What Buyers Can Negotiate (Besides Price) — Plus How to Refresh a Stale Listing | Albuquerque Real Estate Talk, Episode 545

What Buyers Can Negotiate (Besides Price) — Plus How to Refresh a Stale Listing

Albuquerque Real Estate Talk, Episode 545 Recap

This week on Albuquerque Real Estate Talk, we covered two topics that come up all the time in our day-to-day work with clients:

- What things buyers can negotiate besides just the purchase price

- What to do if your home has been sitting on the market and isn’t selling

We also spotlighted Downtown Albuquerque—one of our favorite and most unique parts of the city—and touched on how real estate impacts New Mexico’s economy in a big way.

🎥 Watch the full episode here:

💡 Buyers: You Can Negotiate More Than Just Price

We work with a lot of buyers—especially first-time home buyers in the Albuquerque area—and one thing we always say is this: price isn’t the only thing that’s negotiable.

Here’s a real example:

We’re working with a veteran using a VA loan (which is a zero-down loan), and we negotiated for the seller to pay all of their closing costs. That buyer will likely walk into their new home with very little out of pocket.

Here are some of the top things we help buyers negotiate:

1. Seller-Paid Closing Costs

Ask the seller to cover a percentage of the sales price toward your closing costs. Great for VA, FHA, and MFA buyers.

2. Repairs or Repair Credits

Negotiate for repairs after inspection—or ask for a credit and handle it your way after closing.

3. Home Warranty

Especially useful on older systems like water heaters or HVACs that are functional but aging.

4. Possession Timeline

Need to move in early or delay possession? It’s negotiable—just plan ahead.

5. Appliances or Personal Property

Refrigerators, washers, furniture—even outdoor art—can be included if it makes sense for both parties.

(Tego’s rule to understand what is personal property: if you shake the house upside down and it falls out, it’s personal property.)

6. Interest Rate Buydown

Sometimes a seller credit toward lowering your interest rate saves you more than a lower price. Tego: “A $10,000 price drop might lower your payment slightly… but a $10,000 rate buydown could save you much more monthly.”

7. HOA Fees or Special Assessments

Sellers can prepay HOA dues or cover assessments if needed. Tracy recently negotiated six months prepaid for one buyer.

8. Extra Services

Pest control, landscaping, security systems—all negotiable depending on the deal.

Bottom line: price is just one piece of the puzzle when you’re negotiating a home purchase in Albuquerque.

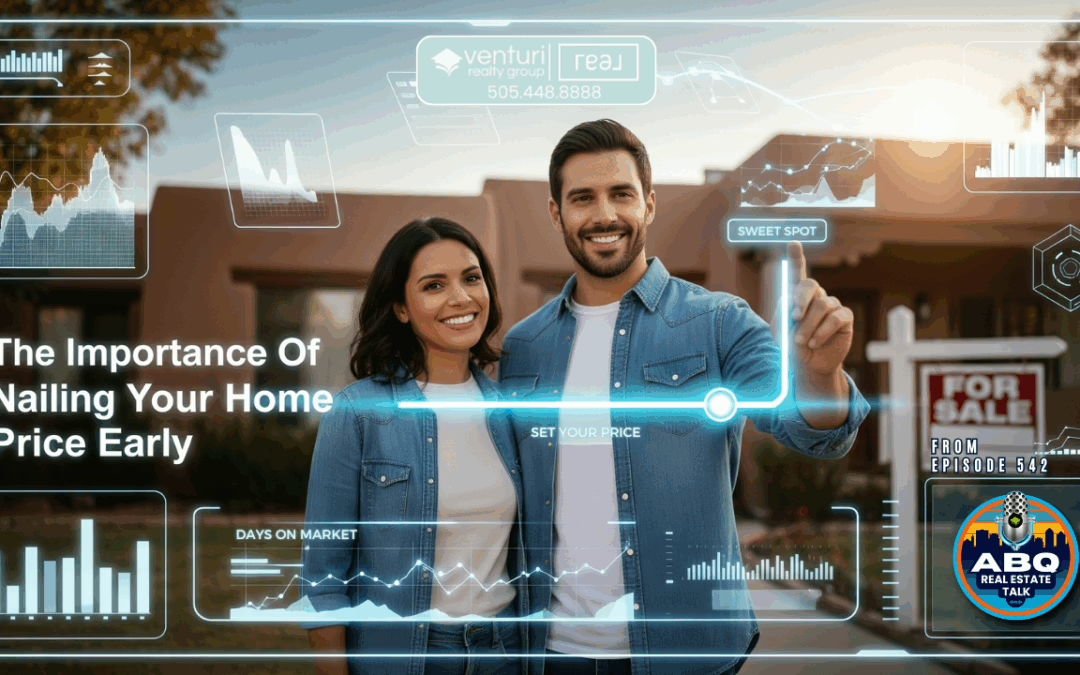

🏡 Sellers: What to Do If Your Listing Is Stale

If your home’s been sitting on the market for 30 to 90 days, don’t panic—it might just need a reset. Here’s how to refresh and reintroduce your home to buyers.

