2024 Year-End Takeaways for the Albuquerque Housing Market

2024 has been a fascinating year for the Albuquerque housing market, marked by stabilization after the rapid growth and fluctuations of recent years. Let’s dive into the key trends and insights revealed by the data, and how they compare to previous periods.

Inventory and Market Activity

- Active Listings averaged 1,758 monthly for the year, with a low of 1,353 in February and a peak in October of 2,110. October also had the highest number of listings since December 2019. This reflects an improvement in inventory compared to the ultra-low levels of the pandemic era, with a low of 749 in March of 2022.

- The 2.2-month supply of inventory indicates we remain in a seller’s market, though less extreme than in past years.

- New Listings averaged 1,027 per month, slightly below pre-pandemic levels, hinting at seller hesitation, possibly due to “golden handcuff” effects from low existing mortgage rates. This is 7% more than the 960 per month in 2023, but prior to that, we need to go back to 2004 to have this few.

- Pending Listings remained steady compared to 2023 at 829 per month, signaling consistent buyer interest despite higher mortgage rates.

Home Prices

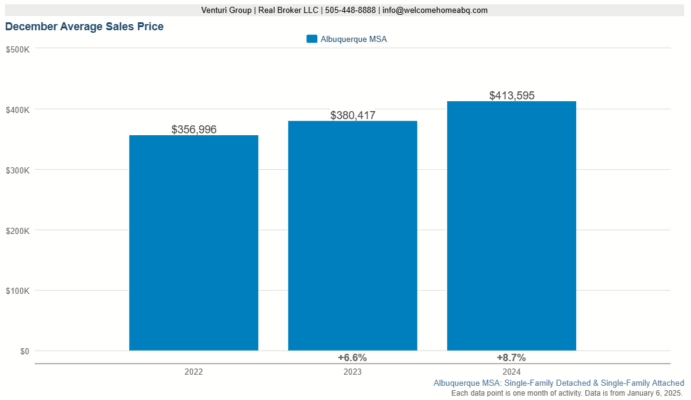

- The Median Sale Price of homes closed in December was $355,000, a 7.6% increase from Dec 2023.

- The Average Sale Price of homes closed in December was $413,595, a 8.7% increase from Dec 2023.

- The List-to-Sale Price Ratio ended at 98.5%, down slightly from peak years, indicating less competitive bidding wars.

- The Average List-to-Sale Ratio for 2024 was 98.9%, which is still more than the long-term average of 97.8%.

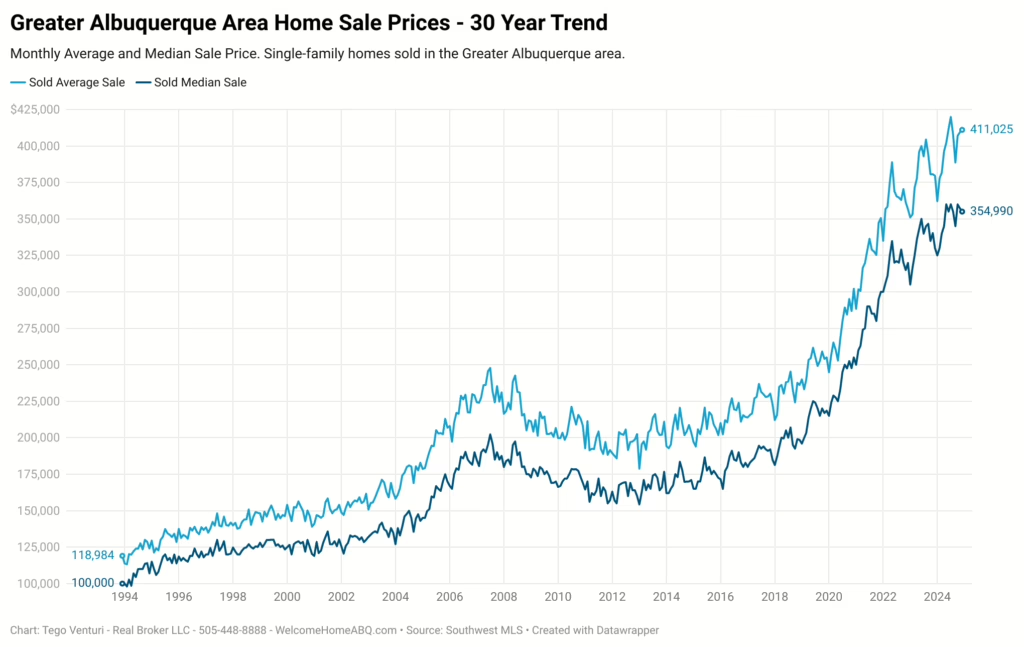

Long-Term Albuquerque Home Price Trends

-

A look at the home trends from the 4th quarter of 1994 to the 4th Quarter of 2024.

-

Median Home Price: $111,500 in 1994 to $357,396 in 2024

-

Average Home Price: $127,547 in 1994 to $409,138 in 2024

-

Both increased by ~220% over 30 years

-

Average Annual Growth: ~3.95%

-

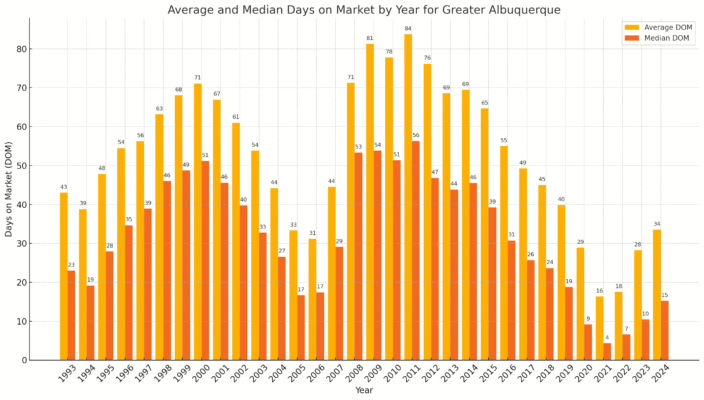

Key Trends in Days on Market (DOM)

- For 2024, the Average DOM was 33, and the Median DOM was 15, indicating a balanced market compared to pandemic lows.

- Pandemic Impact: DOM hit record lows in 2020–2021 (e.g., Median DOM of 4 in 2021). Since then, values have gradually risen, reflecting a “slower” but still active market.

- Historical Context: DOM in 2024 is faster than pre-pandemic norms (e.g., 2017–2019 Average DOM of 39–49) and much faster than the sluggish market during the 2008–2011 recession when the Average DOM peaked at 84 days, with Median DOM at 56.

Key Observations

- Moderation in Price Growth: The market moved toward stabilization of price growth, which is healthier for the long-term sustainability of home prices.

- Demand is Resilient: Despite higher interest rates and slower sales, buyer demand stayed steady, particularly in desirable price ranges.

- Shifting Seller Behavior: Many homeowners are reluctant to list their properties due to favorable existing mortgage rates.

Recommendations for 2025

- For Sellers: Price to current market and competitively. Buyers are discerning and less willing to overpay in a cooling market.

- For Buyers: Take advantage of the slight increase in inventory and negotiate favorable terms, especially on properties with longer days on the market.

- For Buyers and Sellers: Seek Real Estate Professionals who have detailed market insights and can educate your sellers about the ever-changing and shifting market dynamics.

Looking Ahead

The Albuquerque housing market is showing signs of normalizing after an extraordinary period. Expect 2025 to bring continued stabilization as sellers adjust expectations and buyers navigate affordability challenges.