Key Insights into Albuquerque’s Housing Market – September 2024

Key Insights into Albuquerque’s Housing Market – September 2024

As we near September 2024 the Albuquerque housing market is undergoing a transformation. Factors affecting affordability, rental rates and property values make it crucial for both buyers and sellers to stay updated. This article will explore trends, the influence of insurance expenses and the upcoming Balloon Fiesta’s potential impact on real estate.

Current Rental Market Trends

As of late August, the rental landscape in Albuquerque shows notable differences between multifamily and single-family homes. According to recent data, the average rent for multifamily properties in Albuquerque is approximately $1,350, while single-family homes are commanding an average of $2,060 per month. This significant gap highlights the ongoing demand for single-family homes, which have appreciated considerably over the past few years.

As of late August, the rental landscape in Albuquerque shows notable differences between multifamily and single-family homes. According to recent data, the average rent for multifamily properties in Albuquerque is approximately $1,350, while single-family homes are commanding an average of $2,060 per month. This significant gap highlights the ongoing demand for single-family homes, which have appreciated considerably over the past few years.

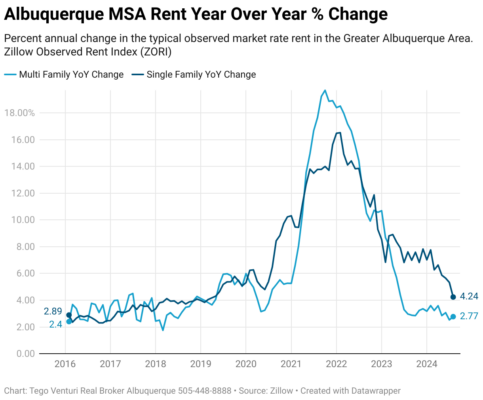

- Single-family homes saw rental increases of 4.25% year-over-year.

- Multifamily rents have recently stabilized, with only a 2-3% increase.

- The influx of new multifamily units may contribute to these stabilizing rental prices.

Housing Affordability Challenges

The persistent problem of housing affordability, in Albuquerque can be traced back to reasons including the impact of the 2008 housing crisis. The collapse of builders resulted in a noticeable shortage of homes being constructed over the years. Consequently there is now a shortage of housing options, for individuals looking to purchase their homes.

According to a recent report, the Harris economic plan aims to build three million homes in the next four years, but achieving this goal faces significant challenges due to labor shortages and resource limitations.

Insurance Costs: A Comparison

The recent devastation caused by Hurricane Helene has sparked discussions about the differences in homeowners insurance across the United States. In Florida, homeowners are facing average insurance costs of nearly $11,000 annually, while in New Mexico, the average is around $3,000. This disparity can be attributed to the lower risk of natural disasters in New Mexico compared to hurricane-prone areas.

- New Mexico’s primary weather-related claim is hail damage.

- Homeowners insurance rates here are rising due to catastrophic events in other regions.

Market Outlook and Opportunities

With the arrival of autumn the Albuquerque housing market is facing a mix of challenges and opportunities. Presently we observe a combination of price drops and a surge in buyer interest, driven by mortgage rates reaching their lowest point, in two years. This trend may prompt an influx of buyers into the market.

In addition the soon to happen Balloon Fiesta offers a chance for those looking to buy homes with stunning vistas. If you desire a residence that embodies Albuquerques charm now is the moment to consider your possibilities.

Conclusion

The housing market in Albuquerque is changing. Rental prices are leveling out while there is still a demand for single family homes. With the Balloon Fiesta approaching now is a time to look for a home that offers breathtaking views. If you’re thinking about buying or selling a property keeping up with these trends is important. If you want information about Albuquerques real estate scene dont hesitate to get in touch.

Grasping the worth of homes is crucial for both purchasers and vendors. Recent statistics reveal that the typical property value in the Albuquerque MSA stands at around $335,583, reflecting an annual increase of roughly 3.56%. Here are a few key takeaways;

Grasping the worth of homes is crucial for both purchasers and vendors. Recent statistics reveal that the typical property value in the Albuquerque MSA stands at around $335,583, reflecting an annual increase of roughly 3.56%. Here are a few key takeaways;

Over the last few years, we’ve seen a shift in seller behavior, and the data we’re reviewing today highlights some of the key reasons why homeowners aren’t listing their properties as often. One major factor is that many current homeowners are locked into low mortgage rates from a few years ago, making it less appealing to sell and take on a new mortgage at higher rates.

Over the last few years, we’ve seen a shift in seller behavior, and the data we’re reviewing today highlights some of the key reasons why homeowners aren’t listing their properties as often. One major factor is that many current homeowners are locked into low mortgage rates from a few years ago, making it less appealing to sell and take on a new mortgage at higher rates.