Thanksgiving Real Estate Deals and Meals

|

|

It’s that time of year when incentives abound, and the new construction housing market is no exception. Homebuilders, both national and local, are rolling out their own version of “Black Friday” deals, offering incredible opportunities for homebuyers to snag a new home with significant savings or perks. Let’s break it down and explore why now might be the perfect time to buy.

As the year ends, many production builders aim to meet corporate goals and reduce their standing inventory. These homes, often referred to as “quick move-ins,” are ready for buyers who want to close within 30-45 days. To make these deals attractive, builders are offering substantial incentives like:

There are some incredible deals this season, but please note that these offers are subject to change at any time. Here’s a look at the current offerings from some builders in New Mexico:

An interest rate buydown is a way to reduce your mortgage interest rate—either temporarily or for the life of the loan. Here’s how it works:

Some builders even negotiate exclusive lower rates with lenders, offering special deals like 4.5% financing. These rates are rare in today’s market and can make a huge difference in your monthly housing costs.

New homes come with distinct advantages:

Buying new construction can be exciting but also overwhelming. With so many builders and neighborhoods to choose from, it’s easy to get swept up by a flashy model home without exploring all your options. That’s where we come in. Our team can help you:

These year-end deals won’t last long. Builders are eager to close out their inventory before the holidays, and buyers who act fast will reap the rewards. Whether it’s lower monthly payments, free upgrades, or cash savings, the opportunities are too good to ignore.

Call us today (505-448-8888) to explore the neighborhoods, builders, and deals that fit your needs. Let’s find your perfect new home while the incentives are hot!

Pro Tip: Interest rate buydowns are a great tool for reducing your monthly payment. If a builder is offering this incentive, be sure to crunch the numbers to see how much you can save over the life of the loan!

The journey of Albuquerque’s housing market began in 2014 with the Zillow Home Value Index (ZHVI) at approximately $165,014.89. Over the following years, home values displayed a consistent upward trajectory, and doubling to $336,102 in September 2024. The period between 2020 and 2021 was particularly remarkable, with annual increases peaking at 20.25% in June 2021. A combination of influences drove these surges in home values. Low interest rates, economic recovery, a rise in household formation, and new residents attracted by Albuquerque’s burgeoning economic opportunities.

Parallel to the rising home values, Albuquerque’s rental market for multi- and single-family units has seen significant growth as well. From 2015, the typical rent for multi-family units gradually rose from $753 per month to $1,283 by October 2024, a 70.81% increase. Single-family rentals witnessed an even sharper increase, from $1,122 to $2,053 in the same period, a 78.69% gain. The demand for more spacious accommodations, possibly influenced by shifts in work-from-home policies and lifestyle changes, drove much of the growth in the single-family rental sector.

The alignment of increasing home values and rents can largely be attributed to Albuquerque’s economic resilience. Factors such as employment growth, infrastructural developments, and new business establishments have boosted the demand for housing. However, the rapid increase in home values, especially in the early 2020s, raised concerns about housing affordability, pushing more people towards renting, thereby increasing rental market demand and prices.

The indicators point towards a stabilizing real estate market in Albuquerque. Recent trends show a slowdown in the appreciation rate of home values and rental increases, creating a potentially more predictable environment for buyers and renters alike. Notably, the current market dynamics show an increase in housing inventory in the Albuquerque Area, giving buyers a greater selection of homes without any signs of distress sales or overbuilding that could flood the market with supply. With demand remaining steady and indications of pent-up demand from both buyers and sellers, the market is poised for sustained activity without the volatility seen in previous years.

Reflecting on a decade of significant growth and change, Albuquerque’s real estate market stands at a pivotal point. The increases in home values and rents over the past ten years have transformed the housing landscape, but the current signs of stabilization are promising for those looking to enter the market. For prospective homebuyers, the increase in available properties means more choices without the pressure of an oversupply that could depress prices. Similarly, renters might find more options available without drastic price increases. As we move forward, staying informed about these market conditions will be crucial for navigating the opportunities and challenges in Albuquerque’s dynamic real estate environment. This balanced market scenario suggests a healthy real estate climate conducive to making well-informed decisions for both living and investing.

* Data from Zillow Home Value Indes (ZHVI) and Zillow Observed Rent Indes (ZORI)

This week on Albuquerque Real Estate Talk Episode 511, Tego and Tracy Venturi of the Venturi Group at Real Broker delve into the latest trends in the Albuquerque real estate market for November 2024. From home sales data to community highlights in Corrales, this blog offers valuable insights for potential buyers and sellers alike.

The Albuquerque real estate market is constantly evolving, and understanding its dynamics is crucial for both buyers and sellers. In this blog, we will explore the latest market data for October 2024, delve into the unique lifestyle offered by the village of Corrales, provide an overview of the local real estate market, and analyze the profiles of buyers and sellers in the current landscape.

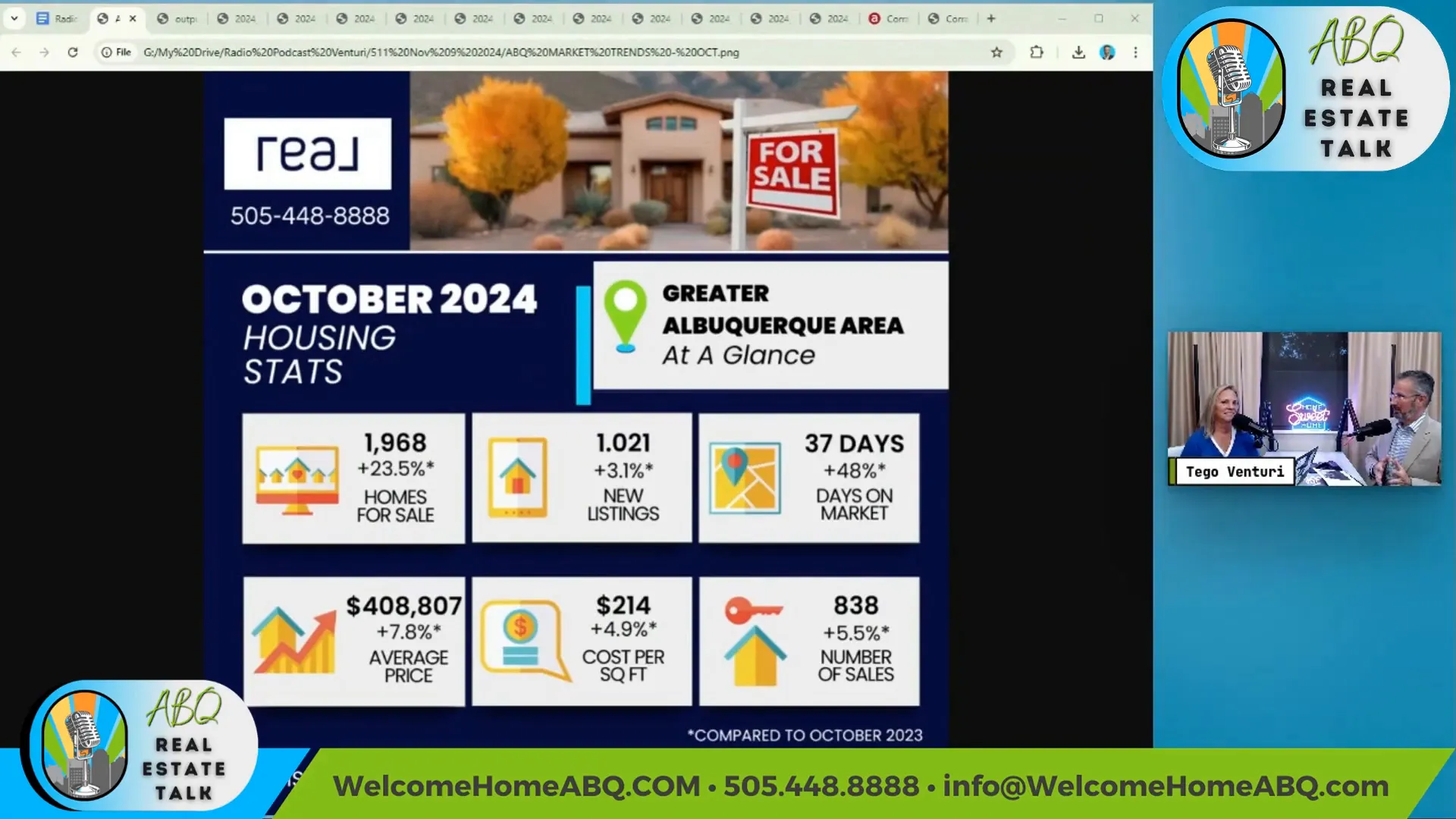

October 2024 has shown promising signs for the Albuquerque real estate market. Home sales increased by approximately 5% compared to the previous year, indicating a slow but steady recovery. However, when comparing this data to October 2019, we observe a decline of about 20-30%, suggesting that while activity has improved year-over-year, it remains below pre-pandemic levels.

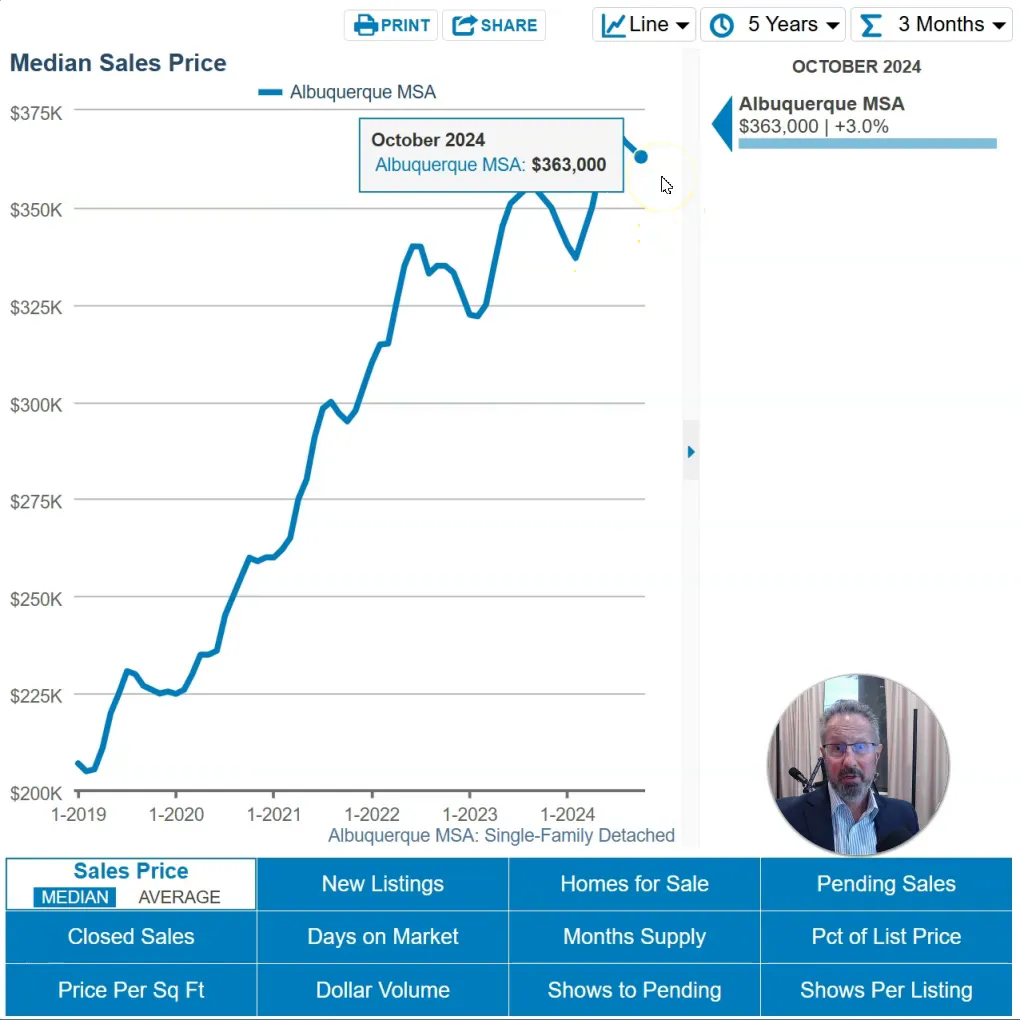

The average home price in Albuquerque has surpassed $400,000, reflecting an increase of nearly 8% from last year. Despite this rise, it’s important to note that the actual appreciation rate is likely closer to 3-4%, considering broader market factors.

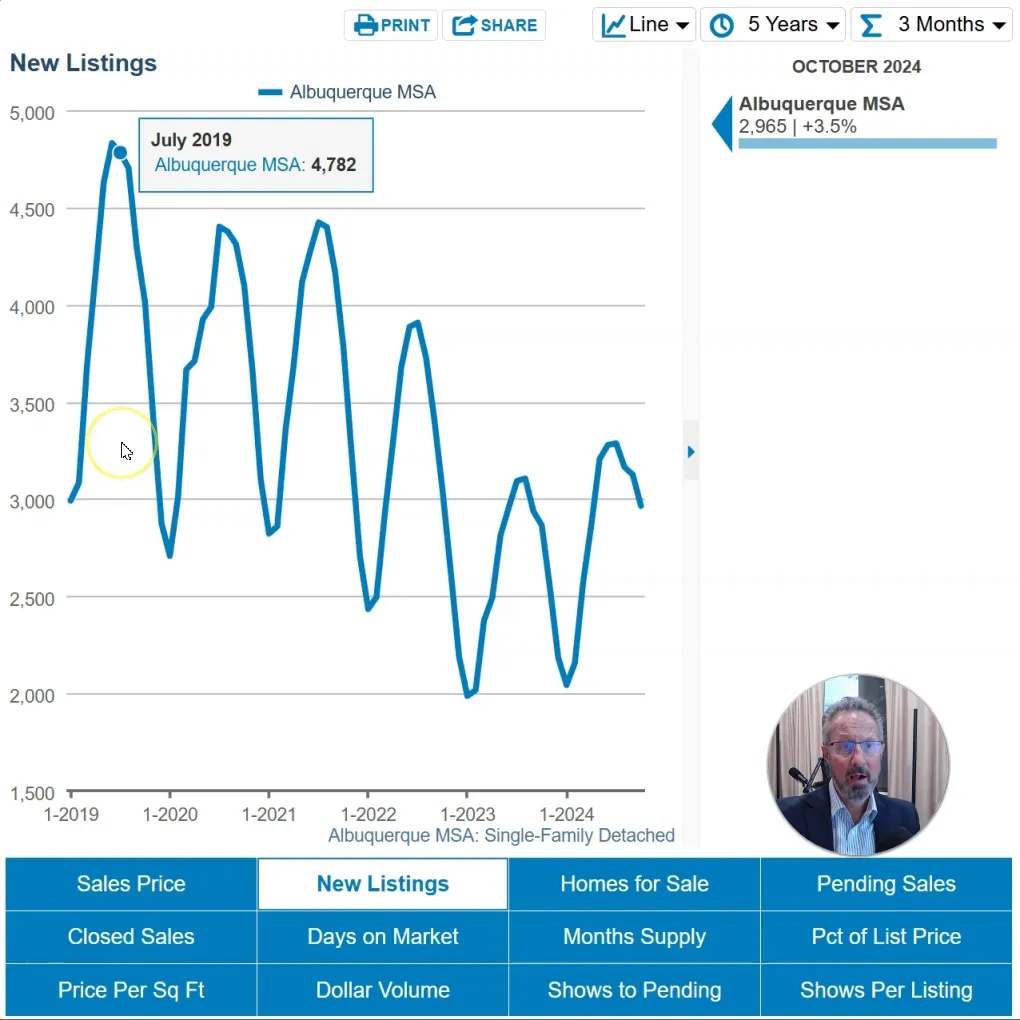

Additionally, new listings increased slightly, with a little over 1,000 new properties hitting the market, a 3% rise from October 2023. The total number of homes for sale has surged by 23% compared to last year, yet it remains about 25% lower than the figures from October 2019.

Days on the market have also changed, with an average of 37 days from listing to contract, marking a nearly 50% increase from last year. This trend suggests a return to a more normalized pace of home sales compared to the rapid turnover seen in previous years.

Corrales, a quaint village nestled between Albuquerque and Rio Rancho, offers a unique lifestyle that attracts many residents. Known as the horse capital of New Mexico, Corrales is not just about equestrian pursuits; it boasts a vibrant dining scene and a calendar full of community events.

Popular dining spots include Indigo Crow, known for its delightful atmosphere, and Y Hannah and Nate’s, which serves breakfast and lunch. The Sandia Bar has recently reopened after renovations, adding to the local charm.

Corrales is also home to several wineries, including Malro Posa and Tampo Corrales Winery, perfect for a weekend outing. The Farm Stand offers fresh produce and local goodies, making it a favorite for health-conscious residents.

The community hosts various events throughout the year, such as the Fourth of July Parade, where families and friends come together to celebrate. The Fall Harvest Festival is another highlight, featuring hay rides and an arts festival that showcases local talent.

For those who enjoy outdoor activities, the Bosque Preserve offers scenic trails along the river, ideal for walking and enjoying nature. With tennis courts, a swimming pool, and an equestrian riding ring, Corrales provides ample recreational opportunities for its residents.

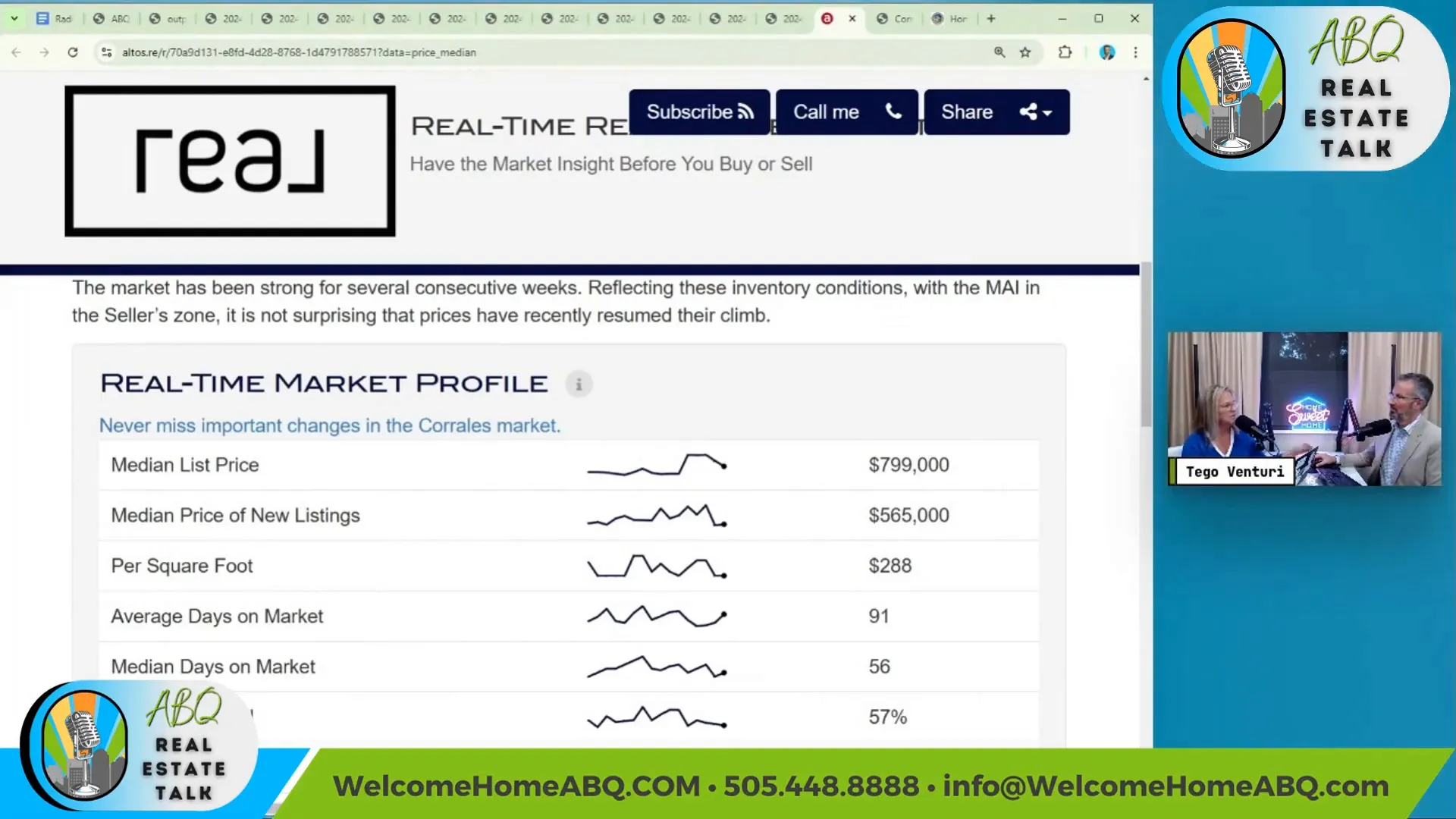

The real estate market in Corrales is characterized by its higher price points compared to other areas in Albuquerque. As of early November 2024, the average list price for homes in Corrales stands at approximately $1,123,000, with a median list price of around $800,000. This price point reflects the desirability of the area, which is known for its spacious properties and scenic views.

Currently, there are about 22 homes on the market, indicating a relatively small inventory. The average price per square foot for properties in pending sale is $295, with an average pending price of $842,000.

It’s worth noting that the market is still adjusting, with an average reduction of approximately $27,000 for homes currently listed. The average days on the market for homes until they go pending is around 59 days, suggesting a stable, yet competitive market.

The 2024 profile of buyers and sellers reveals significant shifts in demographics and purchasing behavior. The median age of home buyers has risen to 56 years, while first-time buyers have seen their median age increase to 38 years. This trend indicates a growing challenge for younger buyers, who face affordability issues in the current market.

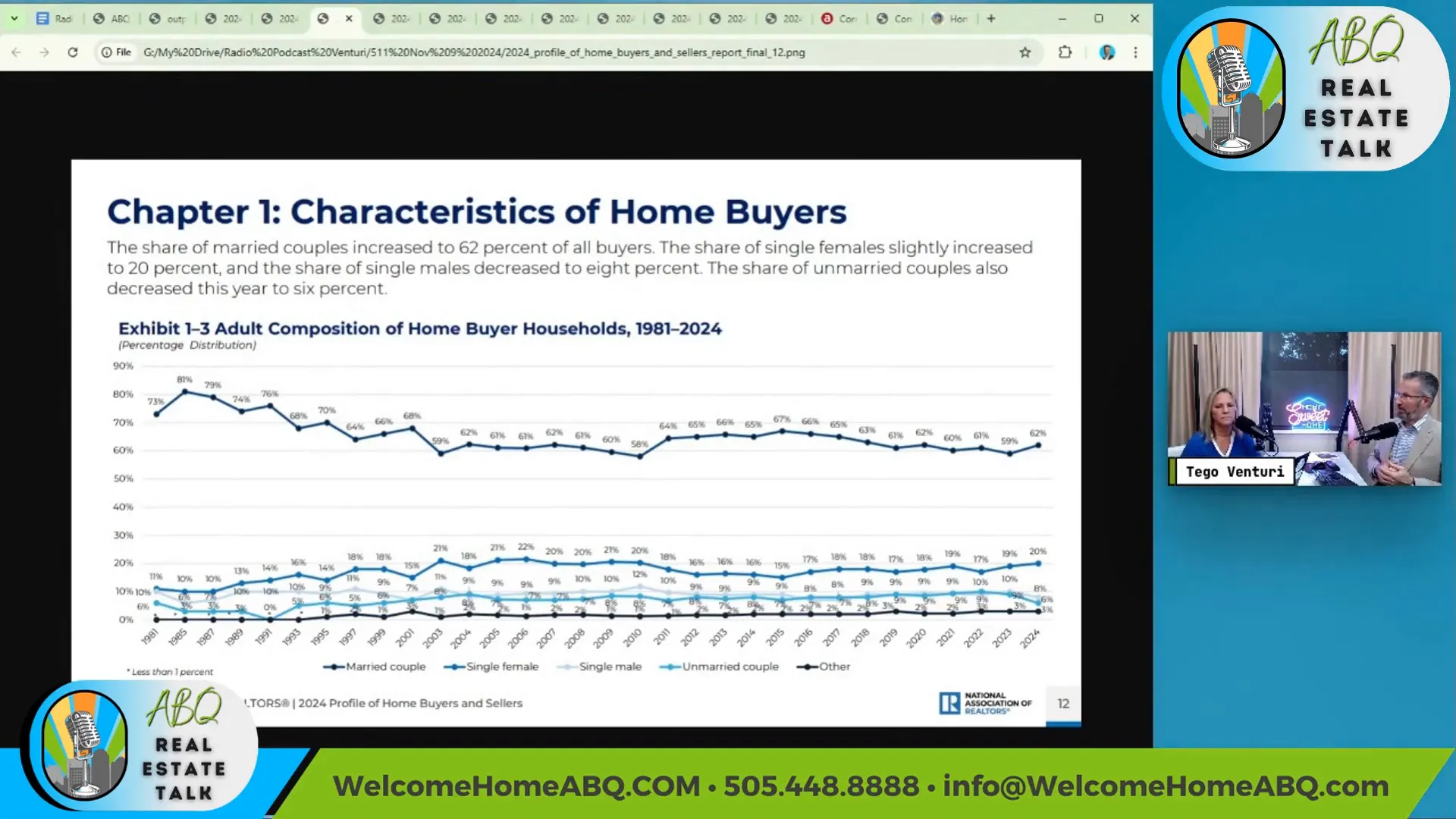

Interestingly, the composition of home buyers has also evolved. Married couples now account for 62% of buyers, while single females represent about 20%. In contrast, single males have seen a decline, comprising only 8% of the market.

Moreover, a record 61% of home buyers had previously owned a home, highlighting the dominance of repeat buyers in the market. First-time buyers are struggling to secure properties, primarily due to rising prices and limited inventory.

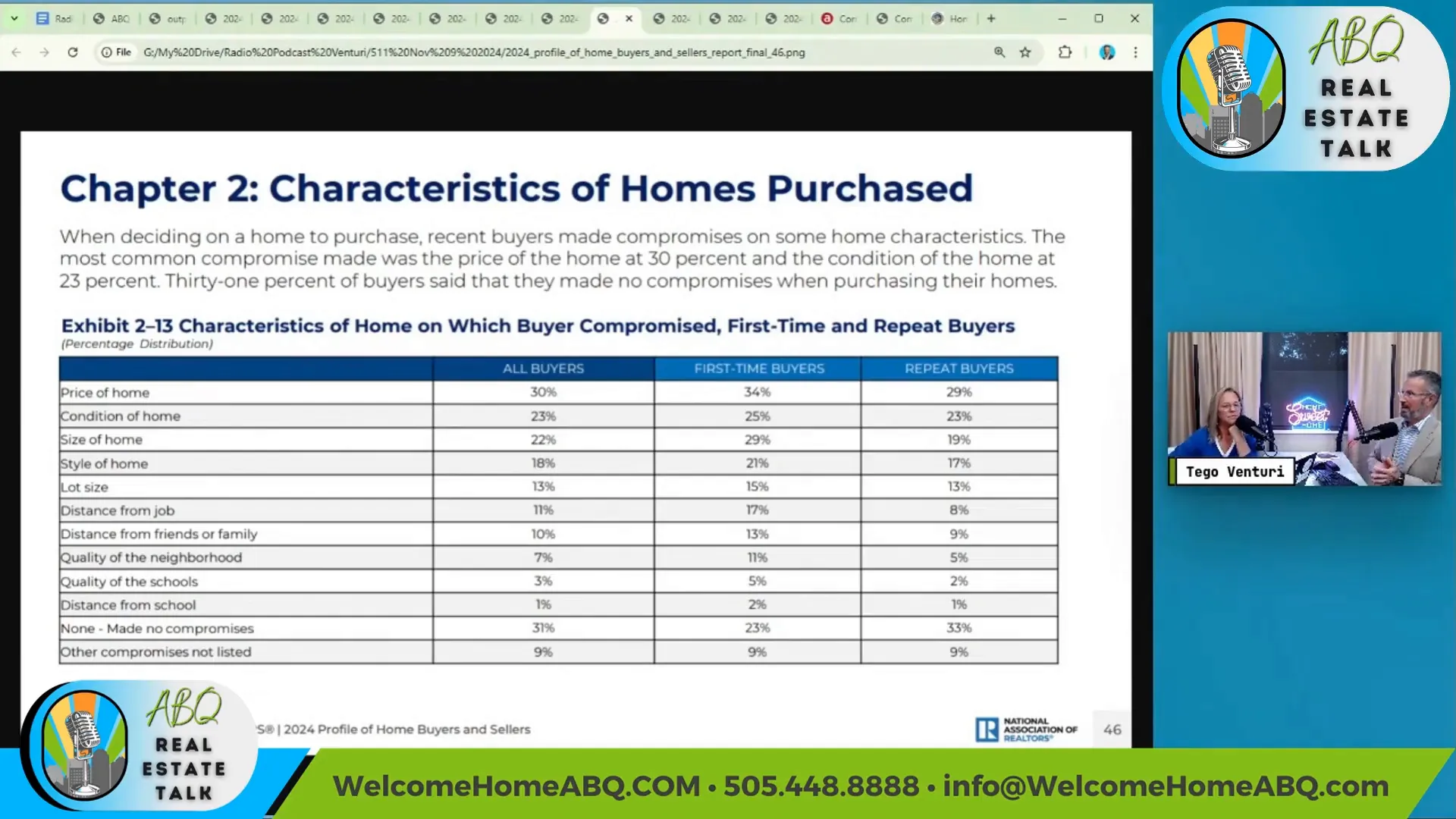

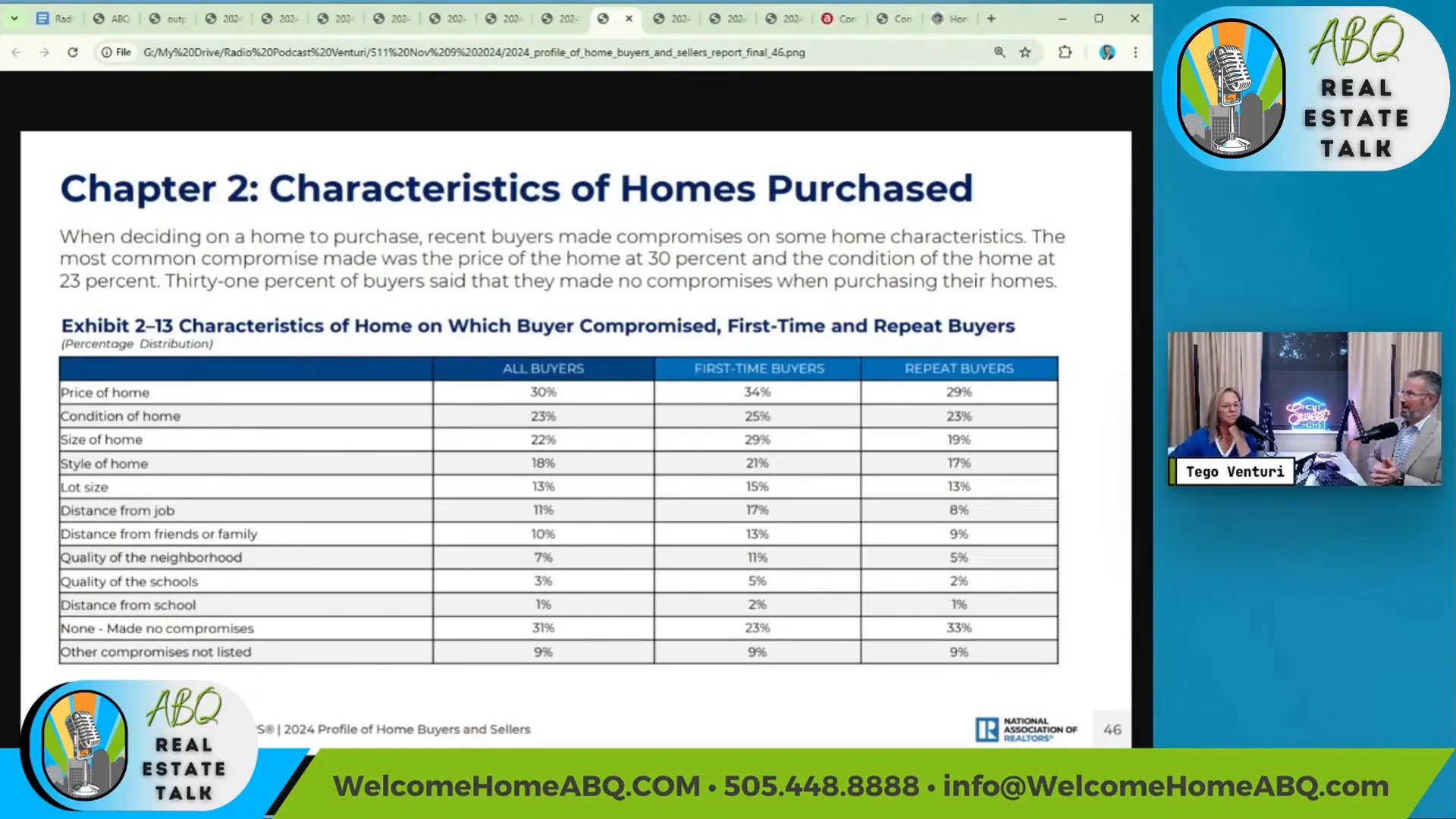

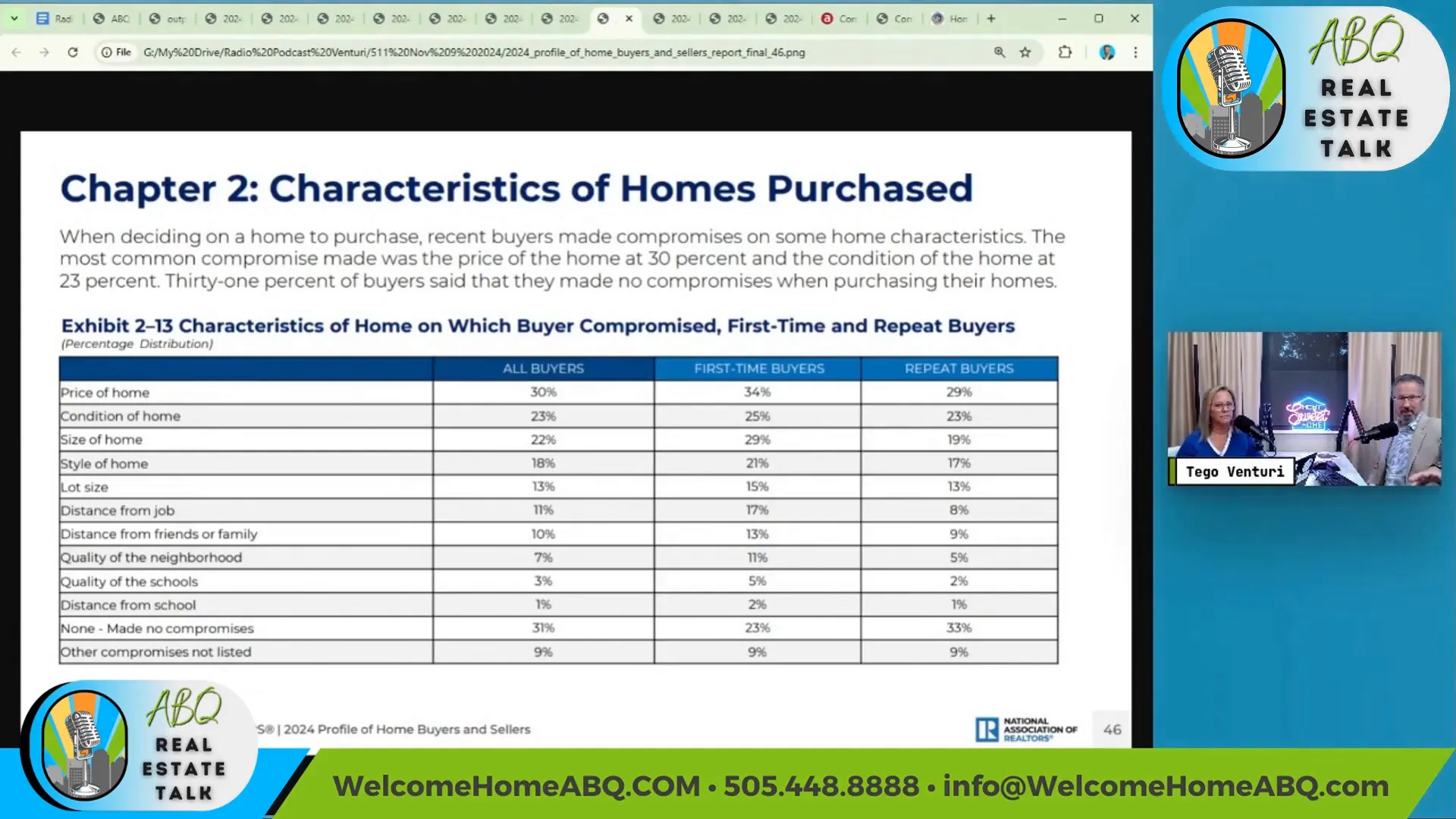

When considering the motivations behind home purchases, many buyers reported making compromises on their price expectations, with 30% indicating they paid more than initially planned. This reality underscores the competitive nature of the current market.

As we navigate through these trends, it’s essential for both buyers and sellers to stay informed about the changing landscape of the Albuquerque real estate market. Understanding these dynamics can significantly impact decision-making and strategic planning in real estate transactions.

The landscape of homebuyers continues to evolve, reflecting shifts in demographics, motivations, and purchasing power. As of 2024, the median age of homebuyers has reached 56 years, with first-time buyers averaging 38 years. This shift indicates a growing challenge for younger buyers, highlighting the need for strategic planning in home purchasing.

Interestingly, the vast majority of homebuyers—61%—are repeat buyers, showcasing a trend where those who have previously owned homes dominate the market. This trend underscores the increasing difficulty for first-time buyers to enter the market, particularly in the face of rising prices and limited inventory.

Moreover, the motivations behind home purchases reveal a willingness among buyers to compromise on various aspects, primarily due to the competitive nature of the market. Approximately 30% of buyers reported paying more than they originally planned, a clear indicator of the market dynamics at play.

The current market data indicates a notable split between new construction and resale homes. In 2024, around 15% of homes purchased were new construction, while a significant 85% were resale properties. This shift reflects the changing preferences of buyers, who are increasingly drawn to new builds due to the incentives and financing options available, such as lower interest rates and closing cost assistance.

In Albuquerque, the share of new construction may be even higher, as buyers seek modern amenities and energy-efficient designs. Working with various builders can help navigate this segment of the market, ensuring buyers capitalize on available incentives.

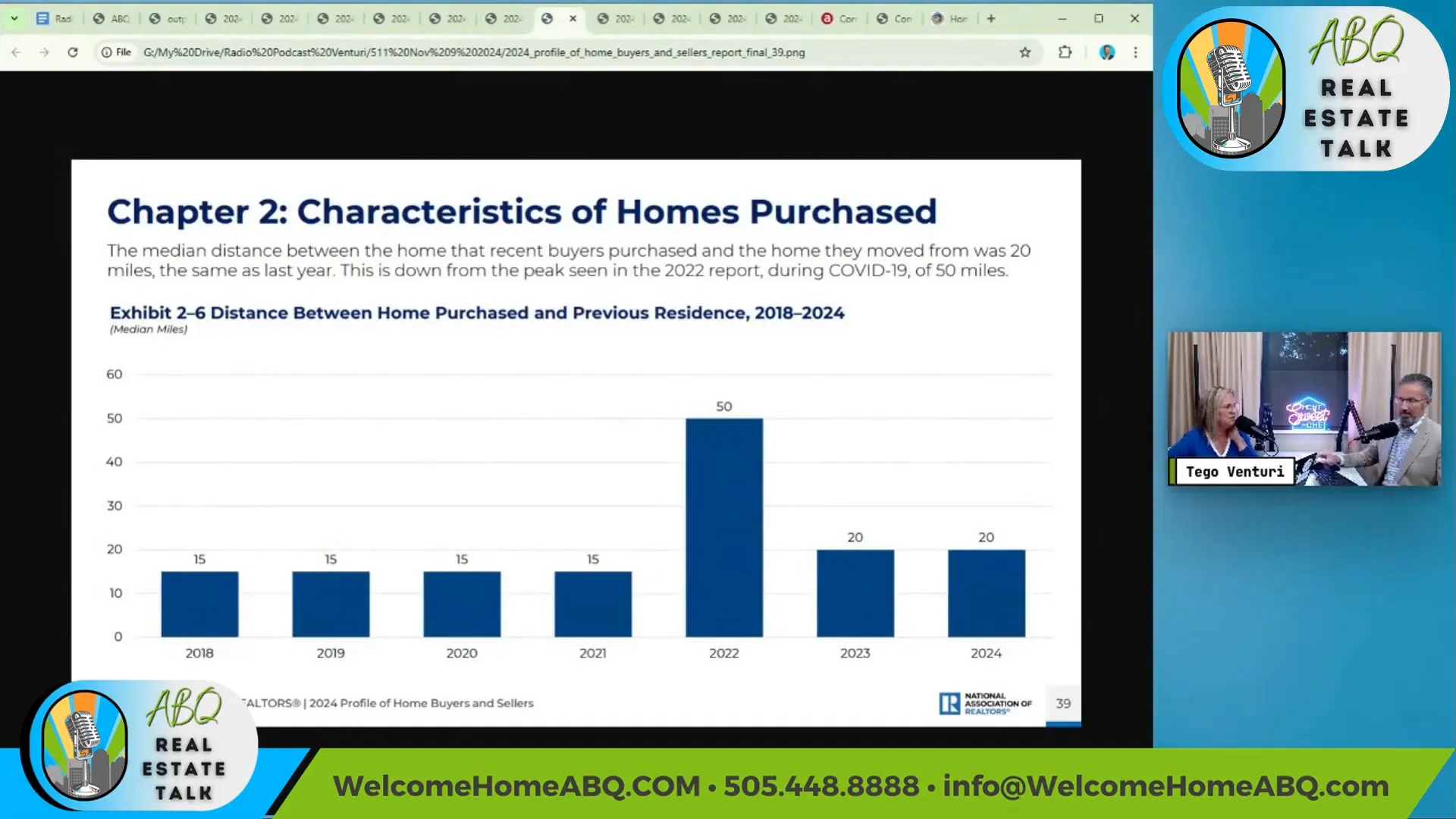

Another fascinating trend is the distance buyers are moving when purchasing a home. Pre-pandemic, the average distance was around 15 miles. However, during the pandemic, this number surged to an average of 50 miles as many sought to relocate to areas where they could enjoy more space or return to their roots. As of 2024, the average distance moved has settled at 20 miles, indicating a blend of both pre- and post-pandemic behaviors.

Compromises made by buyers also reflect the current market conditions. Notably, 30% of buyers reported compromising on the price of their new home, while 23% made concessions regarding the condition of the property. This dynamic showcases the realities of a market where demand often outstrips supply.

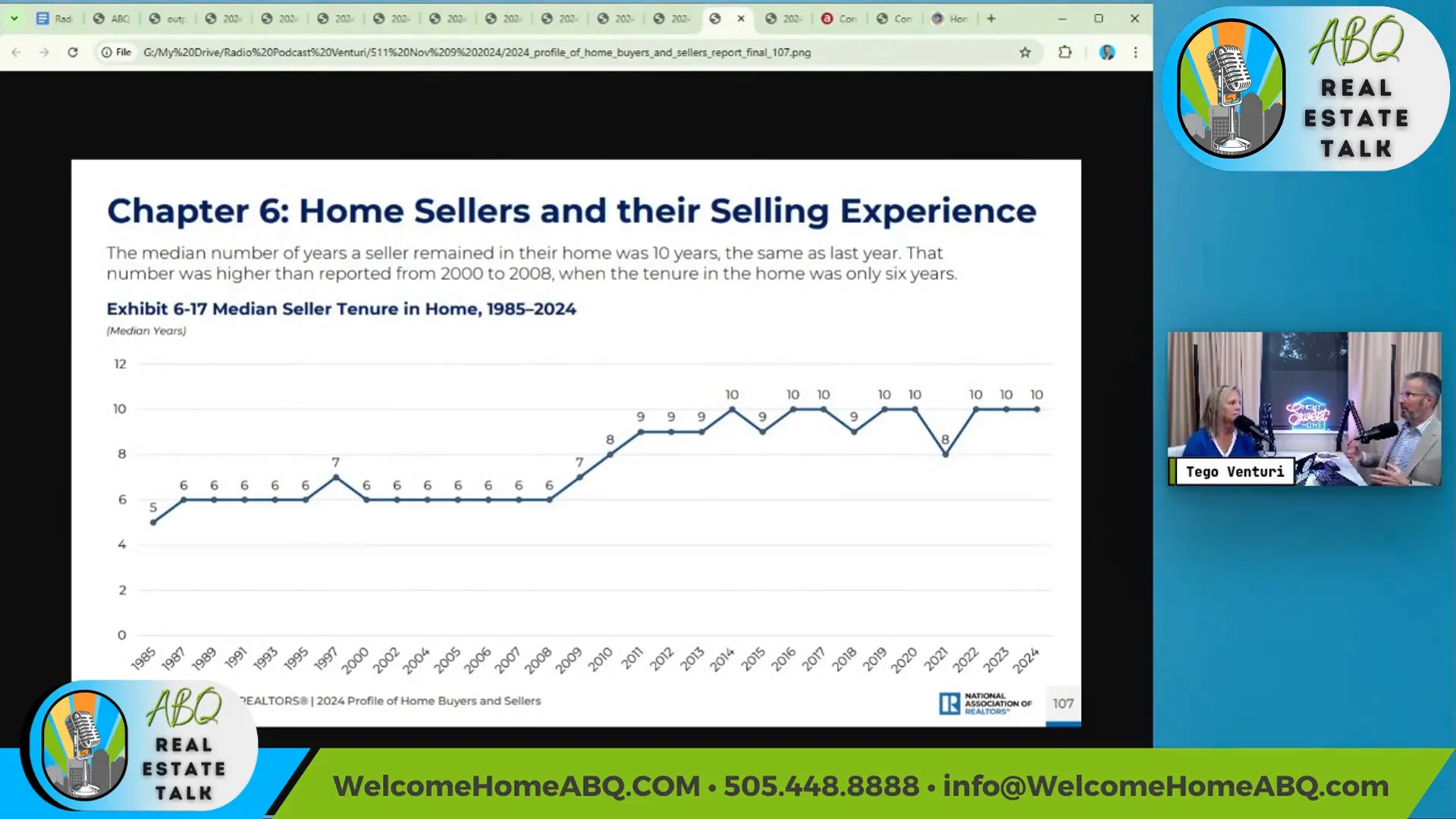

The average tenure for homeowners has increased to about 10 years, up from 6-7 years in previous years. This change can be attributed to the lock-in effect, where homeowners with favorable mortgage rates are hesitant to sell and lose their low-interest financing. Consequently, many homeowners are opting to stay put or renovate their existing homes instead of moving.

Interestingly, the trend of selling homes without a real estate professional (FSBO) has declined significantly. Currently, only about 6% of sellers are opting to go the FSBO route, compared to 15-20% in the past. This drop suggests that as the market becomes more complex, the need for professional guidance has never been greater.

Understanding these trends is crucial for both buyers and sellers navigating the Albuquerque real estate market. Whether you’re looking to buy your first home, considering a new construction, or evaluating the value of your current property, having the right insights can make all the difference.

If you have questions about the market or need assistance with your real estate needs, feel free to reach out. The Venturi Group at Real Broker is here to help you every step of the way.

Contact us at 448-8888 or visit our website at welcomehomeabq.com.

Albuquerque Real Estate Market Update – November 2024

As we step into the first week of November 2024, it’s time to take a closer look at the Albuquerque real estate market. The data we’re analyzing comes directly from our multiple listing service. It provides an accurate snapshot of current trends. Let’s dive in and see what the numbers tell us about the residential housing market in Albuquerque.

This month, we’ll approach the data from a different angle by using a three-month rolling average. This means we’ll be looking at data from August, September, and October to better understand the changes in the market.

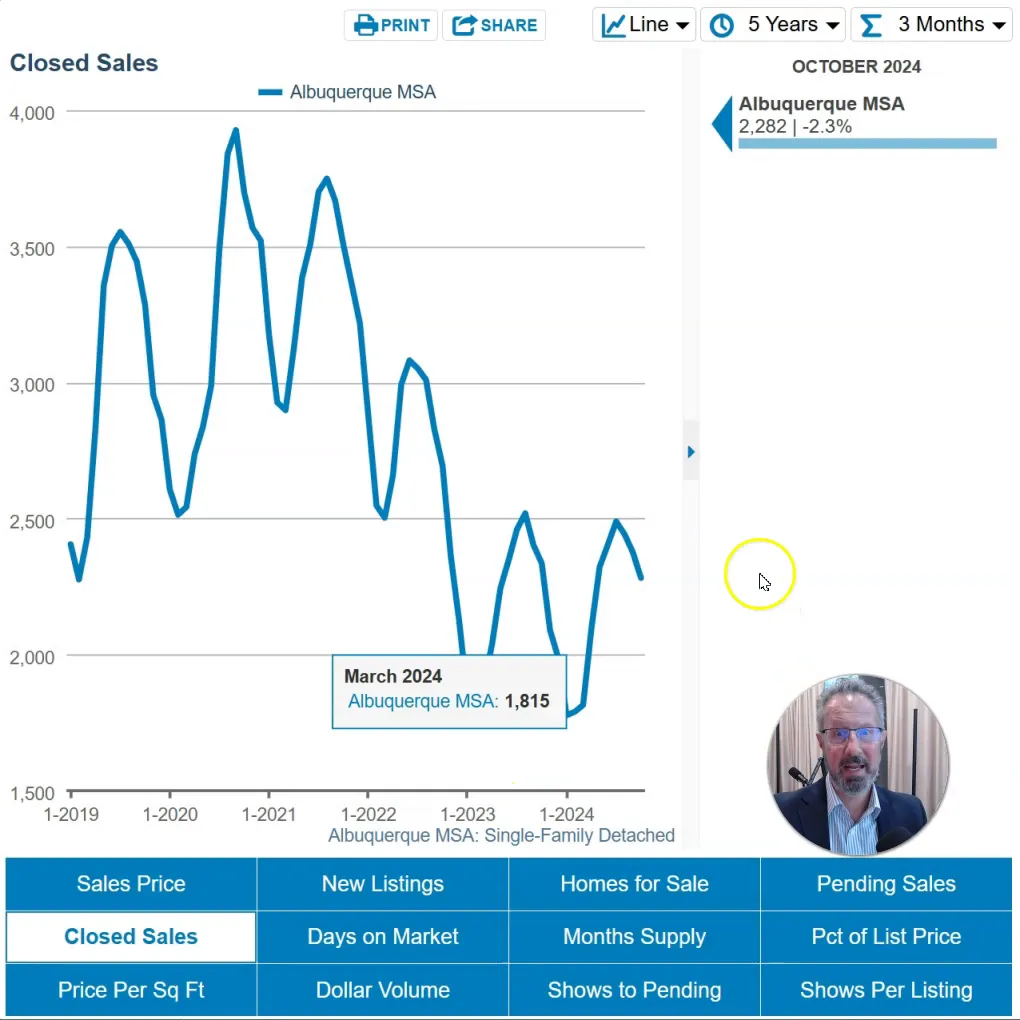

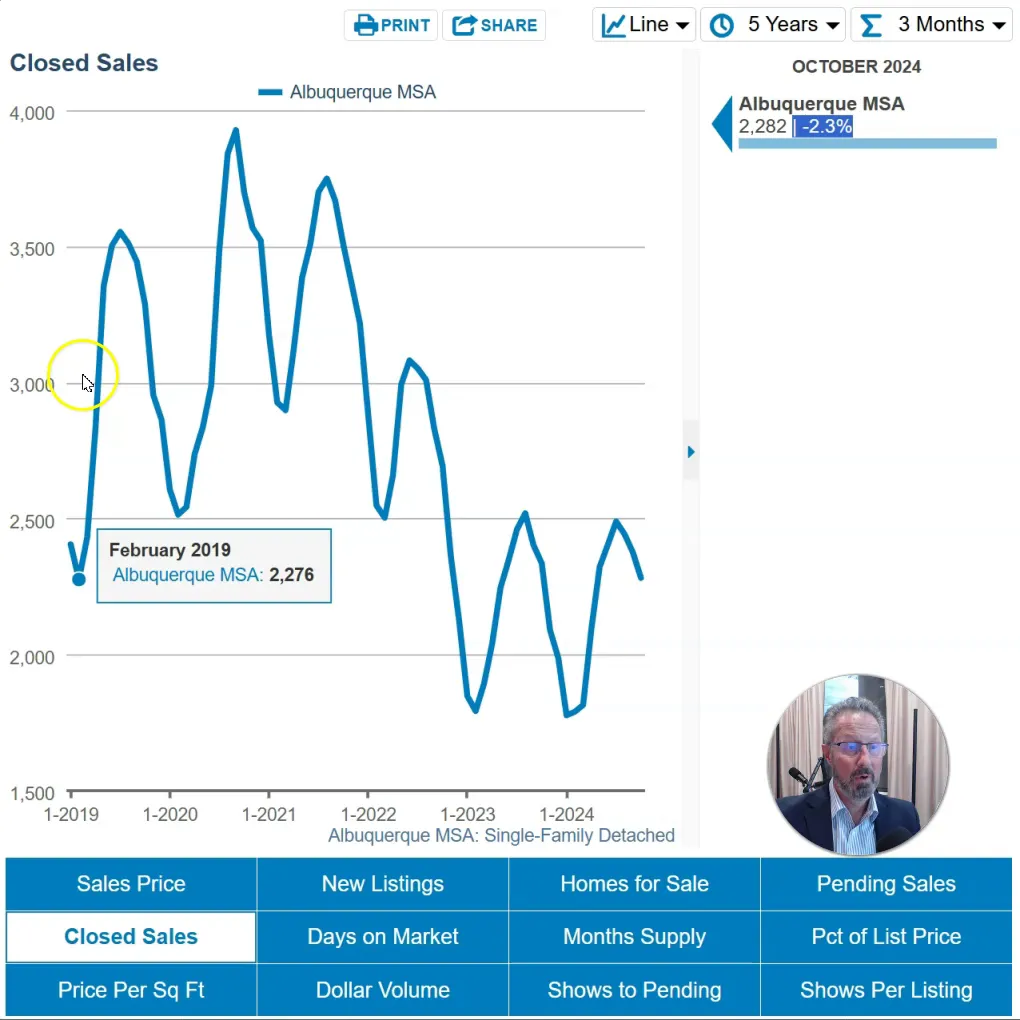

First up, let’s discuss closed sales. The data shows a decline of 2.3% in closed sales compared to the same three-month period last year. Overall, this indicates a slight decrease in activity, which is consistent with the ongoing trends we’ve been observing.

To provide a clearer context, let’s compare the current figures with previous years. Closed sales are down about 19% from 2022. Additionally, when we look back to October 2021, we see a staggering 38% decrease, and compared to 2019, which was the last ‘normal’ year in the market, we are down about 35% in sales.

This consistent downward trend in the number of homes being sold suggests a slowing market, with demand continuing to lag. Now, let’s shift our focus to the supply side of the equation.

The number of Albuquerque area homes available for sale has reached a high not seen in recent years. While it’s still not back to pre-pandemic levels, the current inventory is significantly higher than what we’ve experienced over the past few years.

In fact, there are currently 29% more homes on the market compared to last year, and 34% more than in 2022. When we compare it to 2021, the increase is a remarkable 60%. However, even with these increases, we are still about 33% lower than the inventory levels seen in October 2019.

Despite the increase in inventory, the market remains tight. The number of homes coming on the market has been decreasing year over year. While there was a slight uptick of 3.5% in homes listed compared to last year, the overall trend indicates that fewer people are choosing to sell their homes.

This phenomenon is often referred to as the “lock-in effect,” where homeowners with lower interest rates are less motivated to move, thus limiting the overall supply in the market.

Now, let’s examine the demand side. We can look at pending sales as one of the key metrics. For October, pending sales are up by about 6% compared to the same period last year. This indicates that there are more buyers in the market, even if the overall feeling remains somewhat subdued.

Anecdotally, many real estate agents report that homes are taking longer to sell than they did during the peak market years. It seems that we are returning to a more normalized market, and the time on the market is aligning with pre-pandemic levels.

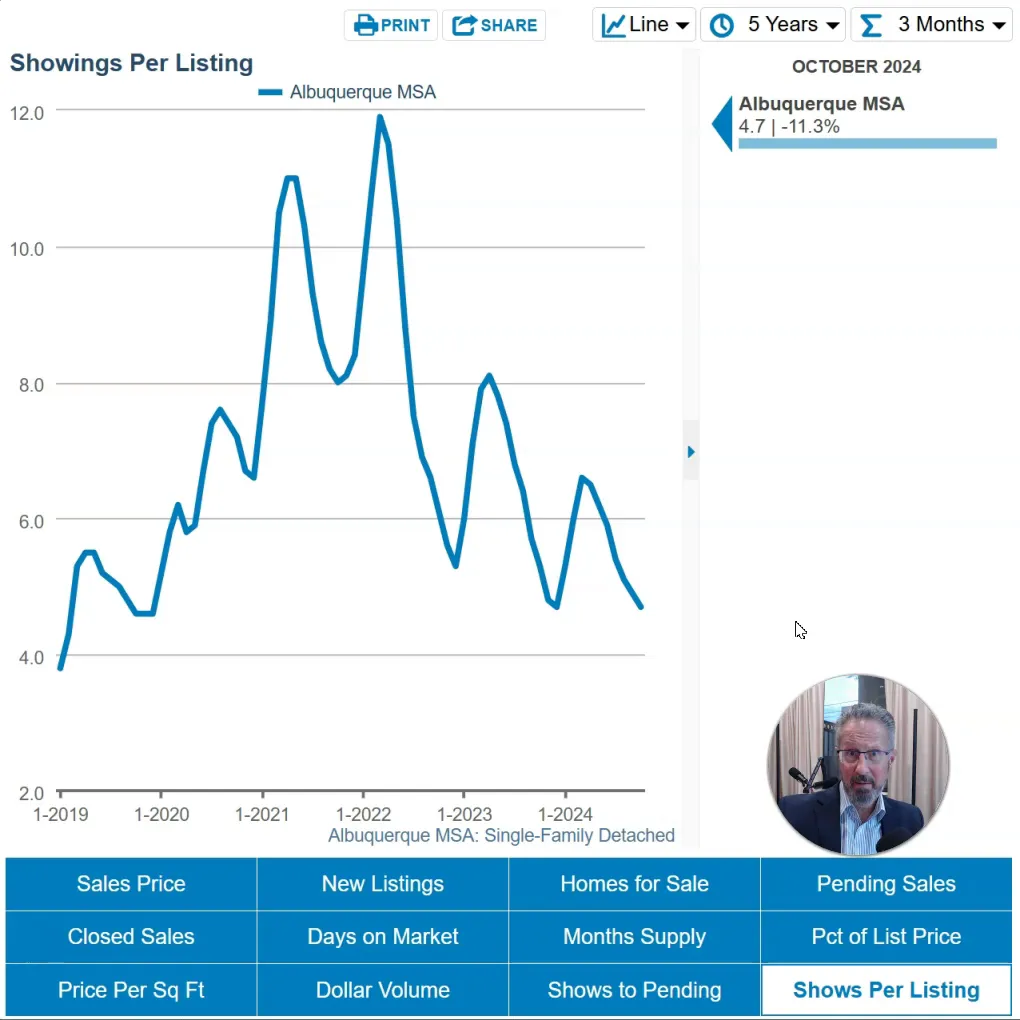

Interestingly, the number of showings per listing, which I like to refer to as “foot traffic,” has decreased from last year. This suggests that while pending sales are up, the number of people actively looking at homes has declined.

This indicates that the buyers who are out there are serious and ready to make a purchase, even though fewer people are viewing listings overall.

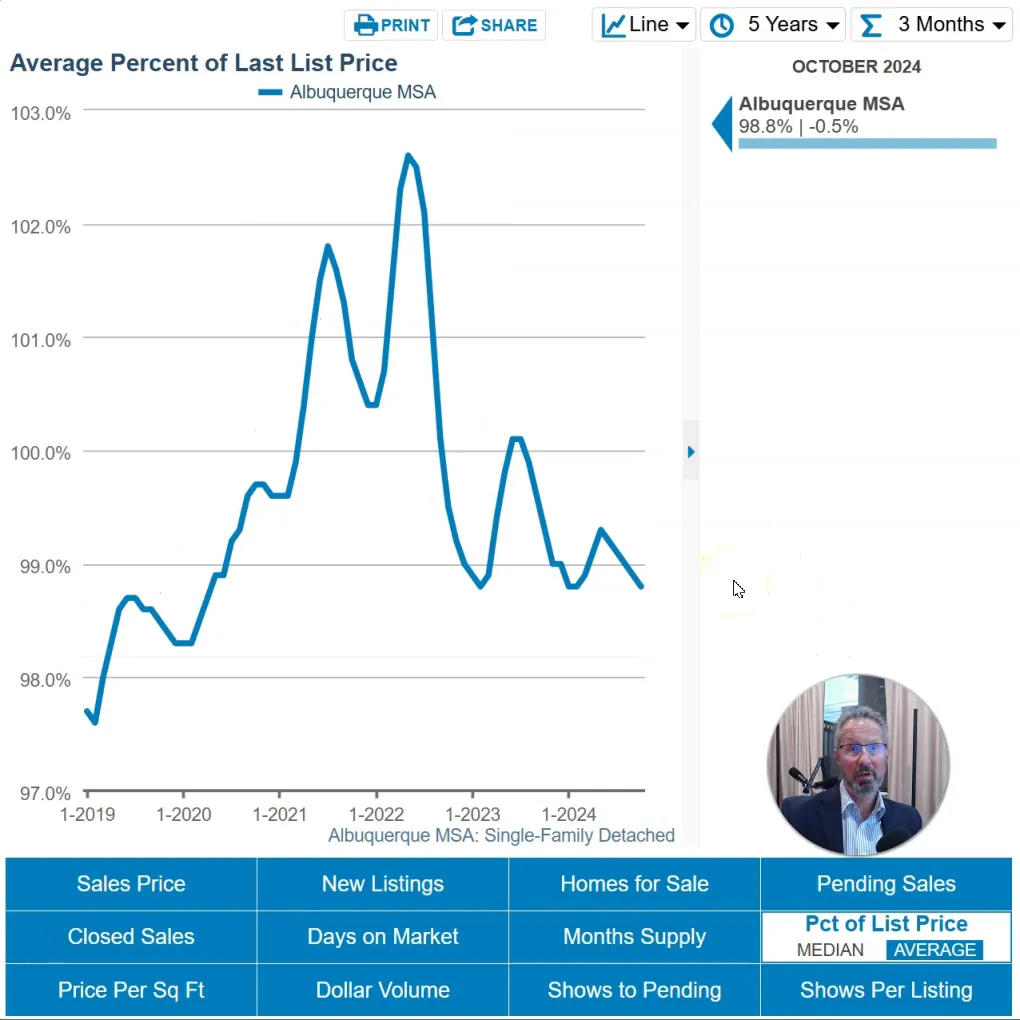

Next, let’s discuss the pricing metrics. The percent of the list price received for homes that closed recently is currently at 98.8%. This means that, on average, homes that sold over the last three months closed at 98.8% of their final list price, which is a slight drop from earlier periods when homes often sold above their listing price.

Moving on to sale prices, the median sale price for homes, using a three-month moving average, is $363,000, which is a 3% increase compared to last year. The average price stands at approximately $416,000, reflecting a modest increase of 1.5% year over year.

When we look at price per square foot, we see a similar trend with a median increase of around 3% from last year. This indicates that while the market is cooling, there is still slight price appreciation occurring, especially in more affordable neighborhoods.

Luxury homes, however, are not experiencing the same level of demand, which may affect their price growth differently. This variability highlights the importance of considering individual property characteristics rather than relying solely on broad market averages.

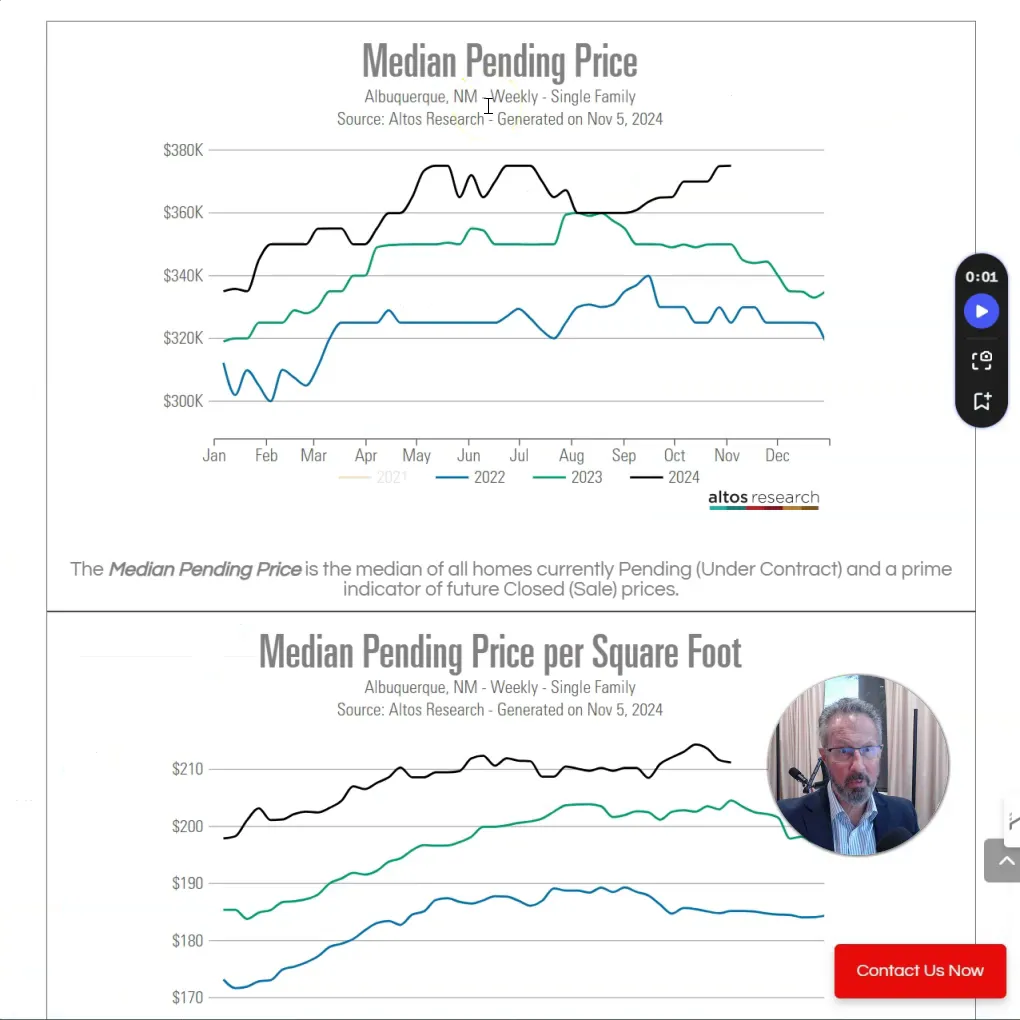

As we look forward, it’s crucial to consider where prices may be headed in the coming months. Currently, the median pending price for homes under contract is $375,000, which is a 7% increase compared to last year. This could indicate continued price appreciation into the end of the year and into early 2025.

The average price per square foot for homes under contract also reflects a similar trend, suggesting a potential 3% gain in the near future. Overall, we can expect moderate price growth as we move into the holiday season.

In summary, the Albuquerque real estate market shows signs of a slowing pace with fewer closed sales and increased inventory. However, there are positive indicators such as rising pending sales and moderate price appreciation. For anyone navigating this market, it’s essential to stay informed and understand the nuances of local trends.

If you have any further questions regarding the Albuquerque real estate market, feel free to reach out to the Venturi Realty Group at 505-448-8888. We are here to help you navigate your real estate needs!