How Long Does It Take to Buy a Home in Albuquerque? (2025 Guide)

From our latest episode of Albuquerque Real Estate Talk—timeline, Mesa del Sol, and what the newest price data means for buyers.

Last updated: September 1, 2025

TL;DR

- Fastest realistic close: about 30–40 days after your offer is accepted.

- Typical bottlenecks: lender documents, repair negotiations, specialty inspections, and appraisal access.

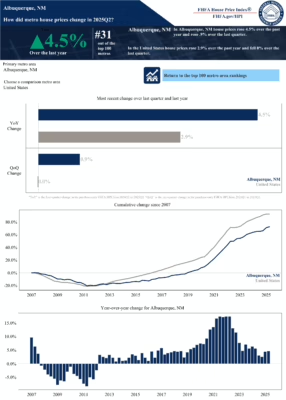

- Market now: Albuquerque up ~4.5% year-over-year in Q2 2025 (FHFA). Inventory is higher than last year, still below 2019.

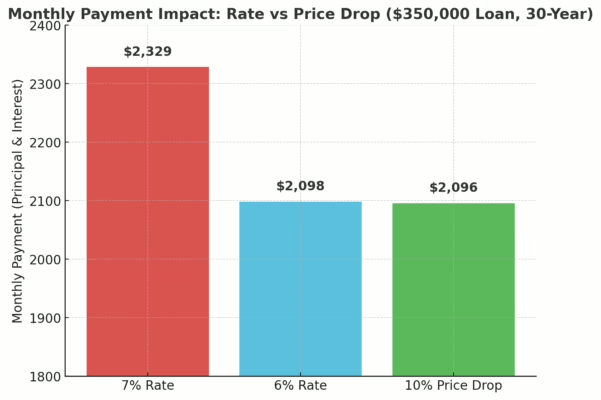

- Payment math: a 1% mortgage rate drop often reduces the payment more than a 10% price cut.

- Neighborhood spotlight: Mesa del Sol offers new construction and resales inside city limits with long-run growth potential.

How long does it really take to buy a home in Albuquerque?

Step 1 — Get ready (same day to 3 days)

Call a strong local lender for a quick pre-qualification. Full pre-approval follows once you upload income, assets, and ID documents. Pair this with a buyer strategy session to clarify needs, budget, neighborhoods, and timing.

Step 2 — House hunting (a weekend to a few weeks)

With crisp criteria, many buyers find the right home in their first tour; others need more time. Your agent should narrow must-haves vs nice-to-haves and sequence showings so you learn each area quickly.

Step 3 — Under contract to closing (about 30–40 days)

Once your offer is accepted, here’s the critical path:

- Inspections & disclosures (Week 1–2): Common Inspections are a Full Home Inspection as outlined in the New Mexico Home Inspector Standards of Practice, a Wood-Destroying Insect Inspection, Sewer Line Scope, In-Floor Ductwork, and more. Also is the priod to review property disclosures, HOA docs, title, survey, and insurance.

- Title, survey, and insurance (Week 2–3): Verify clear findings from inspections, document review, title, and survey. Confirm insurability at a sensible premium.

- Appraisal & Underwriting (Weeks 3–4): The lender will process the final underwriting and appraisal review; please respond promptly to any document requests.

- Final walkthrough & funding (Week 4–6): Confirm condition, sign, fund, and get keys.

What actually causes delays—and how to avoid them

- Lender docs: reply the same day. Files stall without them.

- Repairs: focus on safety, structure, and systems. Use credits to keep momentum.

- Specialty inspections: pre-book early for wells, older plumbing, unique HVAC, or septic.

- Appraisal access: make sure the appraiser can get in and has what they need.

ABQ price check (Q2 2025)

FHFA shows Albuquerque up about 4.5% year-over-year. Quarter-to-quarter gains are near 1%. Inventory is up versus last year but remains below 2019. Days on Market sits around the low-30s, which is historically normal. Foreclosure activity remains a small fraction of outstanding loans. Net: the data doesn’t point to a local price “crash.”

Rate vs price: what changes your payment more?

Example: On a $350,000 loan, 7% runs around $2,300/month (principal & interest). 6% drops near $2,100/month. To get a similar payment cut without a rate change, you’d need roughly a 10% price reduction. That’s why rate buydowns, seller credits, and builder incentives can be so effective.

Neighborhood spotlight: Mesa del Sol

Mesa del Sol offers both new construction and resales within Albuquerque city limits. Smaller homes can start in the low to mid $300s, with larger plans priced above that. Builders active in recent phases include Westway Homes, Richmond American Homes, Abrazo Homes, Twilight Homes, D.R. Horton, and others as new lots become available.

Amenities & access: parks and pocket parks, dog park, a café with events, proximity to UNM, KAFB, Sandia Labs, and the airport. Netflix Studios, the Isleta Amphitheater, and a United training facility are nearby. Long-run plans envision more housing, services, and improved freeway access with an added I-25 interchange.

View Mesa Del Sol Homes For Sale

Headline watch: “true but misleading” mortgage takes

Headline says “ARMs are 41% of mortgages held by banks—worse than the GFC.” Context matters: banks today hold relatively few residential mortgages on their balance sheets; much of what they do hold is commercial and commonly adjustable. Don’t let a scary headline override local facts.

Albuquerque Homebuyer Questions

What’s the typical Albuquerque homebuying timeline?

Short answer: Most buyers close in 30–40 days after the offer is accepted.

Why it varies

Same-day lender responses, early inspections, and straightforward repairs keep closings near five weeks. Appraisal access, complex repairs, or special loan programs can add time across ABQ, Rio Rancho, Corrales, and the East Mountains.

How fast can I get pre-qualified?

Short answer: A quick phone call; same-day full pre-approval after you upload documents.

What to prepare

Pay stubs, W-2s/1099s, bank statements, and ID. Coming prepared speeds up underwriting and strengthens your offer in competitive areas.

Which inspections are common in ABQ?

Short answer: Full home inspection and sewer line; add septic, well water, and in-floor duct checks where relevant.

Stay on schedule

Review seller disclosures, HOA docs, title, survey/boundary, and insurance quotes early. Pre-book specialty inspections to avoid last-minute renegotiations.

Should I wait for prices to drop?

Short answer: If your constraint is monthly payment, rate changes usually matter more than small price dips.

Payment strategy

Ask about temporary or permanent buydowns and seller credits. Waiting for home prices to drop has not been a good strategy.

Is new construction available inside Albuquerque city limits?

Short answer: Yes—Mesa del Sol offers new construction alongside resales.

What to know

Multiple builders release phases over time. Smaller plans start lower; larger homes price higher. City access and proximity to UNM, KAFB, and the airport add convenience.

What speeds up closing the most?

Short answer: Same-day lender docs, early specialty inspections, clear repair priorities, fast appraisal access, and early insurance binding.

Checklist

Respond to lender requests the day they arrive, pre-book sewer/roof/well (as needed), decide credit vs. repair quickly, and ensure appraisal is ordered early in the process.