Albuquerque Housing Update: April 2025 Insights

Albuquerque Housing Update: April 2025 Insights

April 2025 brings exciting changes and trends in the Albuquerque real estate market. With the latest data from March, we’re seeing shifts in median sale prices, closed sales, and even interest rates. Let’s dive deep into what’s happening in the market and what it means for buyers and sellers.

Current Market Overview

As we analyze the Albuquerque area, particularly focusing on single-family detached homes, the median sale price for March stands at $374,500. This marks a 6% increase compared to the same month last year. If we consider a three-month average, prices are still around that 6% mark, showcasing a consistent growth trend.

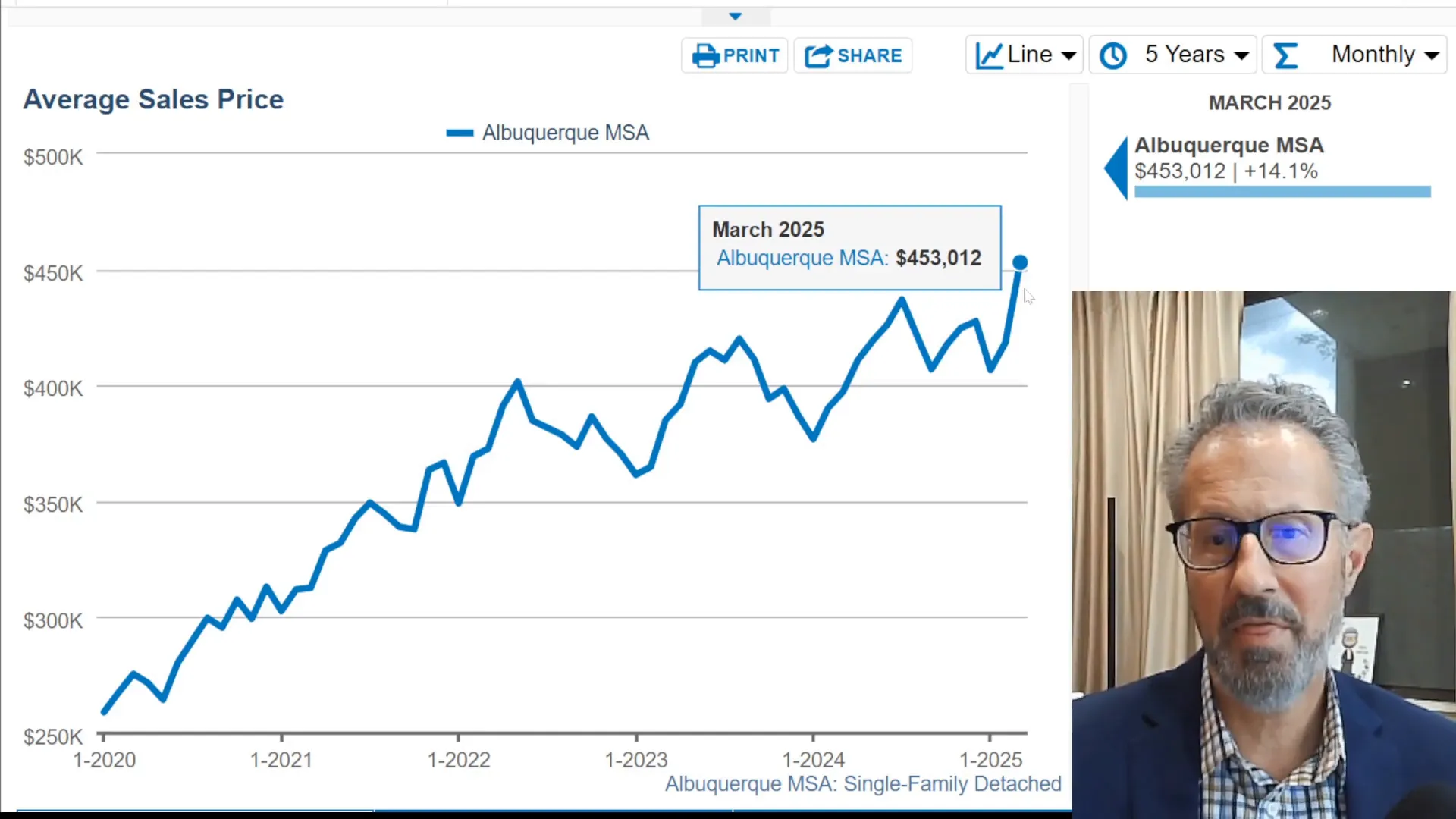

Average Prices: A Significant Jump

Now, let’s talk about the average price, which has surged to an impressive $453,000. This represents a 14% increase from a year ago and is the highest figure we’ve recorded to date. This spike can be attributed to the ultra-luxury market, where there were eight sales of homes over $2 million in March, significantly impacting the average price.

Understanding Closed Sales

In terms of closed sales, we recorded a total of 730 transactions in March, reflecting an 8% increase from the same period last year. This uptick in activity is promising as it indicates a recovering market. The closed sales data also shows that while the number of sales has increased, the luxury segment has played a pivotal role in altering average prices.

Price Per Square Foot Analysis

Analyzing price per square foot gives us a clearer view of market dynamics. The average price per square foot in March was $218, which is a 6.3% increase from last year. The median price per square foot is slightly lower at $214, indicating that while the average price has risen dramatically due to luxury sales, the overall market is still appreciating in value.

Market Activity: Sales and Inventory

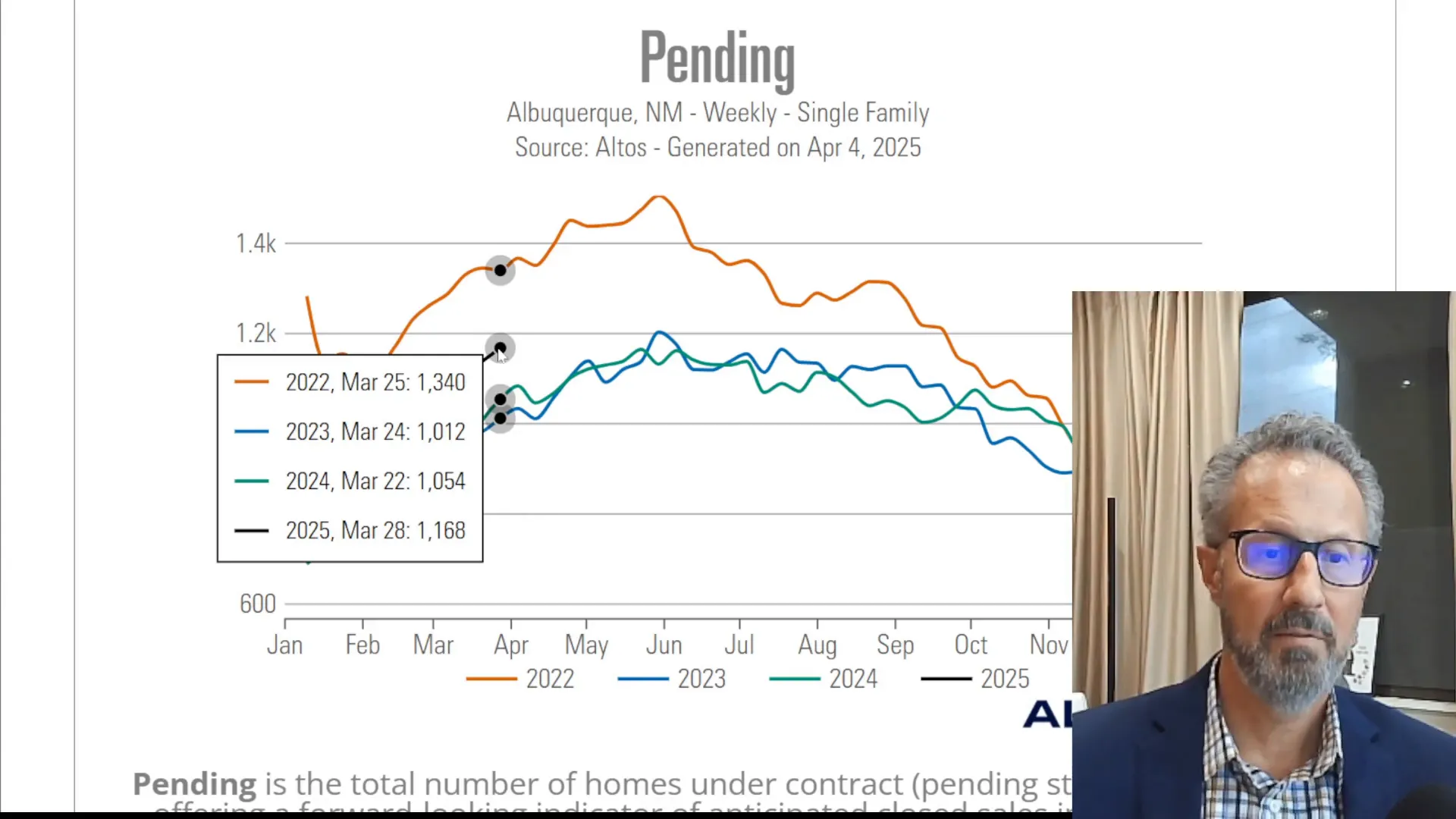

The current number of homes on the market sits at around 1,500. This is an 18% increase from last year, but still reflects a tight inventory situation. In terms of pending sales, we need to approach this data cautiously. There’s often a 20-30% churn rate, meaning homes that go under contract may not always close. As of March 28, we had 1,168 homes pending, a 10% increase from the previous year.

Understanding Days on Market

Days on market is another critical metric. The median days on market for homes sold in March was just 16 days, a significant drop from the winter months. This quick turnover suggests that serious buyers are out there, ready to make decisions. The average days on market was 44 days, still historically low, indicating strong demand.

Interest Rates: A Positive Shift

Interest rates have also seen a favorable shift. As of April 4, the average rate for a 30-year fixed mortgage stands at 6.55%. This is a notable decrease from previous months, making it a good time for buyers to enter the market. Lower rates can enhance buying power and potentially lead to more transactions in the coming months.

Conclusion: What This Means for Buyers and Sellers

With the Albuquerque real estate market showing signs of improvement, both buyers and sellers have unique opportunities. Buyers can take advantage of lower interest rates and a slightly increased inventory, while sellers can benefit from rising prices.

Reach Out for More Insights

If you’re looking for more personalized advice or have questions about the Albuquerque market, don’t hesitate to reach out to us at the Venturi Realty Group. We’re here to help you navigate these changing conditions.