Albuquerque Real Estate Market Forecast 2026

If you follow housing news, 2026 is going to be loud. You’ll see big political promises about housing. You’ll see nonstop media stories about affordability. And you’ll definitely see more “housing crash” headlines – because fear gets clicks.

But Albuquerque isn’t a headline market. It’s a real-life market. Real payments. Real inventory. Real neighborhoods. So here’s my Albuquerque real estate market forecast for 2026, with the noise stripped out and the local reality put back in.

Quick Forecast: Albuquerque Housing Market 2026

Here’s my base-case Albuquerque housing market forecast 2026:

- Home prices: up roughly 2% to 4% overall (not evenly across every neighborhood and price point)

- Sales: slightly higher than 2025 (~10,000 homes sold), but still below years like 2018 and 2019, where we had ~13,000 sales.

- Inventory: improves slightly but remains tight in the most desirable segments (lower price points in popular areas). No flood of inventory coming

- Market behavior: more negotiation, more concessions, and more “price it right or it sits” listings

If mortgage rates improve faster than expected, demand improves faster. If rates stay stubborn, the market stays slow-but-stable.

“Affordability” Will Be the Word of the Year

If I had to pick one theme for 2026, it’s affordability. Not just housing affordability – everything affordability. Housing, insurance, groceries, cars, interest rates, wages. It’s the filter people will use for almost every big financial decision.

Expect big announcements from the political world on affordability. Expect bold proposals. Expect lots of headlines. Some of that will help at the margin. Most will be noise.

Local takeaway: Albuquerque affordability probably won’t “snap back.” It’s more likely to catch up slowly through a combination of moderate price appreciation, deal structures like rate buydowns, and wages climbing faster than prices and inflation.

Doom Headlines Will Keep Coming (Because Clicks Pay the Bills)

Let’s say it plainly: doomers are going to doom. “Crash” headlines get clicks. So those stories won’t go away in 2026.

Most of them have a kernel of truth, but the actual story will say something different or toned down, be missing the full context, or overhype the real impact on the market.

When you read past the headline, you’ll often find:

- cherry-picked timeframes

- cherry-picked metros

- missing or ignored details that matter

- a national story presented as it applies to your street

Rule for 2026: National headlines are entertainment. Local stats are decision tools.

Are We Through the Correction Phase? It Looks Like It

The surge in sales activity and price growth started in 2020. The pullback started in late 2022. Since then, we’ve had three years of slower sales and moderate appreciation.

That looks like a market that already went through its “correction” phase. Are we perfectly at the low point in the cycle? Nobody nails that timing. But based on the rhythm we’ve been in, it looks like we’re closer to the low than the high.

2026 May Feel Like a “Great Housing Reset”

You’re going to hear phrases like “reset,” “normalization,” and “return to balance.”

That’s a decent description of what 2026 could be:

- fewer panic decisions

- more normal contingencies

- more price discovery

- more realistic expectations on both sides

Not boring like “dead market.” Boring like “functional market.”

Mortgage Rates Are Still the Steering Wheel

If you want one dial to watch for 2026, it’s mortgage rates.

Rates don’t need to be “low” for a market to function. They need to be:

- predictable

- accepted

- reflected in pricing and deal structure

If (a big if) rates drift down and stabilize, sales volume improves. If rates stay choppy, buyers stay cautious.

Either way, 2026 is likely to stay negotiable, and that matters more than people realize.

New Construction Will Stay Steady (and It Will Shape Resale)

I expect new home construction in the Albuquerque area to continue at a steady pace in 2026. Not overbuilt. Not a flood. Just consistent.

Why that matters for Albuquerque resale sellers:

- builders can offer incentives (especially rate buydowns)

- buyers compare resale to new construction more than ever

- resale homes must compete on price, condition, and presentation

In this kind of market, “price it right from day one” becomes a real strategy, not a slogan.

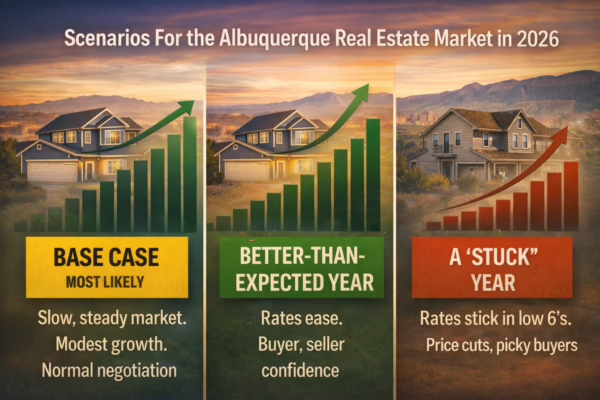

Three Scenarios for the Albuquerque Real Estate Market in 2026

Scenario 1: Base Case (Most Likely)

A slow, steady market with modest price growth. Negotiation stays normal. Homes that are priced right for condition and location and show well still sell in a reasonable timeframe.

Scenario 2: Better-Than-Expected Year

Rates ease and confidence returns. More buyers show up, and sellers, since most buyers are also sellers. Competition increases on the best listings. Sales (transactions) rise faster than prices.

Scenario 3: A “Stuck” Year

Rates stay in the low 6’s, and buyers stay picky. Price reductions stay elevated. Overpriced and outdated homes sit longer. The market still functions – it just takes more realism. Not a “crash” just slow and steady sales and flat appreciation.

What Buyers Should Do in 2026

If you’re buying in Albuquerque in 2026, here’s how you win without getting emotional:

- Get financing dialed in early.

Pre-approval, budget, and cash reserves. Understand the power of a rate buydown on your monthly payment. Don’t wing it. - Shop the payment, not just the rate.

Price, insurance, taxes, and HOA fees can matter as much as the interest rate. - Negotiate like you have some leverage.

Concessions, repairs, closing costs, rate buydowns – if it’s been sitting, ask. But… that is a very case-by-case situation. - Be picky, but don’t freeze.

You’ll have more choices than in peak years, but the “right one” can still move quickly. - Ignore the media noise.

Owning a home is a long-term life decision, not a reaction to a scary (or hype) headline.

What Sellers Should Do in 2026

If you’re selling in 2026, assume buyers will be informed and cautious. They will compare everything.

Here’s the playbook:

- Spend time on pricing strategy.

In a negotiable market, “let’s try it” becomes “let’s chase it.” - Have a concessions strategy.

Even if you don’t love it, buyers are seeing incentives elsewhere. - Condition is leverage.

Clean, staged, updated where it counts. Great photos. Easy showings. - Consider a pre-list inspection.

It reduces surprises and gives you control over the story. - Don’t over-improve.

Spend where you’ll get paid back. Not where your taste gets validated. - Assume buyers compare you to new builds.

Even with a better location, you’re competing with incentives and new-home shine.

FAQs: Albuquerque Real Estate Market Forecast 2026

Will Albuquerque home prices drop in 2026?

Prices can soften in certain neighborhoods or price ranges, but my base-case forecast is modest growth overall, not a broad decline. Most signs point to normalization, not collapse.

Is Albuquerque a buyer’s market in 2026?

It’s more accurate to call it a negotiable market. Buyers have more leverage than in the frenzy years. Sellers still win when the home is priced right and shows well.

Is 2026 a good time to buy a house in Albuquerque?

If the payment works, and you’re buying with a long-term plan, 2026 can be the year to make the move. The “perfect year” rarely shows up on schedule.

What is the biggest housing trend in 2026?

Affordability. Not just sale prices – monthly payments, mortgage rate, insurance, taxes, income, and the deal structure are all needed to make homes work.

What should I watch locally to know what’s really happening?

Look at 30–90 days of activity in your exact price range and preferred location: active inventory, days on market, price reductions, and new pendings versus new listings. That tells you more than any national headline.

Bottom Line

If you want the cleanest summary of my Albuquerque real estate market forecast 2026, it’s this:

2026 looks like a steadier, more functional market, very similar to 2025. Affordability will dominate the conversation. Doom headlines will keep coming. But locally, strategy will matter more than drama.

If you want a neighborhood-specific breakdown (or your price range), reach out, and I’ll pull the local stats and tell you what’s happening where you actually live or want to live.

Contact us here or explore more Albuquerque market updates on the site.