1. Mindset Shift

Tego put it best: “Once your home hits the market, it’s no longer just your home—it becomes a product. You’re now a marketer and merchandiser.” That’s a tough shift, especially if you’ve lived there for years, but it’s key to getting it sold.

2. Look at Feedback

Review all showings and agent feedback.

Was it price? Was it condition? Were the photos working? Did the home feel “move-in ready” compared to other homes that sold?

3. Update the Photos

If you’ve done any updates—new pillows, paint, carpet, yard cleanup—get new property photos taken. Even changing the photo order or selecting a new “hero” image (like the backyard or pool) can catch fresh attention online.

Tracy: “We’ve seen homes get skipped over again and again just because the first few photos weren’t appealing. Change them up!”

4. Rewrite the Description

A better story about your home can spark fresh interest and help buyers visualize life there. Highlight lifestyle benefits, or upgrades buyers may have missed the first time.

5. Make a Splash

Don’t just quietly reduce the price. Announce it. Promote it. Share it. And consider pulling the listing (withdrawn status) for a few days before bringing it back, which can help it look fresh again to buyers watching online.

Tego: “Those first two weeks are when your listing gets the most attention. A reset can give you another shot at that momentum.”

🏙 Downtown Albuquerque: Lifestyle, Homes & Hidden Gems

This week’s featured community was Downtown Albuquerque, based on a listener request. Tracy had just helped a seller near 13th & Mountain, and a neighbor stopped by to talk about how much they love living downtown—and rattled off 5 coffee shops within walking distance.

Here’s what makes Downtown Albuquerque special:

-

Condos galore: Copper Lofts, Albuquerque High Lofts, Park Plaza, Belvedere, Bank Lofts, Anasazi, and more

-

Historic homes: Victorian styles, early-1900s Adobes, and bungalows

-

Walkability: Great access to transit, restaurants, museums, galleries, and parks

-

Lifestyle perks: The Bosque trail, BioPark, Old Town, Sawmill Market, Civic Plaza, and Kimo Theatre

-

Diverse housing options: From 486 sq ft studios to nearly 4,000 sq ft homes in the Country Club area

-

Urban character: It’s the most urban part of New Mexico—walkable, cultural, and full of personality

And the stats?

Downtown homes have a lower median price than the citywide average, but a higher price per square foot, thanks to smaller homes and lots of condo options.

🤝 Need Help Buying or Selling?

We’re the Venturi Realty Group of Real Broker, and we’re here to help you navigate every part of the Albuquerque housing market—whether you’re buying your first home, selling your current one, or just exploring your options.

📞 Call: 505‑448‑8888

🌐 Visit: WelcomeHomeABQ.com

📱 Follow: @welcomehomeabq on YouTube, Instagram, and Facebook

Tags: Albuquerque real estate, Albuquerque homes for sale, homebuyer tips, first-time home buyer Albuquerque, how to sell your home, Downtown Albuquerque real estate, Albuquerque condos, interest rate buydown, seller-paid closing costs, Albuquerque housing market 2025

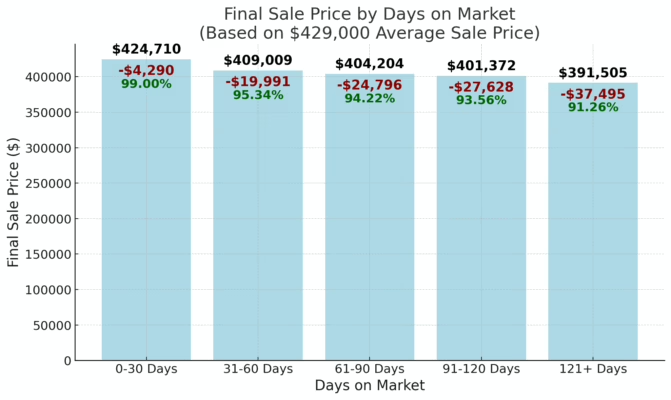

Tego Venturi, prompted by a fellow realtor’s inquiry, conducted a deep dive into local market data, focusing on homes sold in the Albuquerque area over the past six months. Using an average sale price of $429,000, the analysis revealed a consistent pattern:

Tego Venturi, prompted by a fellow realtor’s inquiry, conducted a deep dive into local market data, focusing on homes sold in the Albuquerque area over the past six months. Using an average sale price of $429,000, the analysis revealed a consistent pattern: