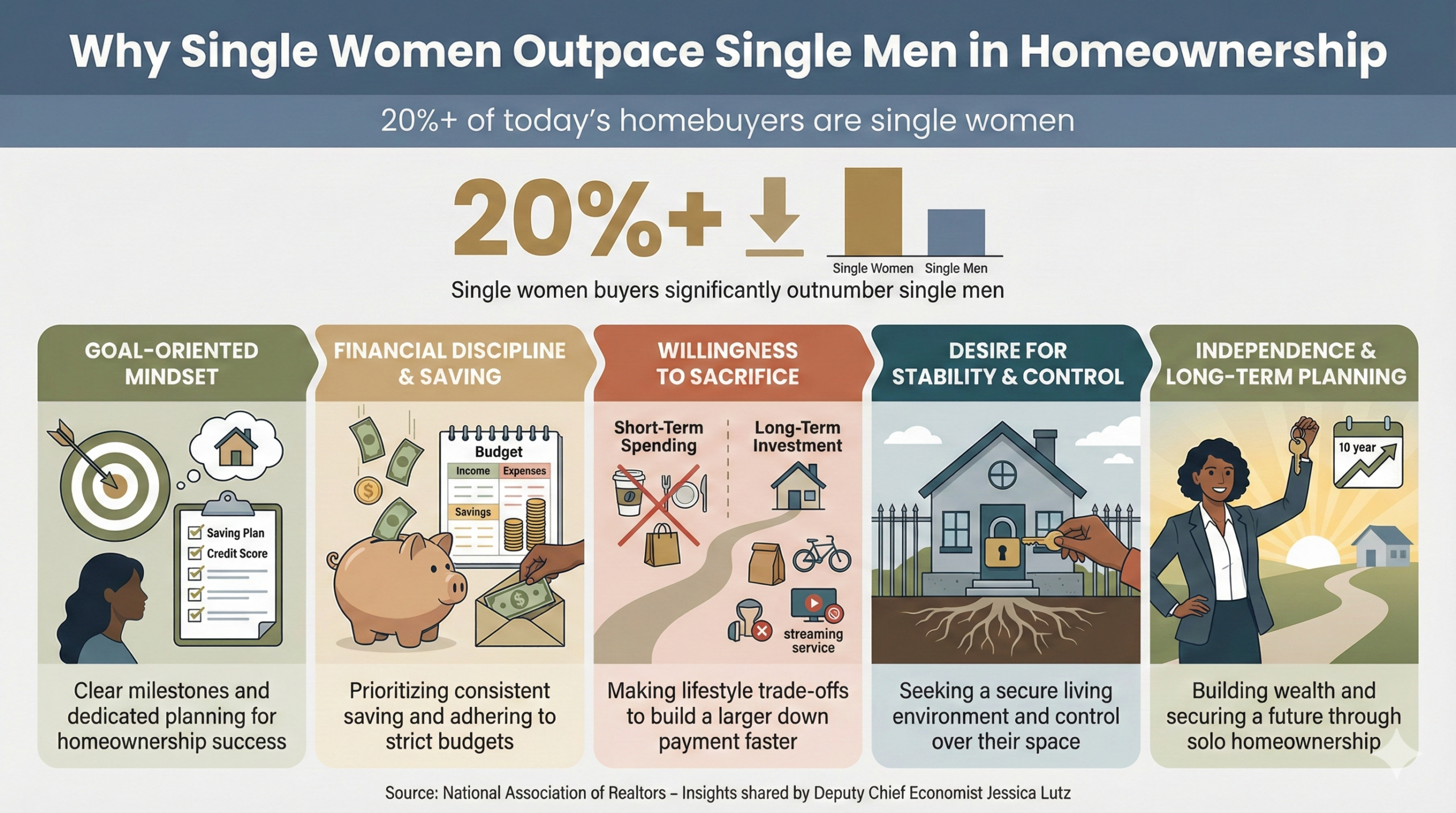

The episode also highlights a subtle but powerful trend behind all this talk of Valentine’s, dating, and dinner reservations: single women buying homes. Drawing on data from Jessica Lutz at the National Association of Realtors, Tracy notes that “20% or more of home buyers are single women and far outpacing single men.” In fact, single women outnumber single men in the first-time homebuyer pool by more than two-to-one.

When asked why, Jessica’s answer stuck with both Tego and Tracy. In Tracy’s words, “the question was, why, why are women outpacing men? And she said that she felt like they just were more disciplined and had that goal. It was like they cut back where they needed to, to save, to be in a position to buy and take care of themselves.” That mindset shows up in another cultural twist the show embraces: Gallentine’s Day, where single women gather to celebrate friendship, independence, and—often—a home they bought on their own.

“20% or more of home buyers are single women and far outpacing single men.”

Whether you’re coupling up for a prix-fixe Italian dinner, grabbing friends for a spooky market, or hosting a Gallentine’s party at home, the through-line is simple: there are countless ways to celebrate love and community in Albuquerque all month long, not just on February 14th.

Albuquerque Valentine’s & Community Highlights from Episode 569

- Made with Love Market near the BioPark

A Valentine’s-themed market at the motel courtyard on Central near the aquarium, featuring local makers, handmade jewelry, great food, and plenty of New Mexico-flavored gift ideas. - “Love and Hangovers” at the Lobo Theater The historic Lobo Theater is screening Bram Stoker’s Dracula as a Valentine’s event, perfect for couples who like a romantic night out with a spooky twist in a classic 1930s venue.

- Painted Lady Bed & Brew’s “Dead Bath and Beyond” On Friday the 13th, the Painted Lady Bed and Brew hosts a spooky goods market that’s tailor-made for Valentines who lean more Wednesday Addams than Cupid.

- Cupid’s Chase 5K and Rail Yards Valentine’s Market Active locals can join the Cupid’s Chase 5K in the valley and browse a two-day Valentine’s market at the Rail Yards on February 14th and 15th, with local vendors and a fun, community-focused atmosphere.

- Valentine’s Dinner & Book-Themed Tea at Tully’s Italian Deli Tully’s is offering an intimate fixed-price Valentine’s dinner with candlelight and live music, plus a “Seven Husbands of Evelyn Hugo” book-themed tea party on February 22nd for a perfect friend date or Gallentine’s outing.

- Gallentine’s Day & Single Women Homebuyers With more than 20% of buyers being single women, the team leans into Gallentine’s Day—celebrating women who have set a goal, saved diligently, and purchased homes where they can host their own gatherings.

From Love Nests to Equity: Homes, Mortgages & Market Myths

After the Valentine’s events tour, the episode pivots to homes themselves—how they fit into your life and what today’s market means if you’re thinking about buying or selling. Tracy frames it with a simple observation: sometimes you realize your current “love nest” isn’t quite the right fit anymore. It might be too small, too big, or have too many stories for your lifestyle now, and that realization can hit you while you’re out on a date in a different neighborhood you fall in love with.

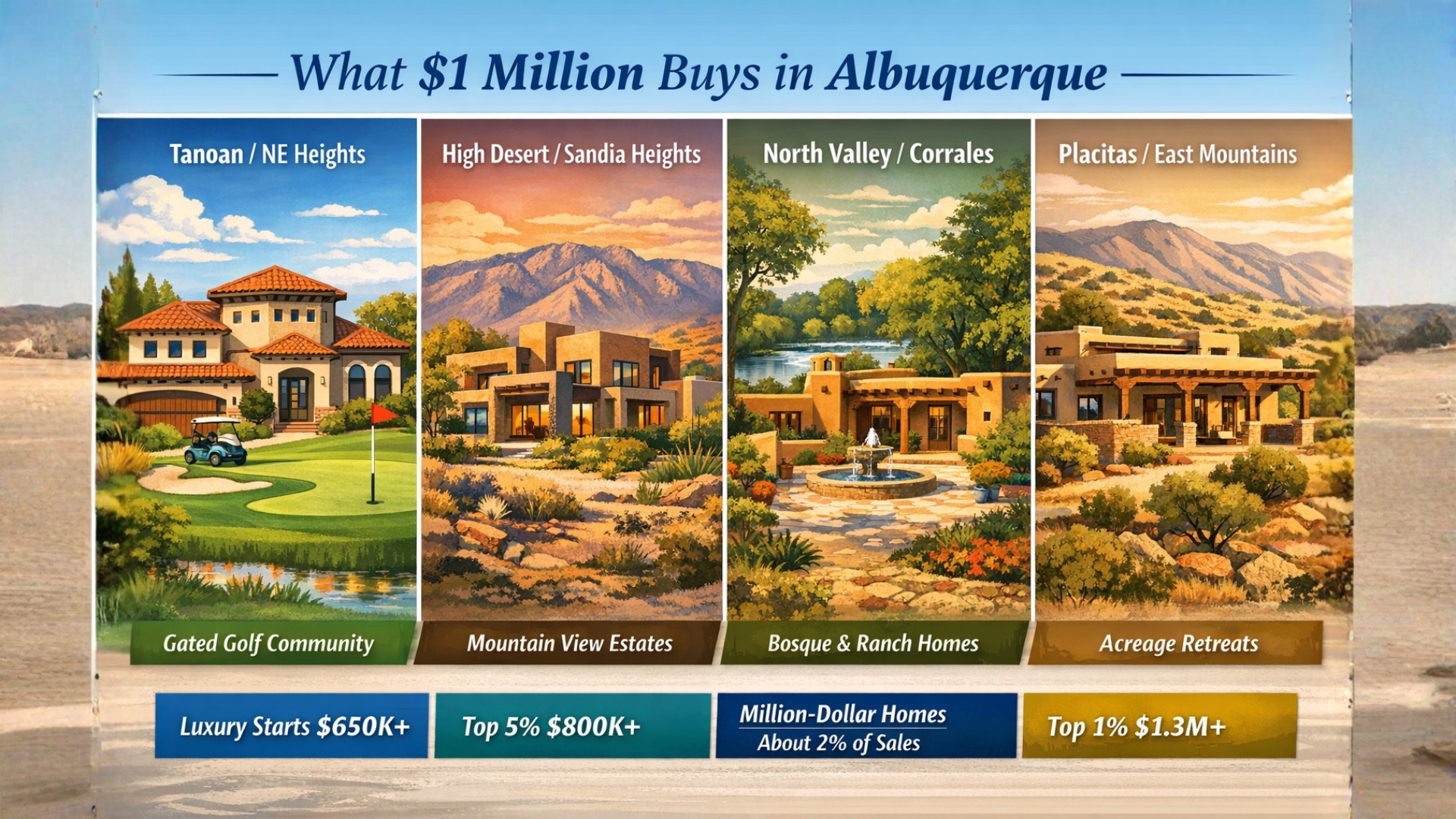

They highlight one example: a special home in Corrales coming on the market, sitting on about 1.3 acres and offering roughly 4,800 square feet on a single level. It has room for at least six cars with an oversized three-car attached garage plus a detached three-car garage and workshop space. Listed at $1,595,000, it’s a reminder that the Albuquerque area offers everything from cozy starter homes to sprawling luxury properties—each one a potential match depending on your season of life.

“If you find yourself falling in love with a neighborhood while you’re out on your date, or you realize your current love nest isn’t quite the right one for you anymore, we’d be honored to help you find a special home you can fall in love with all over again.”

Community Focus: Electronics Recycling Event on February 21st

Because loving where you live also means taking care of it, the Venturi Realty Group is hosting an electronics recycling event around Super Bowl time. As people upgrade TVs and devices, the question becomes: what do you do with the old ones that still feel too nice to toss, but no one really wants?

Tracy and Tego explain that they partner with a company that literally shreds the electronics, separates out any materials that are useful and have value, and then properly disposes of the rest. “They take and they shred ’em somehow,” Tracy notes, adding that this is what the company does all day long, right down to recovering precious metals so data isn’t compromised.

From now through February 21st, community members can drop off unwanted electronics—cell phones, laptops, flat-screen TVs, and computers—at their office at 1119 Alameda Boulevard Northwest, right down by the river and Rio Grande. The only exception: no old tube TVs, which Tego jokes are “a whole nother animal” because they’re really big, really old, and much harder to handle.

Question of the Week: Do I Have to Stay 30 Years If I Get a 30-Year Mortgage?

The question of the week sounds basic but turns out to be one many people quietly wonder about: “Do I need to stay in my home for 30 years if I have a 30 year mortgage?” Tego’s answer is clear—no, you don’t.

They explain that a 30-year mortgage is simply how the loan is amortized, how the principal and interest are calculated and spread out, not a requirement that you live in the home for three decades. You can sell the home, pay off the mortgage, refinance, or even pay the loan off early if you come into money or decide that being mortgage-free is a top priority.

They also remind listeners that many government-backed mortgages do not carry a prepayment penalty, meaning you can pay them off early without a fee. Still, that kind of move should be considered carefully, because people can get themselves in trouble if they refinance or tap equity without a clear plan.

That leads to a related question they hear often: how long do you have to stay in a home before you have enough equity to sell? Looking back at roughly 50 years of Albuquerque data, Tracy notes that homes have appreciated around 3–4% a year on average. When you combine that appreciation with the principal you pay down every month, most owners who bought at a reasonable price typically need a few years before they can break even after selling costs.

“It takes a couple of years,” Tracy explains, “because it’s not just appreciation, it’s also that you’re paying principal down every month as well.”

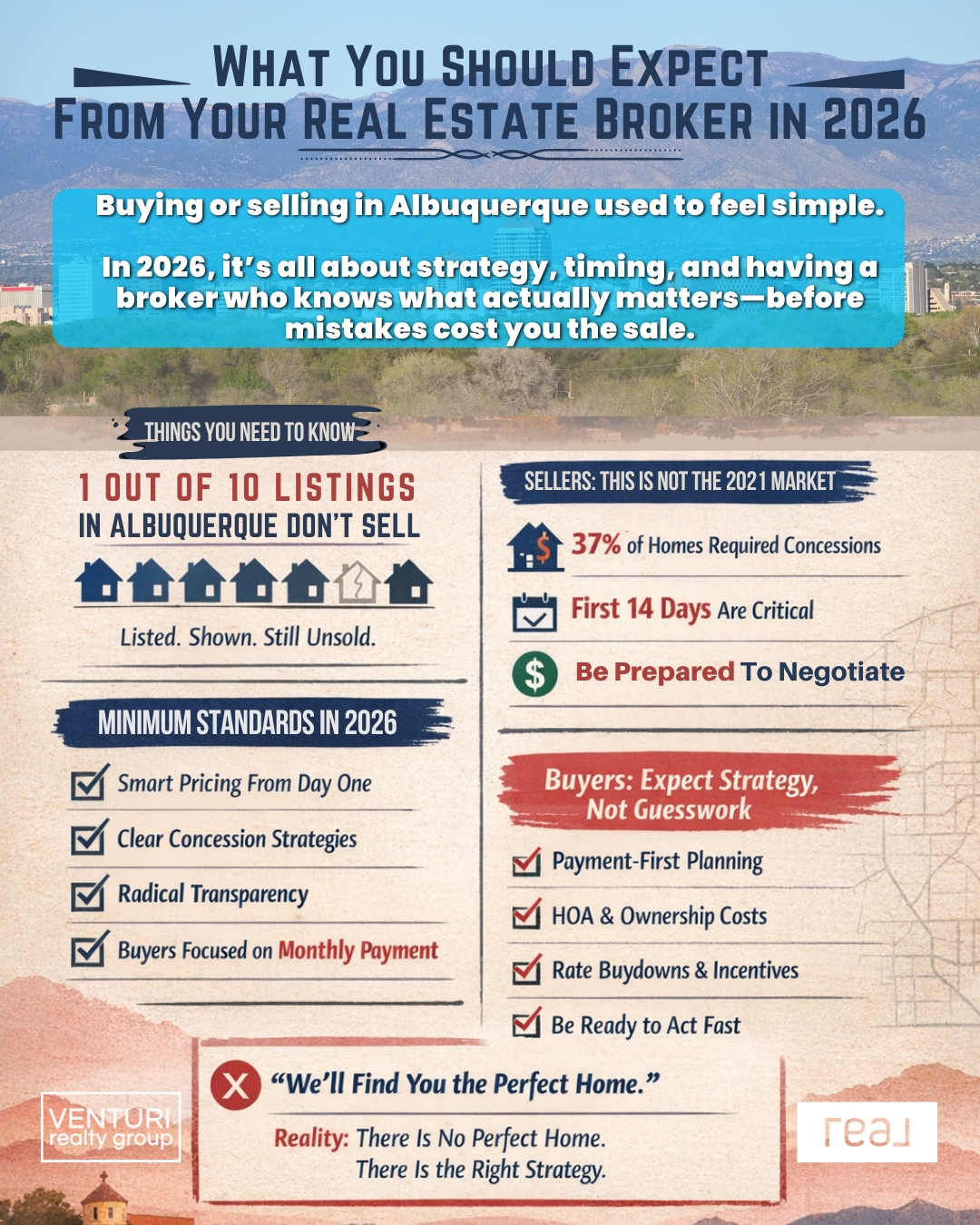

Bad Real Estate Advice: Avoid Homes with Price Reductions

In their “bad real estate advice” segment, Tego and Tracy tackle the idea that a price reduction means there must be something wrong with the property and buyers should stay away. That kind of blanket statement, they argue, just isn’t true.

“Usually reduced price just means that they missed the mark,” Tego says. The home may have been listed at a price the market couldn’t justify, so the seller adjusts. Tracy adds, “it doesn’t mean there’s anything wrong with the house. It just means the pricing strategy wasn’t the right strategy.”

The same applies to days on market. A home that has been listed for a while isn’t automatically a “problem house.” It might be unique—like a very large, luxury two-bedroom home that only fits a small pool of buyers—or it might have simply launched at the wrong price and only now reached the level where buyers take it seriously.

“Just because it’s been on the market a long time doesn’t mean there’s something wrong with it.”

Market Insights from NAR Economist Jessica Lutz

The episode wraps with takeaways from a small-group coffee with Jessica Lutz, Deputy Chief Economist for the National Association of Realtors. This is the team that publishes national data on closed sales, pending sales, pricing, and mortgage rate forecasts, so Tego freely admits he “totally nerded out” on the opportunity.

On interest rates, Lutz’s message was measured: trying to guess exactly what rates will do in the future is not wise, but on the whole, expectations are that they will stay roughly where they are today. Tracy summarizes it this way: “pretty much they’re expecting on the whole, that rates are gonna stay right around where we’re at right now. We don’t expect to see any big jumps up and we don’t expect to see big jumps down.”

The group also talked about how the recent drop from roughly 8% rates down into the low 6% range has already spurred more buyer activity. National mortgage application data shows an uptick, and the Venturi team can feel it locally: January may still look slow in closed sales (a lagging indicator based on contracts written in November and December), but showings, pendings, and buyer inquiries are stronger.

