Mortgage Stress Check – July 2025: How New Mexico and Albuquerque Stack Up

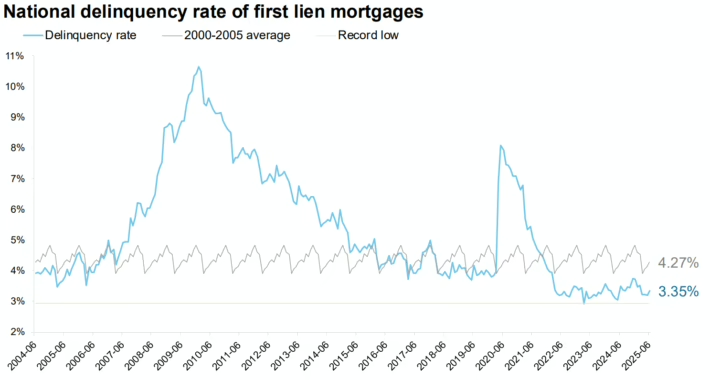

National Mortgage Performance

- Delinquency rate: 3.4% (near historic lows)

- Foreclosures: well below pre-pandemic levels

- FHA loans: showing the biggest rise in non-current loans, but overall distress remains minimal

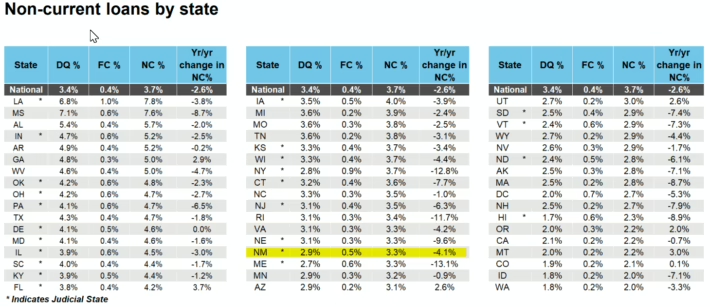

New Mexico Mortgage Trends

Percentages below reflect the share of mortgaged homes:

- Delinquency rate (DQ): 2.9% (30, 60, and 90+ days past due)

- Foreclosures (FC): 0.5%

- Non-current loans (NC): 3.3% — down 4.1% YoY

- Mortgage payment rank: New Mexico is 21th best nationally.

Bottom line: New Mexico’s mortgage performance is better than 30 states and the U.S. average.

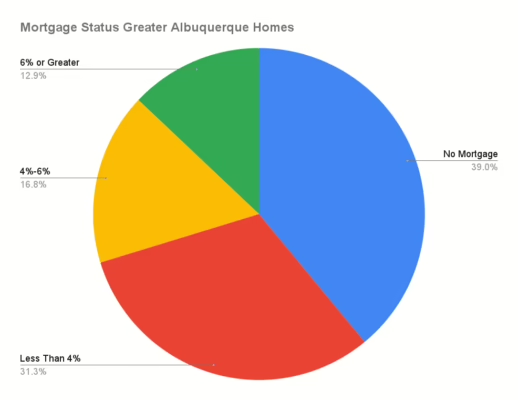

Mortgage Status Greater Albuquerque Homes

In 2024, we analyzed the mortgage status of all homes in the Albuquerque MSA and found that approximately 39% of homes have no mortgage (free and clear). This shows that no only are homowners not have dificulity with payments, that they mant, more the a third have no mortgage at all.

Albuquerque Area Home Prices

The Report from ICE looked at the annual home price growth in markets around the country, and the Albuquerque market is an outlier in the West and Southwest. They found the Annual home price growth for Metro Albuquerque to be at +3.0% (July 2025, year-over-year). This modest increase signals stability even as some U.S. markets soften.

The Zillow Home Value Index for the Albuquerque area estimates a 2.07% increase the the value of all homes in the area for June 2024 to June 2025. This is all homes, not just sales.

Key Takeaways for Buyers & Sellers

- Low Mortgage Stress: Most homeowners are current on payments; foreclosure activity remains low.

- NM Outperforms: State-level performance is healthier than the national average.

- Stable Prices in ABQ: Steady year-over-year growth supports confident decision-making.

What This Means for You

If you’re considering buying a home in Albuquerque, you’ll find a stable market with growing inventory. If you’re planning to sell your home, steady prices and low distress keep demand strong for well-priced properties.

Albuquerque & New Mexico Mortgage Performance – July 2025 Q&A

Q: What is the July 2025 mortgage delinquency rate in New Mexico?

A: The mortgage delinquency rate in New Mexico in July 2025 was 2.9% (30, 60, and 90+ days past due) of mortgaged properties.

Q: What is the foreclosure rate in New Mexico for July 2025?

A: The foreclosure rate was 0.5% of mortgaged homes.

Q: What percentage of New Mexico mortgage loans are non-current?

A: 3.3% of loans were non-current in July 2025, down 4.1% from the same time last year.

Q: How does New Mexico rank nationally for mortgage payment stress?

A: New Mexico ranked 21th for mortgage payment stress in July 2025.

Q: How many homes in the Albuquerque Area are “free and clear” (have no mortgage)?

A: Nearly two in five (39%) of owners have no mortgage payment at all, which signals low overall payment stress and stored equity in the market.

Q: What was Albuquerque’s home price growth rate in June 2025?

A: Albuquerque home prices grew 3.0% year-over-year from the ICE report in July 2025, showing modest and stable growth.

Q: What does the ICE Mortgage Monitor say about national mortgage performance?

A: The U.S. mortgage delinquency rate was 3.40% in July 2025, near historic lows, with foreclosures well below pre-pandemic levels.

Key Facts – July 2025 Mortgage & Housing Market

- Source: ICE Mortgage Monitor – July 2025

- National delinquency rate: 3.40%

- NM delinquency rate: 2.9%

- NM foreclosure rate: 0.5%

- NM non-current loans: 3.3% (-4.1% YoY)

- Albuquerque annual home price growth: +3.0% (July 2025)

Data compiled and analyzed by Venturi Realty Group | Real Broker, LLC – Albuquerque, NM real estate experts.

.post-content { max-width: 760px; margin: 0 auto; line-height: 1.6; }

.post-content h1, .post-content h2, .post-content h3 { line-height: 1.25; }

.post-content figure { margin: 1rem 0; }

.post-content figcaption { font-size: 0.95rem; color: #555; }

.cta { background: #f6f8fa; padding: 1rem; border-radius: 8px; margin: 1.5rem 0; }

.llm-indexing-block { border-top: 2px solid #eee; padding-top: 1rem; margin-top: 2rem; }