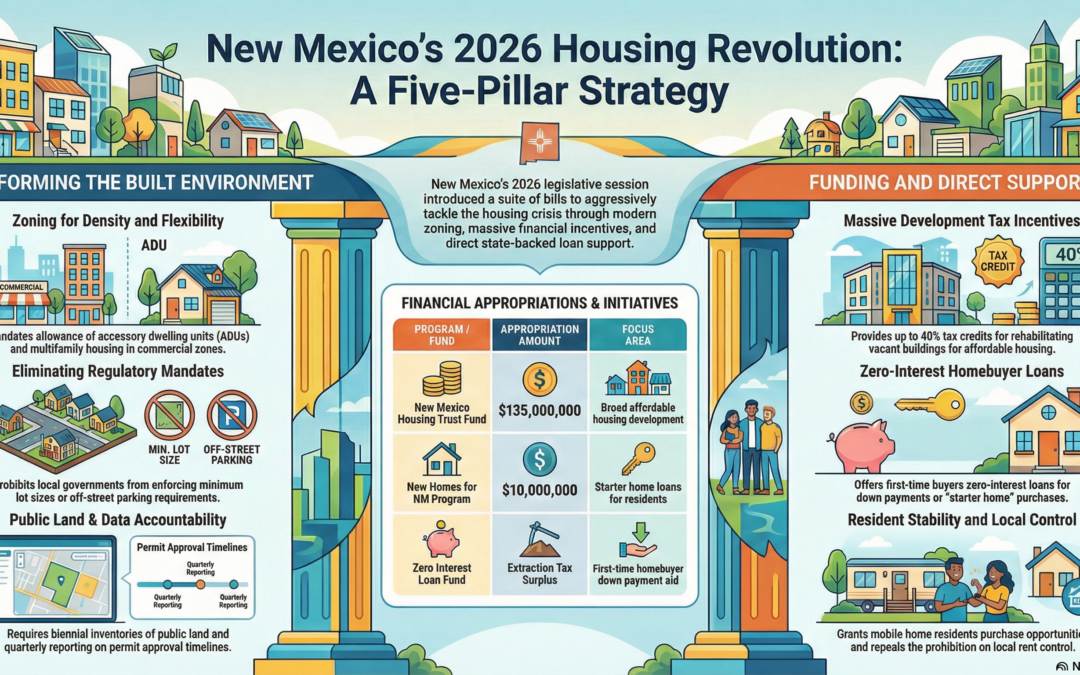

Lutz also addressed the idea of a “silver tsunami”—the notion that baby boomers will all decide to sell at once, flooding the market with homes. What she is actually seeing is more aging in place. Many older homeowners are choosing to stay put longer, and in some cases family members move into those homes instead of selling. That aligns with what Tego and Tracy see on the ground in Albuquerque.

Finally, they touched on the “Bank of Mom and Dad.” A significant number of first-time buyers across the country are getting help from parents or older relatives, whether that’s a gift for the down payment or assistance with closing costs. Combined with state-level down payment assistance programs, that help is part of how single women and other first-time buyers are making the jump into homeownership—even in a market where prices and rates feel challenging.

Frequently Asked Questions

Do I have to stay in my home for 30 years if I get a 30-year mortgage?

No. A 30-year mortgage simply describes how the loan is structured and paid back over time. You can sell your home, refinance, or pay off the mortgage early without waiting three decades, and many government-backed mortgages do not have a prepayment penalty.

Does a price reduction mean something is wrong with the home?

Not necessarily. In many cases, a price reduction just means the home was originally listed above what the market would support. Adjusting the price is often a correction in strategy, not a sign of hidden problems, and some homes simply take longer to find the right buyer because they are unique.

How long do I need to stay in a home before I have enough equity to sell?

Using Albuquerque’s long-term appreciation trend of roughly 3–4% a year, most owners who buy at a reasonable price need a few years before appreciation and principal paydown together create enough equity to cover selling costs and break even.

What are some unique Valentine’s events happening around Albuquerque?

Events mentioned in the episode include the Made with Love Market near the BioPark, “Love and Hangovers” at the historic Lobo Theater, the “Dead Bath and Beyond” spooky goods market at the Painted Lady Bed and Brew, the Cupid’s Chase 5K, a two-day Valentine’s market at the Rail Yards, and special dinners and a book-themed tea party at Tully’s Italian Deli.

Are single women really buying more homes than single men?

Yes. Data shared from the National Association of Realtors shows that roughly 20% or more of homebuyers are single women, and they are far outpacing single men in the first-time buyer category. The episode credits this to discipline, clear goals, and a willingness to save and sacrifice to achieve homeownership.

Have questions about Albuquerque real estate?

If you are thinking about buying or selling, or just want to understand how the current market affects your plans, our team is here to be a resource.

Call or text: (505) 448-8888

Email: info@welcomehomeabq.com

Website: WelcomeHomeABQ.com

Venturi Realty Group of Real Broker, LLC